MARKET PERSPECTIVE

By J Mulraj

Nov 9-15, 2024

India doesn’t protect minority investors

In the 2020 Ease of Doing Business Report (EODB) India ranked 63rd out of 190 countries. There are 10 criteria to determine EODB, one of which is Protection of Minority Shareholders, in which India’s rank was #13 out of 190 countries. It was India’s highest rank out of the 10 criteria. The experience of minority investors is otherwise. Perhaps the World Bank, in its evaluation, places emphasis on form over substance. SEBI ticks all the boxes for processes and procedures to redress minority investor issues. But the Government fails woefully in follow up, investigation, and judicial conclusion. This is reflected in its rank on the criteria of ‘enforcing contracts’ which is 163 out of 190 countries, its worst ranking.

Investigating and enforcement agencies take their own sweet time in doing so. With a backlog of 50 million cases, the delays in the judicial system make a mockery of justice. As a result, of course, fraudsters conclude that white collar crime pays. Indeed, it does.

In the image, the Government’s investor protection outcome is portrayed as a raincoat, to keep the rain out. But the raincoat sports several holes, providing woeful protection.

Vijay Mallya, Nirav Modi, Mehul Choksi are just some of the names of persons declared as willful defaulters to banks, who have fled the country with ill gotten gains. In the five years to 2022 Indian commercial banks wrote off ₹ 10 trillion in unrecoverable loans! Because the lending banks were mainly Government owned, it expended huge resources in trying, unsuccessfully to get the defaulters back to India, to face justice.

The Government and its agencies have not, however, been concerned about investigating Ponzi schemes where the victims were private individuals, instead of Government owned banks. That’s a crying shame, and a blot on PM Modi’s performance. This is why, even when (not if) India becomes a $5 trillion economy, it won’t be called a developed economy, as its social parameters, like minority investor protection, enforcement of contracts, judicial delays, poor quality of primary as well as secondary education which produces graduates of which, according to Anand Ranganathan, 80% of graduates are unemployable, the inadequate medical infrastructure and poor air quality, lack the standard needed for calling it such.

This is how a developed economy handled a Ponzi fraud. Bernie Madoff, who was charged in early 2009 by the Southern District of New York of a fraudulent scheme affecting over 24000 victims. Madoff pleaded guilty in March 2009 and sentenced to 150 years in prison. By 2023, when this article was published the US Government had recovered and repaid over 24000 victims 91% of their investment.

Several individual investors have fallen prey to such collective investment schemes (CIS) aka Ponzi schemes. But the experience of victims in India is poorer.

Consider the 2013 scam perpetrated in National Spot Exchange Ltd (NSEL) in which nearly 13000 investors were duped of ₹ 56 billion. This was an Exchange given approval by the Government which neglected to appoint a regulator for it, thereby facilitating the scam. Having given approval to form and run the Exchange, and having failed to appoint a regulator for it, the Government was obligated to take steps to pursue the fraudsters. It washed its hands off it, instead. Various investigative agencies were appointed, which contributed nothing. Nor did the courts. Ultimately the hapless victims entered into a negotiated, one time, settlement under which they get approximately 35% of the money invested after 12 years, by the time they get it. Contrast that with the 91% payout for Bernie Madoff victims, and you realize that India has to take several steps before it can justifiably called a developed economy.

And if you were to add loss of interest at a safe rate of 5% compounded, (Government bond yield) the payout ratio drops from 35 to 18%.

White collar crime pays in India. The indifference of the Government, callousness of investigative agencies and the ineffectiveness of the judiciary guarantee that.

Merely hitting a $5 trillion GDP mark does not earn India the title of being called a developed economy. It’s more than just a number, Mr Modi!

The insouciance of the Government and the Indian judiciary is amply illustrated in the case of SEBI vs Libra Plantation, as per this article . SEBI, the regulator, had, in 1998, filed a petition seeking urgent regulatory reforms to tackle such CIS, or Ponzi, schemes. It took 26 years for the Bombay High Court to dispose off an urgent petition. By this time it had become infractions, as the Government had introduced measures to regulate CIS.

The irony is that the World Bank, studying up the EODB, gives a high ranking , #13, on investor protection to India, as such regulations have been thought of, and introduced. But the WB does not consider the steps after that. The investigative agencies and the courts move at the speed of a tortoise with gout. Individual investors are left to fend for themselves.

That’s shameful for a country aspiring to become a developed economy by 2030.

Last week the BSE Sensex dropped 1751 points to end the week at 77580.

The US Republican Party managed to achieve a trifecta, winning the Presidency as well as a majority in the US Senate and the House of Representatives. American voters have given Donald Trump the power to make sweeping changes, indicating their strong desire for it.

With great power comes great responsibility. Trump has vowed to:

* stop ongoing conflicts, which is good

* to make America energy independent by ‘drill, baby, drill’ which is good, if environmental concerns are tackled

* to cut excess and wasteful expenditure and reduce the deficit by $2 trillion, over time, for which he has appointed the brilliant Elon Musk and the level headed, articulate, Vivek Ramaswamy, who will make a big dent in the deficit

* to end ongoing conflicts, which is good

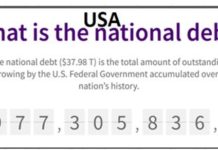

* to send millions of illegal immigrants back to their country, which is necessary for a country which has a $35 trillion debt and can’t look after its own citizens. Immigrants have a path for entering legally.

* to cull a bloated bureaucracy and make Government leaner, which is good. (it should be emulated in India! Sadly, when a coalition Government is formed, ministries are expanded instead, which is a pathetic triumph of expediency over governance)

Trump has also planned to hike tariffs, generally, and even more on imports from China. This would result in de-globalization, and result in a drop in global trade, thence to lower global GDP growth and higher inflation. That’s bad. The world relies on China for a lot of things like rare earth materials. China is the lowest cost producer of EVs and of solar panels and storage batteries. All of these are needed by other countries to meet their target dates to achieve carbon neutrality.

So Trump has a challenge ahead to navigate US China relationship.

Also challenging is the handling of the US economy, left in shambles by Biden, with a $35 trillion debt, crumbling urban infrastructure, the task of rolling over debt when the foreign investors themselves are reeling, and a nation divided along several fault lines.

Fed Chair Powell has cautioned that inflation has not yet ended. Though he cut interest rates by 25 bips last week, there may not be another cut at the next meeting. That would negatively impact US Stockmarkets. Bitcoin seems to be on a race to Mars, competing with Musk.

India, with favorable demographics, has the potential to become the #3 economy by 2047. Provided its polity starts working for the betterment of its people and not for themselves.

To become a developed economy, the politicians should develop their governance.

Image created by imagine.art

Comments may be sent to jmulraj@asiaconverge.com

COMMENTS