16 Feb 2026

India faces an exodus of money, people, and values

By RN Bhaskar and Sakeena Bari Sayyed

Image: Gemini

Even as Piyush Goyal, Union minister for commerce, continues to be exultant about his New Zealand and EU FTAs and his trade deal with the US, there are many who are not enthused. They have staged an exodus from India. They are voting with their feet and are migrating to other countries. Some are leaving for work – because the employment scene is terrible in India. Some leave for acquiring good education – good higher education is open for very few people in India. Other people have to contend with substandard education or opt to go overseas.

But the exodus is not confined to people. There is an exodus of money as well. If the current state of affairs is allowed to continue, it is only a matter of time that Indians begin to lose faith even in the domestic currency as well.

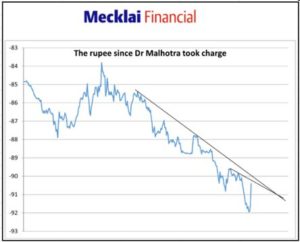

Sadly, many government policies have contributed directly to the weakening the rupee (http://www.mecklai.com/digital/MecklaiResearch/MarketManiac).

Sadly, many government policies have contributed directly to the weakening the rupee (http://www.mecklai.com/digital/MecklaiResearch/MarketManiac).

- Failure to improve the domestic environment for businesses to grow and flourish in, has resulted in a drop in exports. Technically exports have gone up. But imports have gone up faster. Exports could have grown faster if the domestic environment were better.

- Poor agriculture policies. This can be seen in the government’s decision to ban forward trade in the largest number of agri commodities to date. Banning forward trade results in the inability to discover future prices that is often used as a guidance for growing the crop which yields the best returns (https://asiaconverge.com/2022/10/the-folly-of-banning-futures-trading-in-commodities/). It can be seen in the cattle slaughter laws (image of our podcast). It can also be seen in trade deals that will eventually hurt farmers. All these hurt the purchasing power of 50% of India’s population and hence weaken the economy.

- Idiosyncratic bans on export of agri commodities. That too weakens the country as well.

- Ditto with capricious import of agri items like edible oil, pulses, and even dairy items (after the New Zealand FTA). (https://bhaskarr.substack.com/p/india-new-zealand-fta-will-it-destroy)

- Poorly thought of trade treaties and agreements which compel India to import large volumes, give foreign countries a zero-duty entry into India. Even while agreeing to pay 18% on exports.

- Agreeing to stop importing oil from Russia which India got at a 30% discount to market prices. India should have agreed to import from the US only if the same discounts were available. Effectively, India pushes up its import bill and makes manufacturing more expensive in This will further dampen India’s export and widen India’s trade gap. (https://asiaconverge.com/2026/02/us-trade-agreement-india-capitulates/)

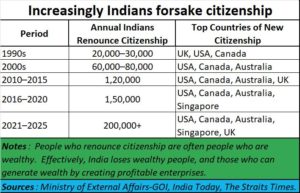

The exodus of people is the most worrisome. This because of several reasons:

- People who leave the country are often the most capable and potentially productive section of the population. India loses its productive energies.

- When people with money begin leaving, it is a double whammy. Their money could have been used for setting up enterprises which in turn could have created both employment and wealth. Moreover, usually, people with money are also the most creative and productive citizens. You lose them.

- Exodus of people looking for jobs. India’s unemployment scene has been worsening year after year. So, the search for jobs overseas becomes urgent. Once again, the most capable manage to get jobs overseas. India, thus, encourages wealth generation overseas and not in India. The desperation for jobs even made many Indians go to other countries illegally. They were not criminals and India should have protested (like Colombia) against the US decision to deport such Indians in handcuffs and shackles. (https://asiaconverge.com/2025/02/trumps-quagmire-now-what-do-we-do/).

- One advantage about Indians working overseas is that they send back part of their earnings as remittances. That is a saving grace. Without remittances, India would have been in dire straits. India should encourage policies that allow them to generate the same wealth in this country rather than overseas. But more worrisome is a new development. Hitherto, remittances into India were always overshadowed by FDI inflows. Lately, FDI inflows have shriveled. Consequently, remittances are today larger than FDI.

- Most frightening is the increasing number of Indians surrendering their own passports. That is most unfortunate. They have had enough of India and have chosen to leave.

- Along with this there has been an exodus of money. This is quite pronounced in respect of outward FDI flows.

But, lately there has been an exodus of FPI as well.

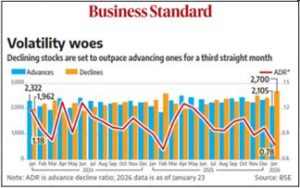

Two factors have caused FPI outflows. One is a lack of confidence in the ability of Indian markets to generate returns. India is the worst performing Asian market.

Two factors have caused FPI outflows. One is a lack of confidence in the ability of Indian markets to generate returns. India is the worst performing Asian market.

The other factor is the erosion in the value of the Rupee. People don’t like investing in a country when the local currency is eroding. When local earnings are converted into dollars, they get fewer dollars. Furthermore, postponing investments allows foreign investors to get more rupees at a later date.

The other factor is the erosion in the value of the Rupee. People don’t like investing in a country when the local currency is eroding. When local earnings are converted into dollars, they get fewer dollars. Furthermore, postponing investments allows foreign investors to get more rupees at a later date.

