http://www.freepressjournal.in/analysis/fdi%e2%80%88mixed-smoke-signals-continue-to-perplex/1140625

Will FDI finally begin to roll into India?

If one looks back, 2014 was a year when many people had a great deal of hope and expectation. FDI was supposed to pour into India. The idea of less government, more governance was music to the ears. That euphoria appears to have faded. But it isn’t dead. Not yet. Not so soon.

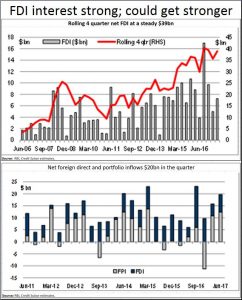

The latest charts from Credit Suisse suggest that things could just bounce back. They provide a contrast to the mounting noises of disapproval. Thus, things could actually be on the mend..

The latest charts from Credit Suisse suggest that things could just bounce back. They provide a contrast to the mounting noises of disapproval. Thus, things could actually be on the mend..

Undoubtedly, there are some dark clouds around. They do cause enormous discomfort.

One relates to the mounting NPAs of banks. Almost everyone knows that these bad loans were not entirely as a result of demonetisation, or global slowdown, or even GST. Most of them were the result of a culture that allowed the private sector to enter into cosy deals with politicians and bankers. They get money for risky projects at terms that were only meant for safe advances. Now the cleanup reminds one of the Augean stables.

Demonetisation was unfortunate (http://www.asiaconverge.com/2017/01/demonetisation-has-made-govt-richer-people-poorer/). It came at a time when the banks were already under stress. There was no need for one more salvo to be fired, especially when everyone knew that the small man – especially related to the small and medium enterprises – would get badly mauled.

GST on the other hand was sorely needed. For long India has promoted tax arbitrage with people using small scale, handloom, and handicraft as tax shields. Business models were built on these platforms. There is an urgent need to get the economy back on a level playing ground. But GST could have been planned better. Today, business travel by cabs and cars are not included for credits, nor stay in hotels in another state by travelling business executives. Export income earners too are required to pay GST first, and then seek refunds. The processes could have been a lot simpler.

But the biggest cloud is the one which threatens unemployment pains. One reason for this has been the uncertain investment climate in the country. At such times, foreign portfolio investments (FPI) become more relevant than foreign direct investments (FDI). But FPI does not create that many jobs. FDI is what is needed.

To be fair, the Credit Suisse charts alongside do affirm that FDI inflows have not been weak. But they could have been stronger. Much of the FDI relates to companies that have already been in India, know the ropes here quite well, and have expansion plans to consolidate their position in this country. That would explain the investment of a Vodafone, or a Maruti-Suzuki, or a Hyundai. But fresh investments in new projects have witnessed a slowdown.

Take for instance the new defence-related joint ventures. Not one has talked about the funds that ought to have come in by now. Or take the DMIC (Delhi Mumbai Industrial corridor) related investments. The first set of smart-cities were supposed to have come up here. The first industrial complexes were to have sprouted roots along the dedicated freight corridor (DFC). Clearly, despite much talk to the contrary, the Japanese too appear to have slowed down their money-tap to a trickle.

One possible reason could be the government’s attempt to tinker with the Bilateral Investment Treaty (BIT) (http://www.asiaconverge.com/2016/08/arbitration-awards-india-shaken/). The government suddenly decided not to allow new investors in Indian projects to benefit from international courts of arbitration with tribunals seated outside India (usually Singapore, London, New York among others). It wanted investors to use India’s own newly-set-up Arbitration Centre in Mumbai. But there was a problem. If the arbitration centre were to be in India, arbitration awards could be opened up by Indian courts (http://www.asiaconverge.com/wp-content/uploads/2016/08/arbitration-2012-09-06_SC-5-member-bench-bharat.pdf). The very purpose of arbitration was to reduce the time taken for litigation and reach a closure. Awards given by arbitration centres seated outside India were not subject to further scrutiny by Indian courts as decreed by a five-member bench of the Supreme Court on September 6, 2012.

Unwilling to be chained to the long-winded processes of Indian courts, most foreign investors have opted to slow down their investments. All countries in the European Union (EU) are said to have informed the government that they will not sign any BIT with India, but would go by what the EU decides. The EU has been clear that no major investment will flow into India till investors are given the right to appeal to arbitration centres outside of India.

Belatedly, the government has woken up to the problem. It is now working round the BIT issue by offering to enter into Free Trade Agreements (FTAs) with specific countries. These FTAs permit investors to approach arbitration centres seated outside of India. So Japan, EU and Israel are likely to be the first major beneficiaries. Expect investment flows to resume soon.

If all goes well, that should mean a resurgent employment market, and a demand for office and residential spaces. Hopefully, the bounce-back could be remarkably pronounced.

The Credit Suisse charts do reinforce the fact that investment interest in India is not dead. It is strong. But it is waiting in the wings. If the government moves quickly to resolve the attendant vexatious issues, expect a resurgence. Else, it will be mere waste of time and money. FPI will continue to dominate (investment in capital markets can easily come in and go out; investments in project cannot. Hence their need for dispute resolution mechanisms is a lot greater).

Expect the impasse to end soon.

COMMENTS