The world order changes swiftly; the West has become less relevant

RN Bhaskar

Last month had three momentous developments. First was the BRICS meet in Kazan, Russia (free subscription — https://bhaskarr.substack.com/p/brics-gold-and-gdp)..

Irrelevant West; relevant BRICS

Today BRICS is an intergovernmental organization. It comprises 9 countries – Brazil, Russia, India, China, South Africa, Iran, Egypt, Ethiopia, and the United Arab Emirates. From an initial number of four countries, its GDP (on a PPP basis) is larger than even that of the G-7. BRICS became a more vibrant and even possibly more relevant organisation in the wake of unilateral actions by the US. These included sanctions, the weaponizing of the financial systems which sought to exclude countries from the monetary systems, and the increasing irrelevance of the International Court of Justice. The ICJ seeks to treat people from other countries as was criminals but not officials of the US or Israel who have been responsible for more deaths than all other countries combined. The Iraq war saw the death of over 655,000 people (https://www.theguardian.com/world/2006/oct/11/iraq.iraq) not 30,000 as claimed by the US. The world is now demanding a new multi-lateral organisation, and BRICS could soon fit the role.

The second was the total change of global economics. Ukraine is on the verge of becoming a failed state. Israel is no longer the vibrant economy it used to be. All its ports are under siege, and its airports have been attacked by missiles. More Jews are fleeing Israel today than ever before.

The third was the resurgence of China on the export front. Coinciding almost with the emergence of Donald Trump as president elect in the US, China came up with results that stumped the entire world. It showed a mind-boggling surge in its exports.

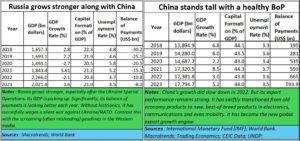

China’s positive balance of trade dropped a bit, but it exports were staggering. Even more stunning was that “China’s trade with countries participating in the Belt and Road Initiative posted robust growth in 2023. The trade volume between China and these countries totalled 19.47 trillion yuan (US$2.74 trillion), accounting for 46.6% of the total, up 1.2 percentage points from 2022.” (http://english.scio.gov.cn/pressroom/2024-01/12/content_116937407.htm). China ended up with a $1 trillion trade surplus (https://www.business-standard.com/world-news/china-nears-record-1-trillion-trade-surplus-as-donald-trump-returns-124111101796_1.html). It has emerged as the world’s biggest supporter of the global South (free subscription — https://bhaskarr.substack.com/p/india-should-be-worried-about-africa).

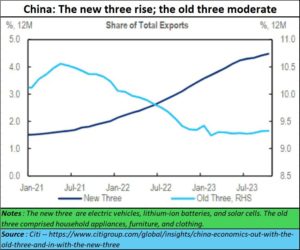

Adds Citi, “China’s exports have seen a marked shift, with the “Old Three” of household appliances, furniture, and clothing giving way to the high-tech “New Three” three of electric vehicles, lithium-ion batteries, and solar cells,” (https://www.citigroup.com/global/insights/china-economics-out-with-the-old-three-and-in-with-the-new-three).

Adds Citi, “China’s exports have seen a marked shift, with the “Old Three” of household appliances, furniture, and clothing giving way to the high-tech “New Three” three of electric vehicles, lithium-ion batteries, and solar cells,” (https://www.citigroup.com/global/insights/china-economics-out-with-the-old-three-and-in-with-the-new-three).

On the other hand, there is Russia, which has emerged stronger and stronger ever since NATO and the US pushed Ukraine into a conflict with its Western neighbour. The result was a shattered Ukraine, and a stronger Russia. The Russian rouble has become stronger. Russia’s negative balance of payments has been shrinking. Anyone who has doubts about the despicable role of both the US and NATO in inciting this conflict should read the NYET means NYET document authored by William Burns when he was the US ambassador to Russia – available at https://wikileaks.org/plusd/cables/08MOSCOW265_a.html . Do read the LSE document as well from https://eprints.lse.ac.uk/61428/1/Wade_Ukraine_crisis_is_not_what%20it_seems.pdf). Ironically, the Western media prefers to look the other way and promote misconceptions and not the truth.

Just look at the headlines of the latest The Economist (https://www.economist.com/europe/2024/11/10/kremlin-occupied-ukraine-is-now-a-totalitarian-hell). Even mainstream media has lost all credibility. People trust social media more for news than such publications.

Just look at the headlines of the latest The Economist (https://www.economist.com/europe/2024/11/10/kremlin-occupied-ukraine-is-now-a-totalitarian-hell). Even mainstream media has lost all credibility. People trust social media more for news than such publications.

In fact, much of the world has changed during the past two years primarily on account of US short-sightedness.

The Ukraine war actually had the effect of not only destroying Ukraine, but also sowing the seeds of the eventual destruction of the European Union (EU). Germany is gasping, and is almost on its legs. The US ensured that its industry was crippled because of the non-availability of cheap energy from Russia. Germany’s economists warned the German Chancellor.

But for unexplained reasons he heeded to US interests more than those of his own country. The Guardian predicted this in 2022 (https://www.theguardian.com/world/2022/mar/14/russian-gas-oil-boycott-mass-poverty-warns-germany) . But Chancellor Olaf Scholz turned a deaf ear to these warnings. He even kept silent when Nordstream 2 was blown up (https://asiaconverge.com/2022/02/the-us-wants-to-checkmate-germany-not-ukraine-over-nordstream2/).

