INVESTMENT PERSPECTIVE

By J Mulraj

Dec 18-24, 2022

A Credit Event Will Trigger A Crisis

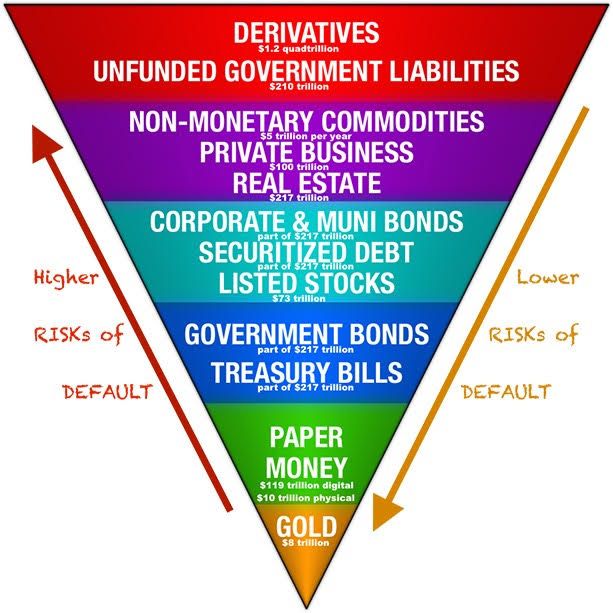

The ancient Egyptians were wiser than today’s Central Bankers. They built pyramids with broader bases and narrower tops. This is, of course, a stable structure. Today’s Central Bankers have built inverted pyramids, which are, inherently, unstable.

Look at the chart above, from an article in Oct 2019. At the bottom is Gold, the most stable asset, providing the foundation, with a value, then, of $ 8 trillion. This supports the next layer of $ 129 trillion of (easy to print) paper money. Next is Treasury Bills, whose yield is used to set the benchmark for a risk-free rate of return. Atop that are corporate and Muni (municipal) bonds, securitized debt (responsible, mainly, for the 2008 global financial crisis), and listed stocks. Then comes a layer of commodities, private business and real estate. The cherry on the top are unfounded Government liabilities (eg future pension payments not backed by sufficient income generating assets, hence likely to be reneged on) and, hold your breath, outstanding derivative exposure of $ 1.2 quadrillion!

I’ll save you the trouble of looking for the definition of quadrillion. It’s a thousand trillion!

Which is more than 100 times global GDP of $ 96 trillion.

Are we all insane?

It is very likely that a ‘credit event’ will trigger the next global financial crisis. A credit event occurs when there is a default on a significant transaction. Several financial institutions are strained, such as Credit Suisse, though it has managed to get a Saudi equity infusion. There are others. Remember, Lehman Brothers was not a particularly large player (it had assets of $ 680 b.) but yet triggered the 2008 GFC.

What triggered the 2008 GFC and can cause another global crisis is that the credit markets froze. Banks were loath to lend to other banks, fearing tainted balance sheets. The debt market is like a gigantic game of passing the parcel; one firm taking the parcel (debt) from another. At a price, funds are available. Until a major default, or a credit event, occurs. That’s when the fan turns rather smelly.

US Government debt is $ 31 trillion. In 2022 the US Fed has raised its rate by 4%, over successive hikes. So interest cost will rise by nearly $ 1 trillion as the rate increases have been in steps. That’s three times the fiscal deficit of $ 33b. Recently both Japan, the #1 holder of US T Bills, and China, the # 2 holder, sold a chunk of US T Bills. So how would US finance a deficit three times larger?

The 5 largest items of expenditure in the US budget are Social Security, 19%, Health 15%, Income security, 14%, Defense 12% and Medicare, 12%. Pension funds, which provide social security, are underfunded, because the rates of return on their investments has declined, and is yielding inadequate returns to meet pension obligations. Outlays for Health can reduce thanks to technological development such as strides in Genomics. India can gain from medical tourism. Cost of healthcare is far lower, with good quality service. Defense costs will only rise due to geopolitical tensions and ever more sophisticated and expensive hardware. Ironically the spend on killing people (defense) and curing people (healthcare) is the same, 12%. Wish John Lennon’s utopia of ‘Imagine’ comes true.

