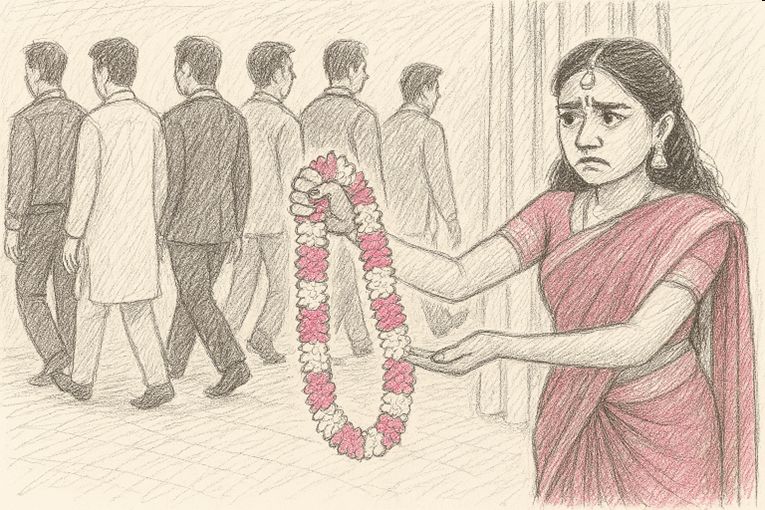

India — frantic search for a suitor

By RN Bhaskar and Sakeena Bari Sayyed

Image: Sourced through CoPilot

India’s search for a partner has yielded no fruit. Nobody is willing to invest in this country – for a variety of reasons. India has lost the goodwill of most countries in this region as well. Ironically, the one suitor who has been waiting in the wings. But that is a suitor that India had spurned earlier. However, as options ruin out, India has begun to try to put up a pretty face and revisit that suitor.

Frantic pursuit

India claims that its economy is vibrant. That it will soon become the third largest country in terms of GDP. That it produces more graduates than anywhere in the world. That it has a vibrant capital market. None of these claims has convinced the Western world to look at India with fondness.

One reason is that they have little money to share with India by way of FDI. They are still keen on grabbing other people’s money as they did in the past – whether it is in Venezuela, or Iran, or Russia. Another reason is that they do not consider India’s investment climate good enough. India has tried wooing them through FTAs instead. Australia, UAE, UK and even New Zealand have been wooed with free trade agreements. But that has not made them investors and partners with India. Their deals are purely transactional. In many instances (as in the deal with New Zealand) India could be headed for a wrecked dairy industry. Moreover, India is saddled with a heavy ideological baggage as well. Its attacks on minorities have not endeared it to anyone except Israel.

GDP myths

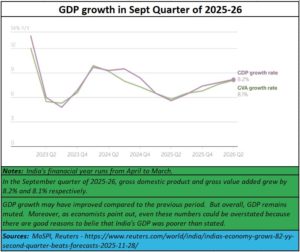

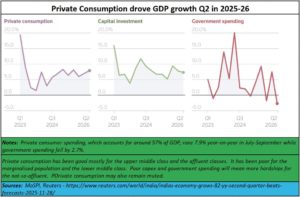

Most people greet the government’s chest-thumping declaration of a resurgent GDP growth with cheers (https://asiaconverge.com/2025/09/india-needs-to-look-beyond-gdp/). But savvy observers of the Indian economy are not amused. They can see behind the makeup and know the wrinkles that the paint conceals. India is not very pretty anymore.

The government’s trumpeters are quick to point out how GDP growth in the last quarter was over 8%. They claim that GDP growth for the year should be over 7%. But this may happen only if one takes the government’s figures at face value. Listen to the country’s former chief statistician, Pronab Sen. He seeks to discount the government’s claims of a high GDP (see timeline 52.30 to 53.20 – https://youtu.be/ttReZu7LHJ4?si=MrtQMqJjU8zJOjuj). He talks of how the government’s estimates are misleading.

The government’s trumpeters are quick to point out how GDP growth in the last quarter was over 8%. They claim that GDP growth for the year should be over 7%. But this may happen only if one takes the government’s figures at face value. Listen to the country’s former chief statistician, Pronab Sen. He seeks to discount the government’s claims of a high GDP (see timeline 52.30 to 53.20 – https://youtu.be/ttReZu7LHJ4?si=MrtQMqJjU8zJOjuj). He talks of how the government’s estimates are misleading.

Take another economist — Arun Kumar is quite candid about the GDP myth where he says that the real GDP growth for India should not be more than 3.5% (time 16.50 to 17.05 — https://youtu.be/8SYDPqB6Qhg?si=z7D-Q-ViAlou3bKL)

Or listen to the astute market analyst, Ruchir Sharma, who in a discussion with Prannoy Roy believes that there is something wrong with the way GDP growth rates have been calculated ( timeline 8:13 to 8:14 — https://www.youtube.com/live/m1QY0S7GgqU?si=G_2kOvZEc_BwW3yh) .

