The hype about India being the most attractive investment destination

RN Bhaskar

Suddenly, there is a rash of announcements proclaiming India to be the best investment destination in the world. Such a view has been echoed by, among others by Outlook India (https://www.outlookindia.com/business/is-india-the-best-investment-destination-in-2023-these-sectors-hold-opportunities-says-report-news-292677) when it quotes Motilal Oswal, and then again a bit later when quoting HSBC Global (https://www.outlookindia.com/business/what-makes-india-best-investment-destination-over-the-next-decade-hsbc-wealth-report-decodes-news-297591). Ditto with Hindustan Times (https://www.hindustantimes.com/india-news/india-bright-spot-best-destination-for-investors-pm-101673460558422.html). And by CNBC 18 as well (https://www.cnbctv18.com/market/yardeni-research-evaluates-india-as-best-investment-destination-and-feds-policy-as-balancing-act-16789211.htm).

Suddenly, there is a rash of announcements proclaiming India to be the best investment destination in the world. Such a view has been echoed by, among others by Outlook India (https://www.outlookindia.com/business/is-india-the-best-investment-destination-in-2023-these-sectors-hold-opportunities-says-report-news-292677) when it quotes Motilal Oswal, and then again a bit later when quoting HSBC Global (https://www.outlookindia.com/business/what-makes-india-best-investment-destination-over-the-next-decade-hsbc-wealth-report-decodes-news-297591). Ditto with Hindustan Times (https://www.hindustantimes.com/india-news/india-bright-spot-best-destination-for-investors-pm-101673460558422.html). And by CNBC 18 as well (https://www.cnbctv18.com/market/yardeni-research-evaluates-india-as-best-investment-destination-and-feds-policy-as-balancing-act-16789211.htm).

By sheer coincidence, similar views had been espoused by Kamal Nath too, in 2005, when he was Union minister of commerce and industry (https://pib.gov.in/newsite/PrintRelease.aspx?relid=12260).

Wild claims

At almost the same time, publications are talking about India replacing China as a better investment destination (see https://indianexpress.com/article/business/india-overtakes-china-most-attractive-emerging-market-investing-https://indianexpress.com/article/business/india-overtakes-china-most-attractive-emerging-market-investing-8824139/, https://timesofindia.indiatimes.com/business/india-business/india-overtakes-china-now-most-attractive-emerging-market-for-investing-report/articleshow/101638469.cms, and https://economictimes.indiatimes.com/news/economy/indicators/india-top-destination-being-explored-by-mncs-as-alternative-to-china-finds-global-ceo-survey/articleshow/100556960.cms0. Really?

Yet, when so many voices keep repeating this message, people are led to believe that this is actually the case. Such proclamations even drown out the clever move that the US recently made recently switching from talking about decoupling with China to de-risking from China.

Yes, China is undergoing some turbulence (https://twitter.com/business/status/1679293586334949378?t=0Zo-3vKsQ5IHFrBL6rvFkA&s=08). But it remains an attractive destination for investments even today. Love it or lump it — China remains relevant. India’s punters must accept that.

A splash of cold water

But look at the data UNCTAD recently provided (https://unctad.org/system/files/official-document/wir2023_en.pdf) about the money flowing into countries as foreign direct investment (FDI). It becomes clear from the available data that India is certainly not the most attractive investment destination. Never mind what politicians and demagogues say.

USA, China, Singapore Hong Kong, even Brazil and Canada managed to attract more FDI into their respective countries than did India. And except for Hong Kong and Canada, eight of the top 10 destinations for FDI saw a surge in inflows in 2022 over 2021. This means eight of the top 10 continued to be attractive destinations for investment. In many countries the surge in FDI in 2022 o er 2021 was even higher than the surge experienced by India. And it also makes it abundantly clear that China still remains an attractive destination for FDI.

Do watch the numbers for France. It desperately seeks a market. It is therefore seriously working with India to purchase its aircraft – the Airbus and the Rafael are life savers for that country. And don’t forget the submarines as well. China needs neither the aircraft nor the submarines. So, India will be wooed with much the same ardour that India has shown for France.

