INVESTMENT PERSPECTIVE

By: J Mulraj

Dec 4 -10, 2021

The US-Russia geopolitical chess game over Ukraine

Even before it became the sole superpower following the collapse of Russia, America had a habit of interfering in the business of other countries. After WW 2 it acquired control over the Marshall Islands in the Pacific, and conducted a series of nuclear bomb tests between 1946-58 (see John Pilger’s wonderful documentary titled The Coming War on China). It entered a plethora of wars, the two longest being the Vietnam War and the Afghanistan war, both lasting over 19 years and costing perhaps $2trillion. Money that could have been better spent on things which were neglected, like infrastructure and the technologies of the 4th industrial revolution.

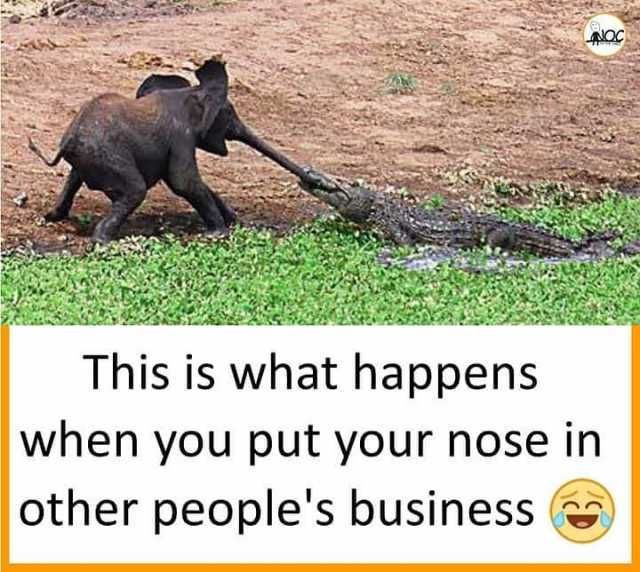

In Vietnam, and in Afghanistan, USA ended up much like the elephant illustrated above.

To be fair, the world does often turn to America to help fight despots and cannot, then, decry its attempts to intervene. The decision on when to intervene and, if it should, when to exit, (after the mission is accomplished), is a delicate balance.

This delicate balance is now coming into play, in three geopolitical scenarios. The most immediate is Ukraine, where Russia has amassed troops on its border, threatening to invade, to protect its Russian speaking Ukrainians from oppression. As also to prevent Ukraine from joining NATO, an organisation of countries that was formed to contain USSR before it was split into various countries.

It would be impractical for USA to send troops to fight a hot war. Frankly, the ludicrous manner of its exit from Afghanistan has made the world doubt the ability of USA to so intervene. At best America can threaten Russia with an imposition of more sanctions (which it has) and with pressuring Germany to cancel the Nordstream 2 pipeline, a project to carry Russian gas to Germany and Europe, bypassing the current pipeline, which runs through Ukraine.

This is akin to a high stakes geopolitical chess game between USA and Russia, over Ukraine. Fifty years ago, Bobby Fisher, of USA, vanquished Boris Spassky, of Russia, at Reykjavik in chess. But it’s quite unlikely that Biden versus Putin, in a geopolitical game, will end the same way. The risks to investors of an intervention are high.

Other scenarios are unfolding, where the delicate balance will be tested. Once the winter Olympics are over, in Feb 2022, China may attempt a takeover of Taiwan; it has always proclaimed its right over Taiwan and seeks to reunify it. That would give it control over TSMC, a world leader in computer chips. Again, whether Biden, and US citizens, have the stomach for a confrontation, is a question. Especially after Afghanistan.

The same for Iran. Its vertebrae have also got strengthened, in the negotiations to rework JCPOA, after seeing the fiasco in the Afghan withdrawal. Should Iran come close to acquiring a nuclear bomb, Israel is threatening to take steps to stop it. Several years ago, Israel had used a software, Stuxnet, to create a setback to Iran’s nuclear ambitions without needing a military intervention.

Besides its military strength, which is now being matched by others, especially Russia and China, America’s strength also emanates from its control over the the global financial system, and also its ecosystem that propels innovation.

In the global financial system, American strength comes largely from two factors. Its currency, the US, is the world’s reserve currency, something that permits the US Fed to create liquidity on tap. Given the size of its economy, a hitherto unblemished credit history, and the fact that the USD is the main currency used in global trade, there is enough demand for the greenback

The other is US dominance over SWIFT (Society for Worldwide Interbank Financial Communication), a universal system used to transfer funds. Its control over SWIFT allows it to block transfers, thus ‘sanctioning’ the entity.

But countries like China and Russia are trying to usher in a new system.

Stephen Lees, an American economist and author, says, in this article that China has taken a big lead in quantum computing, in high performance computing. It appears to be the first country to achieve exascale computing (an ability to do 10 raised to 18 floating point operations per second!! That would, if true, make it 1000 times as fast as existing, peta scale computers. That gives it a huge, perhaps unassailable, edge in military and industrial applications.

China has plans to issue a CBDC (Central Bank issued Digital Currency). This would be fully backed by gold, thus introducing a much needed constraint on the ability of countries to print money endlessly. China already has an agreement with SWIFT. So if, say, a basket of currencies, all backed by gold, can be used to price commodities in international trade, and gets approved by SWIFT, the financial hegemony of the US $ would be greatly diluted.

It is a great pity that the MIC (Military Industrial Complex) indulged in wars, basically in its own self-interest, using trillions of $ in the effort, instead of using the money to build the technologies of the fourth industrial revolution.

Even now, it promotes a progressive, woke culture. The New York City Council just approved legislation under which non-citizens will be allowed to vote in local elections . This is insane and, likely, unconstitutional! You can only allow citizens to vote!

So if these events come to pass, it would increase the price of gold, (if gold backed basket of CBDC currencies replace the USD; the USD would fall; world trade would increase; financial discipline would be introduced in monetary system, thereby stanching the debasement of currencies.

On the flip side, more aggression by certain players would go unchecked, and this can result in a dilution of civil liberties.

So we live in interesting times.

Last week the Sensex closed at 58786, down 215 points, over the week.

Retail investors continue to pump in money into equity mutual funds, in the absence of other domestic saving opportunities. Bank deposits do not give interest rates higher than inflation. In Nov, equity mutual funds saw an inflow of Rs 11,600 crores, more than double Oct inflows of 5,200 crores. The domestic fund industry has the financial heft to be a bulwark against selling by foreign investors.

But a serious global crisis can puncture this. If there is a military big power confrontation over Ukraine, Taiwan or Iran, the bear will run amok. So a lot depends on how Biden reacts to these situations.

COMMENTS