Unlike Pronab Sen and Arun Kumar, Ruchir Sharma bases his conclusion on the contradictions between the government’s claims and ground realities. Salient among these contradictions are:

- Unemployment has been increasing. If GDP growth is really that robust, unemployment should have declined You cannot have a robust GDP growth without a sharp uptick in employment.

- India’s trade gap is widening. It is difficult to envisage a high GDP growth in the face of increasing imports and worsening trade balance. The negative trade balance adds to the country’s deficits. That in turn pushes up interest costs, leaving less money for capital expenditure that is critically important for any country, especially developing economies.

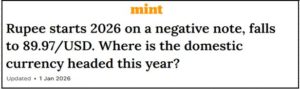

- India’s rupee kept weakening. No country has ever boasted off high GDP growth rates when imports grew faster than exports and the local currency has kept on weakening.

India can be a great myth maker. But myths, like bubbles, have a tendency to burst. The colours and the sparkle then vanish.

India can be a great myth maker. But myths, like bubbles, have a tendency to burst. The colours and the sparkle then vanish.

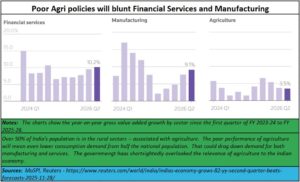

There are other problems as well.

Manufacturing seems to climb in the last quarter and so does financial services. But observe the third chart. Agriculture is slipping. The rural sector accounts for over 50% of India’s population. The people there represent not just wealth generators but also consumers. When wealth generating capabilities get muted, so does consumption. This is because this sector has less money to spend. Weak consumption cannot sustain growth rates in either manufacturing or even financial services (eventually, the government waives loans which puts the financial sector in a worse mess).

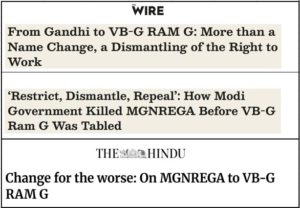

Sadly, the government has promoted policies that are based on ideology and not sound economics.

Also, India’s ill thought of cattle slaughter laws have blighted the rural sector where milk has been the biggest wealth generator (free subscription — https://bhaskarr.substack.com/p/dairy-ruminations-that-make-little). Effectively, while national milk production grew by 74% during the last decade (2013-24), milk production grew by just 46% in the Hindi belt where screaming mobs chase and sometimes kill cattle- and cattle-meat traders (https://en.wikipedia.org/wiki/List_of_incidents_of_cow_vigilante_violence_in_India). South India grew by 98% because it was disdainful. The Southern states believed that these cattle slaughter laws would have hurt rural prosperity, and interfered with personal food habits guaranteed by the constitution.

Also, India’s ill thought of cattle slaughter laws have blighted the rural sector where milk has been the biggest wealth generator (free subscription — https://bhaskarr.substack.com/p/dairy-ruminations-that-make-little). Effectively, while national milk production grew by 74% during the last decade (2013-24), milk production grew by just 46% in the Hindi belt where screaming mobs chase and sometimes kill cattle- and cattle-meat traders (https://en.wikipedia.org/wiki/List_of_incidents_of_cow_vigilante_violence_in_India). South India grew by 98% because it was disdainful. The Southern states believed that these cattle slaughter laws would have hurt rural prosperity, and interfered with personal food habits guaranteed by the constitution.

Effectively, the best one can conclude is that the last quarter was an aberration. Moreover, if India’s GDP growth rate is closer to 3.5% than 7%, it is not even the best performer in Asia or the world.

People matter

Eventually, the biggest resource countries have is people. That is why strong economies invest heavily in nurturing the productive capabilities of its citizens.

India disdainfully cripples education and makes people unemployable. Its solution to poor global rankings in school or university rankings, is to toss out the rankings themselves, and refuse to participate in such surveys.

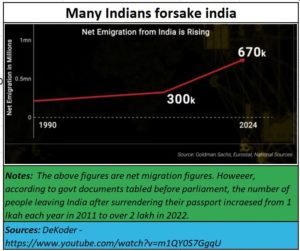

India terrorizes its wealth generators with rules and laws that sap their productive energies. Its tax-laws are a nightmare. Ask Vodaphone, or even Tiger Global. The latter had a tax verdict 10-14 years after the transaction was concluded (https://timesofindia.indiatimes.com/business/india-business/tiger-globals-flipkart-stake-sale-taxable-sc/articleshow/126555589.cms). Not surprisingly, many global companies choose to avoid India. Worse, even Indians have begun surrendering their passports.

