https://www.freepressjournal.in/analysis/policy-watch-money-that-corporate-groups-manage

Money that corporate groups manage

RN Bhaskar

In many ways, this is an unusual article. It is about money. In some ways, it is in keeping with this column’s focus on exploring new ways to look at things. To go beyond common interpretations.

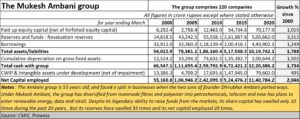

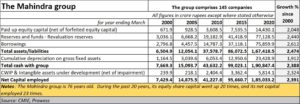

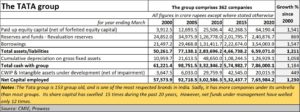

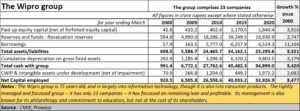

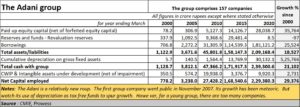

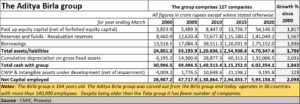

A clarification is required here. The tables are based on data available up to March 2020. This can pose a bit of a problem because many of the money inflows for groups like Adani and Ambani (Mukesh) took place in the subsequent financial year. But we can visit this analysis next year as well. Moreover, the rate at which both groups have been growing, expect numbers to change rapidly in the coming years as well.

We decided to do a three-part series on corporate group performance. And so we picked six from among the largest in India. Gong by alphabetical order, they are the Adani group, the Aditya Birla group, the (Mukesh) Ambani group, the Mahindra group, the Tata group and the Wipro group. The choice of the Wipro and Mahindra groups was primarily to focus on how some groups can remain tremendously focused and profitable.

Not that all the groups are not profitable. But profitability according

to balance sheets and annual reports can sometimes be different

to balance sheets and annual reports can sometimes be different  from a careful examination of numbers.

from a careful examination of numbers.

The first in this series is focusing on how the selected groups brought in money for growth, operations and expansions. The second in the series will be on profitability. It will appear next week. And the third will be on priorities that the group embraces.

Money talks

No business can function without capital. And hence it is important to look at the way money is raised. Some groups operate a very lean ship, with very few companies in their fold, some groups operate through a welter of companies – as does the Tata group. Nothing wrong with having many group companies. But the larger the number of companies, the more diffuse becomes management focus and direction. At times, what appears to be a strategic move to form a new company can become one more entity which has to cope with burdensome compliances in India (https://asiaconverge.com/2021/11/promoters-and-investors-both-need-good-regulators/).

While the charts by themselves along with the footnotes provide some details, a bit of explanation is needed here.

It is important to see how many times the equity share capital has grown for different corporate groups over a period of time. If reserves (less revaluation reserves) climb faster than the growth of equity share capital, the group has used the share premium route very successfully. New groups like Adani have seen their equity capital grow rapidly, but not reserves, possibly because the focus was not on rights issues. Moreover, since it is a new group – barely 20 years old, it has opted for increase in equity share capital.

Some groups have used depreciation funds very successfully to grow. Depreciation is tax free money, and it is a good way of gathering money. The dividend route is taxable, and the money gone to the government. The Adani appears to have relied immensely on depreciation funds, quite successfully.

Typically, the conventional definition of capital has been equity share capital + reserves + borrowings. We believe this definition is inadequate, because groups have large tax-free depreciation funds that lie with them, for use or misuse. They too must be considered.

At the same time, it may make sense to look at capital work in progress (CWIP) which refers to money locked up in projects that have yet to start generating money. Be careful of groups where CWIP starts growing faster than money raised. It points to an accumulation of unproductive assets.

All these charts are being displayed for a specific reason – to explain how groups collect funds. Money, whether taken as equity, reserves or borrowing (or from other sources) must be put to profitable use. And that is what this column will discuss next week.

To understand how much cash a corporate group has at its disposal is the first step. The other two steps will follow in subsequent articles.

Details about companies in each group can be downloaded from

2021-12-02_Adani-Group-Companies

2021-12-02_Aditya-Birla-Group-Companies

2021-12-02_Ambani-group-Companies

2021-12-02_Mahindra-Group-Companies

2021-12-02_Tata-Group-Companies

2021-12-02_Wipro-Group-Companies

COMMENTS