The Ukraine war was totally avoidable. The US has misleadingly encouraged Europe to boycott Russian energy, without having an adequate replacement. Russia had sought talks, to find a way to assuage its concerns over NATO arriving at Russia’s doorstep, by admitting Ukraine as a member of it. Basically USA has outsourced its war with Russia, to Ukraine, by supplying it with weapons and funds. In the process, it has alarmingly depleted its own weapons stockpile. Should it need to enter into conflict, say over Taiwan, or perhaps even a Mid East conflict between Iran and Israel, God forbid, the US would run out of advanced weaponry. And the funds it sends to Ukraine, have urgent uses at home. As mentioned in the last column, over two-thirds of Americans are struggling to pay their grocery bills! It is Ukrainians, not Americans, who have lost lives fighting the war, perhaps 1,00,000 of them! Egging on both the Europeans and the Ukrainians, is an act of unparalleled foolishness.

The only way out of this debt trap is by growing the economic pie. This can be done using available technologies. Technologies like AI, robotics, IoT will help boost manufacturing output. This will result in huge job losses, and provision would have to be made for a universal basic income. Technologies like 3D printing would cut the cost of wastage of material. It uses ‘additive printing’ to add layer upon layer, rather than ‘subtractive’ cutting away, of cloth, or chiseling away, of stone or wood, in the manufacturing process. A customer can pre order a customized shirt, instead of, as at present, going to a shop, selecting from 12 designs, in 6 sizes, and 4 colors which results in year end sale of unsold stock. Use of Genomics to make customized medicines, will reduce cost. Autonomous vehicles will cut fuel costs, increase safety, and so cut insurance premiums. Combined with TASS, transport as a service, it will service personal transport needs with a smaller fleet, free up parking spaces for other, public, uses. The commercialization of fusion energy will solve our energy transition, but is at least a decade away. So is quantum computing.

So use of technologies would help in productivity gains but some time away. Till then, the solution will be by cooling down the jingoistic rhetoric, learning to co-operate and increasing global trade. Cessation of war will also stanch further, unwanted, damage to the environment.

The Indian economy is showing a healthy growth. This is evidenced by the 25.9% increase in direct tax collection up mid December, to Rs 13.64 lac crores (ie trillion). However, tax authorities, with enormous power, are tempted to misuse them. The tax department has levied a Rs 1500 crore GST demand on the Tatas, who are legally challenging it. The Tatas had, pursuant to an arbitration proceeding, paid NTT DoCoMo money due to it for their telecom JV which didn’t work. By no stretch of imagination can this be subject to GST tax. No goods or services were sold! Such arbitrariness in use of discretionary power must be avoided in our journey to ‘developed economy’ status.

Since Tax payers are penalized on losing an appeal, it is appropriate that tax authorities who make untenable demand (the court can judge if it is so) should also be penalized for it. What form the penalty should take can be decided by Government, but this would provide a counterbalance to raising of frivolous and untenable demands.

Last week the Sensex dropped 1468 points to close at 59869.

The Ukraine war, and the resultant (self inflicted) energy crisis in Europe continues to be the main concern of investors. US Fed Chairman, Jerome Powell, stated that he would continue to raise interest rates during 2023. The chances of a global recession are high. Quantitative Tightening (QT) is sucking out liquidity from the market, increasing chances of a credit event.

There may be a Christmas rally in the Sensex. Should the rally take the Sensex past the previous peak of 63000, it would be an opportunity to lighten. Of course, to return later, after the anticipated fall.

Picture source: https://sdbullion.com/blog/financial-crisis-protection

Comments may be sent to jmulraj@asiaconverge.com

COMMENTS