http://www.freepressjournal.in/analysis/how-much-gold-can-be-mined-in-india-r-n-bhaskar/1291467

Can India ever allow genuine gold exploration and mining in India?

RN Bhaskar — | Jun 07, 2018

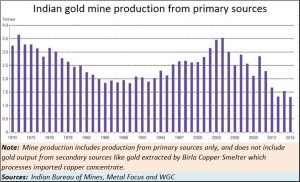

Officially India mined just 1.61 tonnes of gold in India during 2017-18. That was essentially from primary sources.

But ask geologists, and they will tell you that India should be mining a lot more gold. This is because the terrain from Australia to China has similar geological features. There is a lot of gold to be found there.

But ask geologists, and they will tell you that India should be mining a lot more gold. This is because the terrain from Australia to China has similar geological features. There is a lot of gold to be found there.

For instance, points out an Australian geologist, “In Australia we produce around 300 tonnes (9.7 million troy ounces) compared to barely 2 tonnes in India. We think India could produce a lot more. In fact,” he adds, “look at China. Even China has a similar terrain. In 1994, India produced around 2 tonnes, and China produced around 3 tonnes. Today, China produces 450 tonnes.” Clearly the potential for India is huge.

Thanks to the Supreme Court, which demanded that all natural resources ought to be auctioned, in May 2016, the Parliament approved an amendment to the Mines and Minerals (Development and Regulation) Act 1957 (MMDR). It allowed private companies to bid for mining licences through a competitive bidding (auction) process. The new mining leases were for 50 years, and the royalty on gold mines would now be a flat rate of 4% royalty on the gold revenue. In addition, gold mines must contribute to the National Mineral Exploration Trust and District Mineral Foundation. Put together the royalty is 5.28% irrespective of volumes produced. Under the initial issue of 43 mining blocks for tender, three were for gold mining deposits.

One of the first beneficiaries of this policy was Vedanta (earlier Sterlite group). In February 2016, Vedanta Resources became the first private company to successfully bid for a gold mine in India – the Baghmara gold mine in Chhattisgarh –with potential gold reserves of 2.7 tonnes of gold (http://ismenvis.nic.in/LatestNewsArchieve.aspx?Id=11888&Year=2016).

Next is Karnataka. Deccan Gold Mines, the sole gold explorer listed on the Bombay Stock Exchange wants to bring its flagship Ganajur project in Karnataka into production in 2018 or 2019, Annual output is estimated at just over 50,000 troy ounces (1.55 tonnes).

Some Australian investors of Deccan Gold Mines decided to back yet another project, Janagiri Mines, which hopes to approach the capital market soon for raising money to finance its Rs.300 crore capex for setting up its gold mine. The target – to produce around 25,000 troy ounces a year (appro 777 kg of gold).

Karnataka is also home to two of the oldest gold mines in India – the Kolar gold fields and the Hutti mines. In 2001, the government decided to close down the Kolar mines. This mine had been in existence for more than 120 years, and had produced during its life span some 800 tonnes (or 26 million troy ounces) of gold. That leaves India with just one functioning gold mine. The Hutti gold mine which, in 2015 alone, produced some 45,000 troy ounces (1.399 tonnes) of gold. But its production volumes appear to be ebbing.

Many geologists disagree. They say that instead of closing down existing gold mines, the government should offer them to other miners through auction. They can do a better job of extracting gold than the government can. They also point to the millions of tonnes of depleted ore that lies outside the existing mines. Conventionally, 1.5 grammes of gold is extracted per per tonne of earth. Good beneficiation techniques can extract at least 0.5 grammes from the depleted ore. Why can’t the government auction off the waste ore lying around?

As one expert points out, India’s policies may favour gold mining, but its bureaucracy will never allow gold mining to take off here. This is because officials make a good deal of money from people who engage in illegal gold mining in small pockets even today. The government forgets that mining is labour intensive. With good skilling and mining practices India could reduce its forex outgo on gold imports. The country imports approximately 800 tonnes of gold each year (http://www.asiaconverge.com/2018/02/gold-and-budget-2018/). True, several changes in the regulatory mechanism have been made, but bureaucratic red-tape prevails everywhere.

According to a research paper (The Kolar Gold Mines, India: Present Status and Prospects for Phyto-mining (https://www.researchgate.net/profile/P_A_Azeez/publication/270280429_THE_KOLAR_GOLD_MINES_INDIA_PRESENT_STATUS_AND_PROSPECTS_FOR_PHYTOMINING/links/54a639b40cf257a63608db05/THE-KOLAR-GOLD-MINES-INDIA-PRESENT-STATUS-AND-PROSPECTS-FOR-PHYTOMINING.pdf?origin=publication_detail) the Kolar fields have “33 million tonnes of tailings with 0.72g [per tonne of ] gold spread all over the mining township of KGF [Kolar gold fields]”. There is a need to offer the depleted ore reserves to the highest bidder through an auction process.

Yes, there is an increasing realisation that India could have more than 50 more gold mines. The map that can be found at https://www.researchgate.net/profile/P_A_Azeez/publication/270280429/figure/fig1/AS:295090288381966@1447366415764/Distribution-map-of-gold-occurrences-in-India-Source.png shows how many gold mining sites could exist.

But are India’s policy makers willing?

COMMENTS