http://www.freepressjournal.in/analysis/rn-bhaskar-a-novel-way-to-resolve-the-bank-npa-issue/1078090

Is there a way to handle NPAs and yet save the Indian banking system?

Sometimes, it is important for finance ministers to consider the valuation approach in order to resolve the non-performing assets (NPA) crisis afflicting Indian public sector banks (http://asiaconverge.com/2016/02/when-banking-becomes-a-nightmare/). This is the method adopted by most investment bankers and astute financial advisers. It is what the government of India was willing to adopt in the early 1990s when India’s finances were so stressed that it was compelled to mortgage even its gold.

According to at least one astute financial advisor, Pradip Shroff, a simple way to handle bank NPAs is to look at the underlying assets of all public sector banks in the country. Conventionally, only buildings, plant and machinery are revalued. But it is possible to push the envelope further. Instead of talking about revaluation reserves, there is a method to there is a method to convert (within the existing legal framework) revaluation into realisable reserves (2017-06-02_FPJ-PW-reval-reserves-and-realised-reserves).

According to at least one astute financial advisor, Pradip Shroff, a simple way to handle bank NPAs is to look at the underlying assets of all public sector banks in the country. Conventionally, only buildings, plant and machinery are revalued. But it is possible to push the envelope further. Instead of talking about revaluation reserves, there is a method to there is a method to convert (within the existing legal framework) revaluation into realisable reserves (2017-06-02_FPJ-PW-reval-reserves-and-realised-reserves).

There is a general belief that Indian banks could have at least 100 times (if not a thousand times) more valuable assets on their hands than shown in the books. This is because most banks sit on precious land. The method to be adopted therefore would be to transfer all the land and building of banks to 100% (wholly-owned subsidiaries). Since the assets of banks remain with banks (through their subsidiaries), the financial bodies are not deprived of their crown jewels. But as the subsidiaries would have to acquire these land and buildings at market value, the actual price realised by banks would be significantly higher than shown on their books.

The transaction could be done on the basis of ready-reckoner values given out by the income tax department for all territories in India. The amount now shown on the banks’ books now becomes a realisable value. And NPAs can now be set off against these sums.

After all, all NPAs are advances (appearing on the asset side of the balance sheet) which have become stressed. The banks have to adjust these advances against realisable values of the ‘defaulting’ borrowers. Usually, the bank has to take a haircut (a loss) on account of the difference between the advance and the realisable value (which is itself a revaluation).

In the new approach, the bank does the same thing. It too works on realisable reserves. The advantages are there for everyone to see.

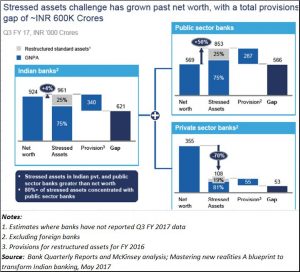

First, the banks would be able to free up their cashflows. In the financial year (FY) 2016, Indian banks made provision for Rs.3.4 lakh crore (see chart), out of a total NPA of Rs.9.61 lakh crore. This means that Rs.3.4 lakh crore was sucked out of circulation, at just the time when the government needed to provide additional loans and advances to finance infrastructure building costs. This is because, currently, all profits a bank are set aside as provisions for bad loans or heavily stressed assets. The ‘liberated’ cashflows permit banks to return to health far quicker than is the case at the moment.

Second, since the assets are with a subsidiary, the bank can always have access to them. The only difference is that any incremental value of the realised assets will go into the books of the subsidiary and not the (parent) banks. Eventually, banks and the RBI will have to decide whether the realisable should be shown on the banks own books, or on the books of their subsidiaries (2017-06-02_FPJ-PW-converting-reval-res-into-realised-res). The concept of valuation of fixed assets at its market price and the difference between the book-value and the market price is termed as revaluation reserve, while the difference between the quantum of loans and advances given and their realisable value is termed as loss arising from possible bad debt. In fact, both are figures that emerge from revaluation. They, therefore, need to be treated similarly.

Third, the cost of selling the assets (land and buildings) to wholly owned subsidiaries could involve a tax of around 5%. But the amount is significantly lower than the potential loss of business caused by the impounding of profits towards provisioning.

Fourth, since the government is the majority owner of each of these banks, it would earn dividends on the unfettered profits made by these banks. The government becomes richer, non-government shareholders feel happier, and the banks get the space to do more business.

Fifth, whatever profits the banks make from the sale of (written off) assets (belonging to ‘defaulters’) will be windfall gains, because this amount has already been written off as an NPA.

There are accounting purists who would frown at such accounting re-interpretations. But this is something that is being done already. When a company with stressed loans goes in for corporate debt restructuring (CDR), the value of land is also considered for repaying its debts to banks and other creditors. What is good for stressed assets of borrowers should apply to banks as well.

Finally, there is a good case for the government introducing a law compelling all companies and individuals to periodically (say every 2-3 years) revalue the land and assets owned by them. This would permit shareholders to know the actual market value of the underlying assets of companies they have invested in or have lent money to. It would prevent brazen attempts by promoters to purchase land from their own companies at a fraction of their market value (remember the recent happenings at Raymond Ltd). Such a move will certainly lead to more transparency, and a healthier mark-to-market approach.

If the government were to do all this, the NPA problem could be handled overnight. Yes, there could be issues relating to stamp duty and insurance, but these can easily be taken care of. But the main purpose of having healthier banks and a vibrant economy would me met.

COMMENTS