When the best opt to reject their citizenship, you know that something is not right. According to figures presented in the parliament (https://asiaconverge.com/2023/09/inflated-views-and-deflated-economy/) the number of India who surrendered their passport and took up citizenship in other countries grew from around 1.2 lakh a year in 2011 to over 2.2 lakh by 2022. Worse, even Indian millionaires have begun to flee this country (https://asiaconverge.com/2025/07/capital-and-millionaires-flee/). These are not signs that the Indian economy is resurgent.

When the best opt to reject their citizenship, you know that something is not right. According to figures presented in the parliament (https://asiaconverge.com/2023/09/inflated-views-and-deflated-economy/) the number of India who surrendered their passport and took up citizenship in other countries grew from around 1.2 lakh a year in 2011 to over 2.2 lakh by 2022. Worse, even Indian millionaires have begun to flee this country (https://asiaconverge.com/2025/07/capital-and-millionaires-flee/). These are not signs that the Indian economy is resurgent.

Money follows people

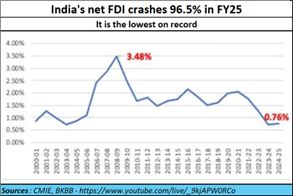

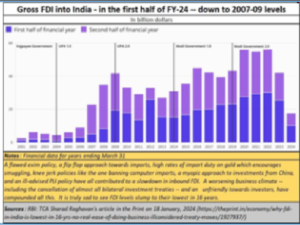

When talented people choose to leave India’s shores permanently, it is not surprising that investments also shy away. India’s FDI has declined to its lowest in seventeen years.

Even the latest year saw FDI decline sharply. Instead, investments have begun flowing out, leaving India with a negative net FDI. If India were a corporate entity, its shareholders would have demanded and got a dismissal for the entire board of directors.

Even the latest year saw FDI decline sharply. Instead, investments have begun flowing out, leaving India with a negative net FDI. If India were a corporate entity, its shareholders would have demanded and got a dismissal for the entire board of directors.

Poor FDI = poor employment

Poor FDI has meant fewer new enterprises coming up. That in turn has meant fewer job creation opportunities. India was myopic enough to spurn China’s investment in start-ups. Barely five years ago, China was the biggest investor in India’s start up ecosystem (https://asiaconverge.com/2020/03/china-investments-in-india-are-strategic-and-profitable/). Almost all the unicorns that emerged from India were with the assistance of Chinese investments. Then India decided to ban China’s investments and spurn them. It had not learnt the lesson from even a small country like Vietnam (free subscription — https://bhaskarr.substack.com/p/is-india-spooked-by-china) – that border disputes and conflicts should be discussed separately. They should not mix up with economic growth. Such myopia caused investments to dry up. Fresh investments from other countries could not fill this gaping void created by the ban on investments.

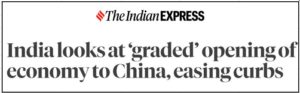

Today, neither the US nor Europe has the ability to invest in India. Perforce, India is now going back to China to seek fresh investment and thus create new jobs. Even this move was after Russia stepped in and pointed to the huge advantages of an RIC (Rusia-India-China) approach (https://bhaskarr.substack.com/p/trade-blocs-vie-for-relevance). India needs new wealth generation centres in urgently. As Ruchir Sharma puts it, unless India can sustain a healthy GDP growth rate for six quarters at least, foreign investors are not likely to come to India. It is only when foreign investments begin trickling in, HNIs too will come back to this country.

Today, neither the US nor Europe has the ability to invest in India. Perforce, India is now going back to China to seek fresh investment and thus create new jobs. Even this move was after Russia stepped in and pointed to the huge advantages of an RIC (Rusia-India-China) approach (https://bhaskarr.substack.com/p/trade-blocs-vie-for-relevance). India needs new wealth generation centres in urgently. As Ruchir Sharma puts it, unless India can sustain a healthy GDP growth rate for six quarters at least, foreign investors are not likely to come to India. It is only when foreign investments begin trickling in, HNIs too will come back to this country.

Options

So, what options does India have?

- Put normalisation of relations with China on the fast track. China needs India’s market and India needs Chinese investment and technology. Together, China and India (along with Russia) can generate huge wealth for each other, making Trump’s tariff less relevant. But that will mean fighting against Western interests that have insinuated their way into this country’s policymakers (with bribes, favours, and sinecures). Sergei Lavrov spoke of this quite openly in New Delhi in 2023 (https://youtu.be/HYP7qHJPNwA?si=zKwr2Jz0mHcp0-Lu) . These vested interests will try and promote the US despite the insults, humiliation, and constrictive demands that the US has heaped on India.