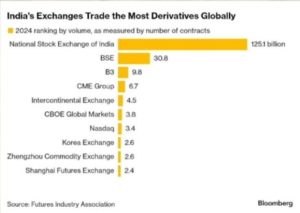

- In any case, India’s policy makers have encouraged speculative trade more than FDI. Ironically, over 60% of speculative derivative trade comes from India, even though this country accounts for barely 4% of global market capitalization. The recent provisions in the budget also point to the shallowness of government thinking. Higher STT (Security Transaction Tax) only means that the government wants a share of the obscene returns some FIIs make. There has been no attempt to reduce speculation by keeping away small players. The government prefers letting foreigners make small investors lose money, provided the Indian exchequer itself gets a share of the booty.

RBI cover up

Tragedies can be most painful when people and organisations refuse to disclose facts and instead try to mislead the general public. India’s central bank is occasionally guilty of doing this.

For instance, the central bank is not supposed to play to the gallery. It has no business telling people why a trade deal is good for India. That is a role that politicians play.

For instance, the central bank is not supposed to play to the gallery. It has no business telling people why a trade deal is good for India. That is a role that politicians play.

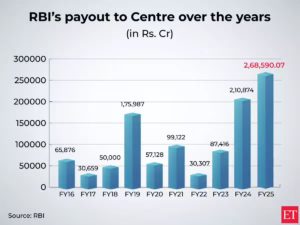

The RBI’s willingness to contribute (over)generously to the dividend pool of the central government is another good example. It even justified giving away such funds. The RBI should instead keep its reserves for strengthening the rupee and its balance sheet. Yet it gave away the highest ever dividends.

The RBI’s willingness to contribute (over)generously to the dividend pool of the central government is another good example. It even justified giving away such funds. The RBI should instead keep its reserves for strengthening the rupee and its balance sheet. Yet it gave away the highest ever dividends.

It is also interesting to see how India’s currency has depreciated even against a collapsing dollar. As the chart above shows the dollar depreciated by almost 12% in the last one year. The rupee has weakened even against this weakened dollar. Thus, it is fanciful talking about low inflation when it should actually be over 12% a year.

It is also interesting to see how India’s currency has depreciated even against a collapsing dollar. As the chart above shows the dollar depreciated by almost 12% in the last one year. The rupee has weakened even against this weakened dollar. Thus, it is fanciful talking about low inflation when it should actually be over 12% a year.

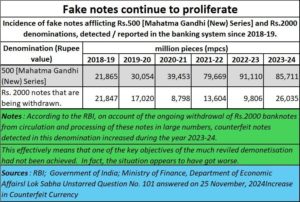

The RBI has not yet created the right policies in consultation with the finance ministry to prevent the increasing incidence of counterfeit notes.

The RBI has not yet created the right policies in consultation with the finance ministry to prevent the increasing incidence of counterfeit notes.

The seriousness of the situation can be best gauged when one looks at India’s forex reserves. India’s reserves even as they exist today barely covers twelve months of imports. Imports in 2024-25 stood at $ 915.19 billion. India’s reserves stood at $646 billion. (https://www.pib.gov.in/PressReleasePage.aspx?PRID=2122016®=3&lang=2)

The seriousness of the situation can be best gauged when one looks at India’s forex reserves. India’s reserves even as they exist today barely covers twelve months of imports. Imports in 2024-25 stood at $ 915.19 billion. India’s reserves stood at $646 billion. (https://www.pib.gov.in/PressReleasePage.aspx?PRID=2122016®=3&lang=2)

More frightening is how the figure of reserves has been window dressed. Conventionally, gold was included as part of reserves at historic value. Now the gold has been revalued to current market prices. This is not a bad thing to do provided the RBI also made public data for reserves without gold. When we compute these numbers, we discover that India’s reserves have actually fallen. Had the RBI not transferred its reserves and dividends quite generously; this awkward situation could have been avoided.

Exodus of values

There has also been a gradual exodus of value over the past two decades. It started with RBI governors not putting their feet down when coins were allowed to promote religion. This happened under the finance ministership of Chidambaram, where he wallowed such coins (https://asiaconverge.com/2013/11/is-the-govt-promoting-religion-through-coins/).

RBI governor similarly did not put in an objection note when coins of one denominations began to resemble coins of another denomination (https://youtu.be/g0J9Q4I8s5g?si=-9Ux3pNyU6q0fxgh). True, coins are the domain of the finance ministry, not the RBI. But RBI is the custodian of all currency. It could have lodged a protest note.

Even the present RBI governor has made no attempts to normalize the sizes and colours of currency notes.

It is as if the central bank is willing to make mockery of the basic principles of numismatics (see timeline 5:20 at https://www.youtube.com/watch?v=g0J9Q4I8s5g)

Moreover, the RBI has not been willing to give out time series data of foreign exchange reserves, exports-import-trade gap, FDI and FPI among many other items. This is also true of time series data for a variety of agriculture and industrial produce, state wise, so that a meaningful analysis of state performance is also available. The absence of data makes reasonable analysis extremely difficult forcing people to go to foreign research organisations.

Conclusion

When a country witnesses an exodus on so many fronts, it is obvious that things are not right. It is one thing to talk of a Viksit Bharat and another to find a reflection of this strength and progress in the country’s statistical data. The contrast is horrifying and disturbing.

===========

My latest podcast is on dedollarisation. You can find it at https://youtu.be/T4gLFt5Kssk

============================

And do watch our weekly “News Behind the News” podcasts, streamed ‘live’ every Saturday morning, at 8:15 am IST. The latest can be found at https://www.youtube.com/live/WZNsFZUuFyE?si=XCffhrDnHzdBTBgV

============================

COMMENTS