Just look at the numbers. Germany’s GDP growth is scraping the bottom.

France looks less ravaged because it did not depend on Russian energy. It had its own nuclear facilities. But watch its balance of payments. It is also on the brink of collapse. Germany was the workhorse for the EU. With its failure, expect France and other EU states to remain weak-kneed.

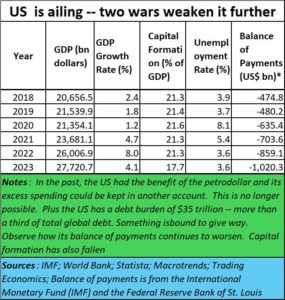

Even the US is in terrible shape. Its unstinted support to Israel, its willingness to provide Israel with huge bombs that were not meant for precision targeting, its amazing brazenness to invite the Israeli Prime Minister to address the US Congress, even after he and his key lieutenants had been singled out as potential war criminals (though a formal indictment is still pending), and its refusal to stop the genocide of Palestinians have made it lose face and credibility in much of the Middle East. Not surprisingly, the Petro-dollar is dead. Any deal with Israel for building a new cargo movement corridor through Saudi Arabia has been totally wrecked. The US war machinery, which it used to be proud of, has been shown to be ineffective during the attempting bombing of Iran. Suddenly, the rules of war and engagement are being hastily re-written. The US does not have war escalation dominance any longer.

Worse, its $35 trillion debt is now beginning to worry, even frighten, economists. Earlier, some of the debt could be parked in the notional Petro-dollar basket. Ditto with the adverse balance of payments. Now all of them have come to Washington’s doorstep. Analysts say that the US has few options left – (i) will renege on its debt obligations, which could make it a pariah of the financial world, (ii) learn to cope with rapid inflation (iii) go in for austerity measures as a process of belt tightening. None of them are comfortable options. The dollar and the stock markets remain buoyant despite these signs. Expect something to give way.

The Ukraine and Middle East wars have ravaged its finance. GDP growth is nothing much to write home about. And its balance of payments has swollen enough to become an embarrassment.

The US could be the cause for another financial meltdown.

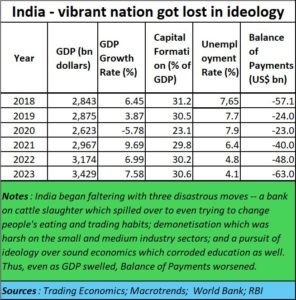

India is now in an awkward place. It had hoped for support from the US to confront China. Today, the US has become weaker, with a record of destroying those it professes to love. China has emerged stronger, and has the funds to invest in India. Both the EU and the US won’t go very far in helping India out. India has to look at China afresh (the discussion on Both Sides of the India-China Divide at https://www.youtube.com/watch?v=z4CRoW8lKOU is quite interesting. What emerges is the inability of the government to arrive at a political decision on how to deal with the border, unlike what previous governments have done. That can be extremely worrisome. India appears to have not learnt its lessons from Vietnam – that it is possible to deal with a border dispute without sacrificing commercial and business interests (https://bhaskarr.substack.com/p/is-india-spooked-by-china). No wonder, its growth rates are truly marvellous.

India also seems to have forgotten the memorable statement by the former UK Prime Minister Margaret Thacher, who declared that “There is no such thing as public money” Just the first three minutes of her speech at https://www.youtube.com/watch?v=xvz8tg4MVpA should suffice to relearn the message.

Yet you have the prime minister who castigates the revadi (freebie) culture at one forum and announced more and more freebies on the other. His PLI scheme is hurting India (https://asiaconverge.com/2022/10/pli-and-the-indian-economy/).

The Reserve Bank of India’s (RBI’s) alacrity in pulling up NBFCs for lending at high rates is misplaced. The sectors that need money badly are the small and medium sectors. But they represent greater risks which must be priced in by6 charging higher interest rates (https://www.youtube.com/watch?v=kIKhYqKTxbQ). It is ironical that the RBI pulls up NBFCs even while banks charge as much as 3.5% per month on loans outstanding against credit cards. Can the central bank allow NBFCs to remain to a flailing Indian economy?

The government continues to raid Indian businessmen, making the country an unsafe place to do business in. If its unemployment numbers in the table above look benign, look at the actual unemployment numbers from the World Bank.

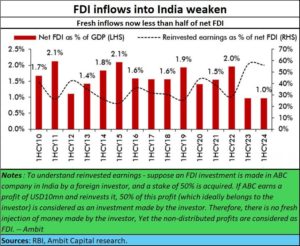

The acid tests for an economy doing well are FDI, unemployment, and balance of payments. All are in terrible shape.

Education which has the potential of saving India is getting worse with each passing year (https://bhaskarr.substack.com/p/ideology-causes-india-to-decline).

Education which has the potential of saving India is getting worse with each passing year (https://bhaskarr.substack.com/p/ideology-causes-india-to-decline).

It is time, India’s lawmakers listen to Margaret Thacher once again. It is also time it worked with countries that have the ability and willingness to invest in India. And, most importantly, it is never too late to allow education to flourish along the lines what the markets — and not ideologues — want. India needs good economics, not good ideology.

=======================

Do watch my latest podcast on the incredible story of Jamsetjee Jeejeebhoy — https://youtu.be/c1l09R0nUAw

==============================

COMMENTS