2. Focus on skill development. Currently, India has gone about skill development in a ham-handed manner (https://www.youtube.com/watch?v=nx60TRElEhg). It has introduced new schemes which have very little additional money for upgrading its teaching talent which is crucial for good skill development. India does not adopt an outcomes-based approach – where the outcomes of teachers, students and even education institutions are evaluated on a fortnightly basis. Teachers and institutions with poor outcomes need to be weeded out. There is little sense in pouring good money over bad. Poorly performing institutions can be handed over to more competent management. However, that will require immense political will. Currently the government has more political will for ideology, not for sound education or skill development.

2. Focus on skill development. Currently, India has gone about skill development in a ham-handed manner (https://www.youtube.com/watch?v=nx60TRElEhg). It has introduced new schemes which have very little additional money for upgrading its teaching talent which is crucial for good skill development. India does not adopt an outcomes-based approach – where the outcomes of teachers, students and even education institutions are evaluated on a fortnightly basis. Teachers and institutions with poor outcomes need to be weeded out. There is little sense in pouring good money over bad. Poorly performing institutions can be handed over to more competent management. However, that will require immense political will. Currently the government has more political will for ideology, not for sound education or skill development.

Currently, as the CAG report shows, the government’s expenditure on skill development had been shoddy and ill-planned. (https://www.indiatoday.in/india-today-insight/story/cag-exposes-underbelly-of-indias-flagship-skilling-scheme-pmkvy-2842568-2025-12-27). This is no way to proper skill development.

3. But skill development must go hand in hand with better school education. For this, it is imperative that the government adopts an outcomes-based approach. Once again, this will require sagacity and political will without ideological baggage. India’s schools are in a terrible shape, which is the biggest contributor to unemployability (https://bhaskarr.substack.com/p/the-state-of-education-in-india). Even this podcast shows how terrible the situation is — https://www.youtube.com/watch?v=m74BaqgWD-g

4. Shed the constant temptation to rig the markets to higher levels. Indi has already over-valued \(timeline 4 7:10 to 47:25–https://www.youtube.com/live/m1QY0S7GgqU).

When compared with other countries, India does not even have the energy to try outperforming the USA (see timeline 2:23 to 2:55 in the above video), which is itself a declining economy.

When compared with other countries, India does not even have the energy to try outperforming the USA (see timeline 2:23 to 2:55 in the above video), which is itself a declining economy.

5. India needs to strengthen its rural sector. For this it must guard itself against some of the provisions in its ill-advised FTA with New Zealand. (https://bhaskarr.substack.com/p/india-new-zealand-fta-will-it-destroy)

5. India needs to strengthen its rural sector. For this it must guard itself against some of the provisions in its ill-advised FTA with New Zealand. (https://bhaskarr.substack.com/p/india-new-zealand-fta-will-it-destroy)

Do bear in mind that any further weakening of the milk and dairy sector will accelerate the crippling of India’s rural prosperity. Milk is the biggest revenue generator among all the agriculture related sectors in India.

Do bear in mind that any further weakening of the milk and dairy sector will accelerate the crippling of India’s rural prosperity. Milk is the biggest revenue generator among all the agriculture related sectors in India.

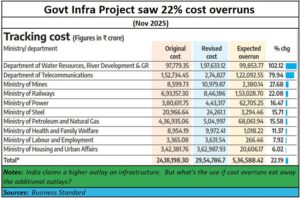

6. Focus on improving infrastructure. Begin with the Western Dedicated Freight Corridor (DFC) which is crucial for much of India’s industry.

6. Focus on improving infrastructure. Begin with the Western Dedicated Freight Corridor (DFC) which is crucial for much of India’s industry.

With private capital shying away from India and investments not taking place, government spending will have to increase if it wants to sustain a high GDP growth rate for the next six quarters.

With private capital shying away from India and investments not taking place, government spending will have to increase if it wants to sustain a high GDP growth rate for the next six quarters.

But this will also mean that the government must usher in better project management skills to control infrastructure cost inflation through time and cost overruns. If India cannot do that, India will be another lost country in the garbage heap of history.

Conclusion

India is not that attractive anymore. It had many suitors wooing for its hand in the first decade of this century. Yet, it disdainfully kept looking for better opportunities – especially during the past decade. Effectively, it made ‘better’ an enemy of the ‘best’ and was left with dregs instead.

India needs to make itself attractive once again. This can happen only through more investments (China becomes crucially important here), better education, more meaningful skill development, and effective project management for infrastructure spending. Time is not on India’s side nor are global developments. India must move quickly with the right partners. It has wasted too much time with partners who proved unreliable or turned out to be extortionists.

===========

Do view my latest podcast on the Venezuelan crisis and how it will endanger the entire planet. You can find it at https://www.youtube.com/watch?v=_f160Rh4OJ4/

============================

And do watch our weekly “News Behind the News” podcasts, streamed ‘live’ every Saturday morning, at 8:15 am IST. The latest can be found at https://www.youtube.com/live/GglgN7SauUI?si=QT6ULahgNKqy-0mR

============================

COMMENTS