India’s slip is showing- underperformance is the culprit

RN Bhaskar

India has been witness to a lot of bluster and chest-thumping. But recent numbers have begun to highlight the country’s underperformance. One of the first signs is the slowing of exports and the rise of imports.

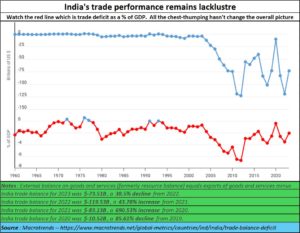

Undoubtedly, some indications suggest that India is doing well. For instance, the export of Apple phones. But overall, the picture isn’t very rosy. Exports have been under pressure. While the trade balance was just $10.5 bn in 2020, it swelled to $73.5 bn in 2023. A weakening rupee should have helped exports, but clearly, even this did not help. Many reasons have been cited:

- It has failed to cultivate neighbours — especially the ASEAN countries (Free subscription — https://bhaskarr.substack.com/p/india-china-and-russia-could-be-dancing).

- It depends largely on the West, which is in terminal decline thanks to the US instigated wars in Europe/Ukraine and Israel/Gaza.

- Failure to promote India’s labour-intensive sectors like leather, and focus more on hi-tech products which currently warrant even more import of components (https://asiaconverge.com/2022/10/pli-and-the-indian-economy/).

There is a fourth factor as well. India has been playing with import duty rates in such a manner that it pushed up energy costs for the country. In the name of protecting domestic industry, it imposed duties and tariffs on solar installations to such high levels that they became twice as expensive than in many countries. Result: underperformance. It is only this year that the government slashed import and other tariffs. Whether this will mean lower costs remains to be seen.

The Indian rupee has been weaking. One would have expected India to stand a chance in the global competitive market and improve on its exports. But that did not happen for several reasons. Underperformance again.

Many of Indian exports were found to be substandard. This was particularly so in the field of pharmaceuticals. It is not known how many officers of the Food and Drugs Administration were dismissed for this laxity, on account of which the country earned a bad name.

Key items of export, where India has stood its ground through the past few decades, have faced difficulties in India. This is especially true of leather and beef industries (https://asiaconverge.com/2023/01/sodhis-resignation-has-dire-warnings-for-agriculture-and-milk/). Somehow, ideology appears to have governed policy making than economic considerations.

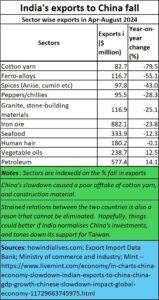

Then there were areas where the government abruptly banned exports (https://asiaconverge.com/2023/08/india-trade-slips-deeper-into-the-mire/). This was true of agricultural goods, as well as cotton yarn. Disruption in supply invariably leads to lack of trust in the country’s ability to meet time and delivery schedules. For instance, India used to export sugar to China. The government banned that. Ditto with cotton yarn (https://www.bbc.com/news/world-asia-india-17256230). Not surprisingly, India’s export markets have blossomed.

Finally, as mentioned above, India’s inability to cultivate East Asian markets, and its inclination to look at the West – which is declining – also has become a major problem.

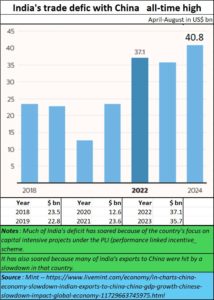

People often overlook the fact that even before the thaw in India-China relations began, India’s trade with China remained vibrant. Now with relations becoming less tense, you can expect trade between the two countries to flourish even more.

Many critics of China point to the growing trade deficit with that country. That is a problem, true. But examine the components of what India imports. It is mostly electronics and chemicals. Many of these chemicals are used by producers of speciality chemicals; the APIs are needed by the pharmaceuticals sector. These recipient sectors of electronics and chemicals are also major exporters. Had such imports not taken place, India’s exports would have also tanked. Hence, in all fairness, critics need to give some weightage for imports arriving from China which later become part of exports.

It is quite possible that with the thaw in relations, the trade gap may widen further. But if India negotiates well, it could take up some of the industries that China has been transferring to countries like Bangladesh, Vietnam and the Philippines. If that happens, it could become a win-win situation.

It is quite possible that with the thaw in relations, the trade gap may widen further. But if India negotiates well, it could take up some of the industries that China has been transferring to countries like Bangladesh, Vietnam and the Philippines. If that happens, it could become a win-win situation.

There is yet another issue that India needs to look at very carefully. It needs to work out ways by which China can begin investing in this country’s startups. Do remember that five years ago, almost two-thirds if not more of startups were funded by China(https://asiaconverge.com/2020/03/china-investments-in-india-are-strategic-and-profitable/) . India may think that by banning China’s investments, it is hurting China. But then India matters little when it comes to the Chinese export basket. But India will need such investments urgently if it wants to generate wealth on the one hand, and employment on the other.

Another sector that may have to be revisited in the telecom sector. Like Singapore and Vietnam (Free subscription — https://bhaskarr.substack.com/p/is-india-spooked-by-china), India need to allow Chinese investments as well. This will allow for better price (and technology) discovery. Else India will end up paying higher prices to Western countries. The best way to avoid that is by allowing for more competition. India could get some lessons from Vietnam on how this is possible. Such measures could reduce India’s overall balance of payments, though this number could go up in India-China trade.

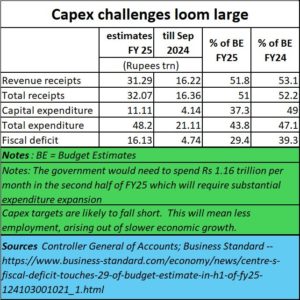

Investments will also be required to boost capex. India’s ability to spend on capex will be highly restricted. It will have to spend at least Rs.1.16 lakh crore in the second half of FY 25 which existing revenue sources may not permit. Without such expenditure, India will be hobbled in creating new jobs.

That is again where China may be welcome. Unlike the West, which is in decline thanks primarily to the wars in Ukraine and the Middle East, China has investible funds. That will ease India’s problem. It will also allow a surge in China’s GDP. Both countries could come to each other’s aid.

Eventually, the acid test for a vibrant economy is surging FDI inflows. Current indications suggest that FDI inflows may be worse than those of last year.

With private investment on the decline, India sorely needs FDI. The West has little money to offer, and when it does, there are too many strings attached. China may offer a better alternative.

Clearly, there is a great deal of underperformance. Some of its can be addressed through better trade relations and restructuring. But the need for better money management will be felt more acutely than ever before.

Will India be able to do this? The present state of cost overruns in the country’s infrastructure sector (https://bhaskarr.substack.com/p/indias-big-infrastructure-investment) suggests that India still has a long way to go. It has not even achieved the efficiency levels of the Vajpayee government.

Can this change. Well, it must. Else, India will be branded an idle dreamer. Much talk of vision, and little else.

=======================

Do look up my podcast on why India needs to worry about Africa at https://www.youtube.com/watch?v=bMTx-Ik2lzw

============================

Picture source — https://specialisthrsolutions.co.uk/how-do-i-tackle-the-issue-of-an-underperforming-employee/

COMMENTS