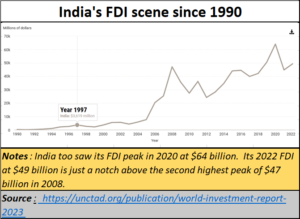

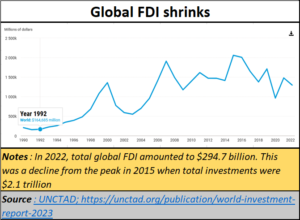

There is no denying that total FDI in the world shrank in 2022. In that year, total global FDI amounted to $294.7 billion. This was a decline from the peak in 2015 when total investments were $2.1 trillion. Similar fluctuating fortunes could be seen in the case of India as well. It too saw its FDI inflows fall from a peak of $64 billion in 2008. Its 2022 FDI at $49 billion is just a notch above the second highest peak of $47 billion in 2008.

Clearly, this is not the best season for FDI inflows for India, as for the world.

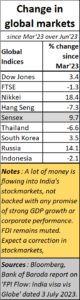

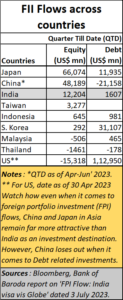

Even FII flows for India were not all that great. In a report by Bank of Baroda — ‘FPI Flow: India visa vis Globe’ dated 3 July 2023 – FII flows to India were less than those for Japan and China. Once again, it contradicted statements that India was turning out to be a better destination for investments than China.

Even FII flows for India were not all that great. In a report by Bank of Baroda — ‘FPI Flow: India visa vis Globe’ dated 3 July 2023 – FII flows to India were less than those for Japan and China. Once again, it contradicted statements that India was turning out to be a better destination for investments than China.

The BoB report showed that Japan attracted the largest investment flows into debt and equity. China, on the other hand, saw investors shunning debt instruments, but embracing equity. In India, debt instruments lacked much appeal, but equity markets were attractive for investors.

That in turn explains why India’s stock markets are flaring up, scaling peaks hitherto not attained. That this rise in stock prices is taking place when balance of trade is becoming worse (https://asiaconverge.com/2023/05/can-de-dollarisation-help-the-inr-plans-of-becoming-the-reserve-currency/) and unemployment remains uncomfortably high (https://asiaconverge.com/2023/03/india-tries-to-regain-its-balance/) only underscores the fact that the stock market indices have been soaring because of excessive funds chasing a limited number of shares. At such times the recipe is just right for the cake to rise and look even more attractive. Unfortunately, constant harping on such misleading news attracts small investors as well, who will be the first to get hurt when the FIIs decide that they have made enough money, and want to move out.

Maybe, government-backed entities will persuade FIIs to stay on till elections are over. Maybe they will try and tell people another story, that the market indices are soaring because of good economic policies of the government of India, and not because of more money chasing few stocks. This time, when the FIIs exit, expect small investors to be badly scalded. Once again.

Just look at how India’s stock markets are racing ahead, much ahead of other countries. It is irrational, reckless, even dangerous.

Just look at how India’s stock markets are racing ahead, much ahead of other countries. It is irrational, reckless, even dangerous.

There are some other factors that people should consider before reading too much into India’s FDI inflows.

Deflating numbers

Go through the UNCTAD report and you learn that the FDI for 2022 included investments earmarked for the large greenfield chip manufacturing project by Foxconn in partnership with Vedanta. That investment is now being scrapped, and it should get taken over by the Tata group soon.

Ditto in respect of the green hydrogen and steel projects that the Adani group wanted to set up.

Together, investments by Vedanta and Adani would have accounted for $19 billion and $5 billion respectively. The $49 billion FDI into India in 2022 should therefore be scaled down by $24 billion, bringing down the quantum to just $25 billion.

India’s abysmal performance on the trade and investment front is also echoed by Grant Thornton’s analysis (https://www.grantthornton.in/en/insights/articles/monthly-dealtracker-may-2023/?utm_source=substack&utm_medium=email).

Thinking big, acting small

At the same time, there is no denying that India is trying to think big. As the UNCTAD report puts it, “The number of international project finance deals also rose in most regions, although more modestly. The most significant rise was in India, where project numbers increased by 64 per cent, making it the recipient of the second largest number of international project finance deals. In the European Union (EU), project numbers increased by 27 per cent, with significant increases in Italy (78 per cent), Germany (57 per cent) and Spain (10 per cent).”

Yet thinking big is not enough. Domestic policies must also work in sync to encourage investments. But with government tax raids (often said to be targeting people funding the opposition parties), investors have begun fleeing the country (free subscription – https://bhaskarrn.substack.com/p/earlier-it-was-diamonds-will-it-now?sd=pf). So have common citizens (https://asiaconverge.com/2022/07/major-financial-turbulence-ahead-inr-may-weaken-further/).

That is why the exuberance in the stock markets is extremely worrying.

COMMENTS