All-round growth for Adani Enterprises — H1 FY23 Results

Consolidated Revenue increased by 202% to Rs. 79,508 cr

Consolidated EBIDTA increased by 86% to Rs. 4,100 cr

Ganga Expressway financial closure achieved for Rs. 10,238 cr

Ranked 7th in ESG Rating by DJSI (S&P) in its peers in the world for 2022

Group, today announced its results for the half year & quarter ended September 30, 2022

Financial Highlights H1 FY23 (Consolidated) (YoY Basis):

Total Income increased by 202% to Rs. 79,508 cr on account of strong performance by IRM and Airport business

- EBIDTA increased by 86% to 4,100 cr on account of strong performance by IRM and Airport business

- Attributable PAT increased by 92% to Rs. 930 cr in line with EBIDTA

Financial Highlights Q2 FY23 (Consolidated) (YoY Basis):

Total Income increased by 183% to Rs. 38,441 cr on account of strong performance by IRM and Airport business

- EBIDTA increased by 69% to 2,136 cr on account of strong performance by IRM and Airport business

- Attributable PAT increased by 117% to Rs. 461 cr in line with EBIDTA

“Adani Enterprises has yet again validated its standing as India’s most successful new business incubator as it continues to build on exciting ideas strategically aligned with the diverse strengths of the Adani portfolio of companies,” said Mr Gautam Adani, Chairman of the Adani Group. “AEL’s accelerating pace of business incubation and its remarkably consistent success demonstrates the robustness of the Adani Group’s fundamental approach to value creation as we transform sector after sector through digitisation, innovation in technology and a greater emphasis on equitable energy transition. We continue to believe ever firmly in the India growth story and remain committed to our core philosophy of nation-building through the development of advanced, efficient and world-class infrastructure that delivers increasing shareholder value.”

Business Updates (Q2 FY23):

Updates in Incubating Businesses

- Adani Airports Holdings Ltd (AAHL – Airports)

- During the quarter, Adani Airports handled –

-

- 16.3 Mn passengers at 90% of pre-covid level

- 126.9 k Air Traffic Movements

- 2.0 Lacs MT Cargo

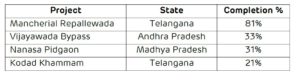

- Adani Road Transport Ltd (ARTL – Roads)

- Provisional COD received for 2nd HAM Road project at Suryapet Khammam

- Update on four HAM projects which are under execution:

Secured financial closure for Ganga Expressway Project for Rs.10,238 cr

Secured financial closure for Ganga Expressway Project for Rs.10,238 cr

- Construction activities in full swing for 7 projects (including 1 BOT project)

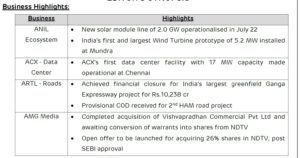

- AdaniConnex Pvt Ltd (ACX – Data Center)

- First data center facility of 17 MW made operational at Chennai

- Noida Data Center – project activities completed ~22%

Updates on Established Businesses for Q2 FY23

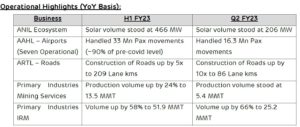

- 1. Adani New Industries Supply Chain Ecosystem

- New 2.0 GW solar module line operationalised

- Existing 1.5 GW capacity plant is being upgraded to 2.0 GW with TopCon Cell technology

- India’s first and largest Wind Turbine prototype of 5.2 MW installed at Mundra; testing and certification in progress

- Volume stood at 206 MW vs 267 MW

- Primary Industries (Mining Services)

- Mining Services production stood at 5.4 MMT

- Operational Peak capacity of coal mines at 50+ MMT including iron ore mine

About Adani Enterprises Ltd

Adani Enterprises Limited (AEL) is the flagship company of Adani Group, one of India’s largest business organisations. Over the years, Adani Enterprises has focused on building emerging infrastructure businesses, contributing to nation-building and divesting them into separate listed entities. Having successfully built unicorns like Adani Ports & SEZ, Adani Transmission, Adani Power, Adani Green Energy, Adani Total Gas and Adani Wilmar, the company has contributed significantly to make the country self-reliant with our portfolio of robust businesses. This has also led to robust returns to our shareholders at a CAGR of 38% over 25+ years.

The next generation of its strategic business investments are centered around green hydrogen ecosystem, airport management, roads, data center and primary industry like copper and petrochem all of which have significant scope for value unlocking.

COMMENTS