MARKET PERSPECTIVE

By J Mulraj

July 15-21, 2023

How can the world emerge from the chakravyuha of borrowing?

Large economies with high debt/gdp ratios include Japan, the highest (263%), USA (116%), India (89%), UK (85%), China (77%), and Germany (71%). Some figures may be misleading, e.g. China’s Local Government debt of $ 9 trillion is not included in its Government debt figure, if it were, the % debt/gdp would increase by over 50%. Global debt is $ 305 trillion.

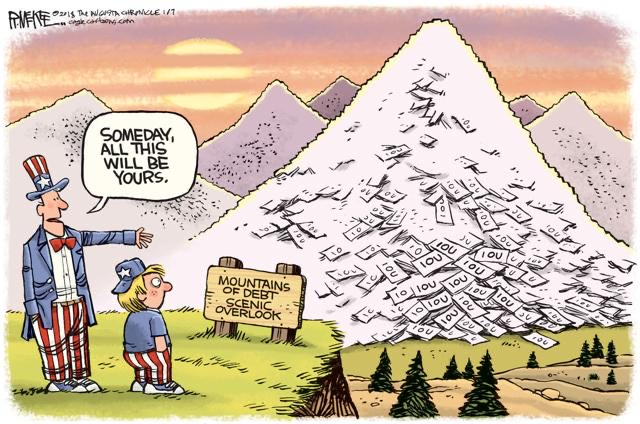

As depicted in the illustration, this mountain of debt is a legacy we bequeath to our children. The insanity of this debt is that a lot of it has been taken to destroy assets, through wars, instead of building assets, for the future. Even as the assets are destroyed, the debt remains, like a tightening noose around the fragile global neck.

Central banks have raised interest rates by 5% over the year, to fight inflation they themselves created by devaluing money with zero interest rate policies (ZIRP). This adds $ 15 trillion (ie 15% of global GDP!) to interest costs which will, in the absence of higher income be met by incurring more debt!

The only way to service more debt, with high interest rates, is by growing the income pool. Several factors are working against income growth, triggered, in large part, by geopolitics. China’s economic, industrial and military growth, combined with its aggressive, wolf warrior diplomacy (it claims, falsely, jurisdiction over the entire South China Sea) has led USA to perceive China as a challenger to its economic hegemony. Under the presidency of Trump, but continued by Biden, USA entered into a trade war, followed by a sanctions war, on China. Other countries, too, recognized their vulnerabilities to dependency of their supply chains on China, and are building alternative ones.

Globalization has been dented, and the flat world has developed road bumps. This rearrangement of supply chains is adding to inflation. That leads to the chakravyuha (a military formation, difficult to enter but impossible to exit) of rising interest rates, thus higher debt servicing costs and to more debt. How can the world get out from this chakravyuha?

The easiest, albeit idealistic, way out is to reduce geopolitical tensions, bring back globalization, allow the theory of competitive advantage to thrive, and spur global growth. But, given the proclivity of the global polity to war-war instead of jaw-jaw, this seems to be an idea that would emerge from La-la-land. So, it is only after supply chains are reorganized that benefits of globalization will start to flow again. Despite so, geopolitics will interfere in supply of crucial raw materials, such as rare earth minerals, needed for EVs, from China to the West, or uranium, needed for nuclear power plants, from Russia to Europe, USA and others.

The other alternative would be to cut costs. Interest costs take a big bite off the revenue pie, and can’t conceivably go to ZIRP again. Other major costs are in defense, which are zealously protected from cuts, by the military-industrial-complex, so unlikely to come down, and social spending on retirement benefits and healthcare. These, too, are holy cows! Even for carnivores.

So the hopes rest on technological innovation to cut costs. There are several technologies that can do that, but will take time.

In energy, besides cost savings from increased renewable energy (wind and solar), the prospect of limitless supply of virtually free energy, from nuclear fusion, is tantalizing. However it is at least a decade away. This article in the Wired talks about the work being done to develop an enhanced geothermal system to tap geothermal energy in Utah.

In manufacture, 3D printing will cut wastage, hence costs. It is a process of additive manufacture, layer upon layer, and is already being used in building construction and other areas. Artificial Intelligence, IoT, robotics are other, existing, technologies that cut costs.

In pharmaceuticals, protein folding will significantly cut and will enable the development of patient-specific cures.

In food, new technologies of precision fermentation and cellular agriculture can, by allowing the use of lab grown meat (which tastes the same as animal meat as it is grown, in a Petri dish from a sample of meat) can save planet Earth from the enormous use of land and water resources now consumed by the animal food industry. Animal agriculture uses a whopping 77% of the world’s farming land. And 20% of the world’s freshwater resources. A switch to precision fermentation and cellular agriculture can release these resources to feed humans.

An impending disaster in feeding humans looms large.

After Ukraine attacked the Kirch Strait bridge, which links Russia with Crimea, Russia has withdrawn from the grain deal. The deal was to expire on July 19, unless Russian conditions, to lift sanctions on one bank, to allow it to receive payment for the grain it exported (a logical demand) was met.

This means, however, that Ukrainian and Russian grain will not be evacuated from the Black Sea. More than a quarter of the world’s wheat comes from these two countries. So wheat prices will shoot up. This will result in civil unrest (riots) and, sadly, in famine. Russian fertilizer exports will also be hit, which will lower production, and raise prices of, other food like corn. India has stopped the export of rice.

Seemingly oblivious to this looming disaster, the bulls charge on. Last week the Sensex rose 594 points to close at 66684.

Markets were enthused by the lower US CPI rate of inflation, at 3%. Inflation in UK has also come down, though much higher than 3%. So markets are expecting interest rates to start coming down, though, perhaps after one more hike of 25 basis points at the next meeting of the US Fed.

That depends, however, on how the cessation of the grain deal is handled. If the polity realizes the need for urgent remedial action, agrees to the reasonable Russian demand of being allowed to receive payment for its grain exports, thus avoiding civil unrest and famine, food inflation will be checked. Central banks may then start lowering rates. And the bull will then charge ahead.

But if grain is not evacuated (some Ukrainian wheat has been destroyed by bombs), the resultant food inflation will not allow central banks the luxury of lower rates. This is what I fear.

The stomping bull may be stopped by another mindless escalation of the Ukraine war, triggered by the fatuous decision by Biden, to supply Ukraine with cluster bombs. Should Zelensky be stupid enough to use these, Russia will use its own, larger, stockpile of cluster bombs, and the situation may escalate. This would be a nightmarish scenario.

China’s Q2 GDP growth is reported at an anaemic, at 0.8%. In USA, banks are staring at unrealized losses on their T Bill portfolio, aggregating $ 500 b. (See https://www.youtube.com/watch?v=MepUGo3pLJc, at 6:23) This is because the value of the T Bills has fallen after the 5% interest rate hike. That’s what led to the collapse of SVB.

It is difficult to see a path out of the chakravyuha of excessive global debt. Perhaps, but hopefully not, Governments may resort to seizing private assets. If global leaders cannot find a solution on the Ukraine grain deal, food inflation will rise, and make interest rate cuts difficult. Tough times ahead.

Picture Source: https://www.greenevillesun.com/opinion/cartoons/mountains-of-debt/article_34581e52-939f-59a3-92ce-d09ae03fab35.html

Comments may be sent to: jmulraj@asiaconverge.com

COMMENTS