MARKET PERSPECTIVE

By J Mulraj

Aug 12-18, 2023

Nations on a path to self-destruct

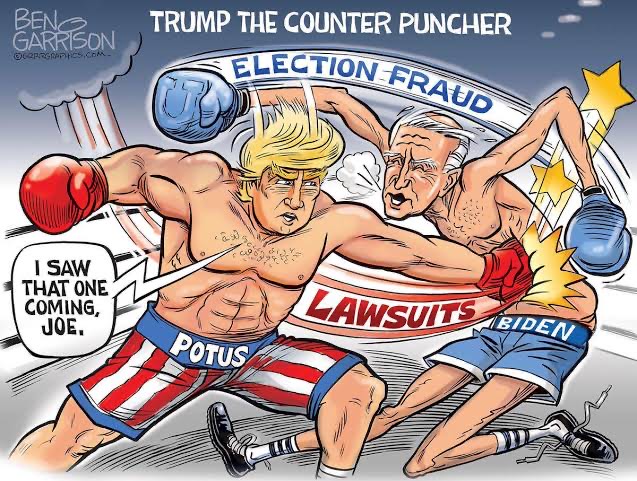

In the movie Rocky 4, Sylvester Stallone and his opponent, Drago, throw a simultaneous double punch, near the end of the fight, and succeed in knocking each other out. This is what seems to be happening between Joe Biden and Donald Trump, in the political arena, now. Both are busy using allegations and lawsuits to try and prevent the other from running in the forthcoming 2024 Presidential elections.

Donald Trump has several pending lawsuits against him, including for the Jan 6 revolt (renowned lawyer Alan Dershowitz says the Prosecutor failed to mention that Trump had urged his supporters to March peaceably), the 37 count indictment in the classified documents case (Trumps team points out that Biden had kept more classified documents, some in an unsecured garage; documents he, then not a President, was not entitled to keep), the Stormy Daniel’s case, a case filed by Georgia under RICO, for election meddling, in which he has been indicted by a grand jury, and others. If convicted in a criminal case, Trump’s incarceration would impact his candidacy.

Meanwhile, Republican James Comer, who is Chairman of the House Oversight and Accountability Committee, has gathered sufficient evidence relating to payments by foreign countries, including China, Ukraine and Romania, to the Biden family which, along with bank records, lay out a case for impeachment of President Joe Biden, on charges of corruption. The Republicans ask, quite fairly, what the payments, made to some 20 shell companies, were meant for. Hunter Biden had provided no products or services (nor was he registered as a foreign agent, legally required to receive payments), other than access to the White House. Bribery is a ground for impeachment.

So both candidates are landing punches at each other, like Rocky and Drago did, in the movie. Can it result in a double knock out? Which would throw up some interesting contests.

This assumes great importance because America is facing other severe problems on which its political leaders should be focusing, instead.

It’s national debt has exceeded the $31 trillion limit and, after a 5% hike in interest rates by the Federal Reserve, is impossible to service without cutting expenditure elsewhere. It’s financial sector is in a crisis, 3 banks were rescued but others, mainly community banks, will go under, particularly due to the woes of the commercial real estate sector.

Rating agency Fitch downgraded, on Aug 1, the US rating from AAA, the highest, to AA+. It now warns that it would review, and May downgrade some, of the 70 US banks it rates, including JPMorgan! (). It’s the world’s largest bank by market cap, and #5 by assets. Banks, especially the community banks, who have lent for commercial real estate (offices and shops) are expected to come under strain as the commercial real estate (CRE) market has collapsed. An 11 story office building in San Francisco recently sold at a 66% discount, a distress sale indicating the crisis in the CRE market.

There’s also a breakdown of law and order. Flash mobs are freely looting luxury stores in LA and squatters invaded a luxury home in Hollywood Hills. The entire police force of Goodhue, a town in Minnesota, has resigned and the town will have no police in 8 days. USA has money to fund Ukraine but it defunds its own police!

In such circumstances, one would have thought the polity would unify to sort out the country’s financial, economic and social problems instead of squabbling. The US Federal deficit has nearly tripled to $ 1.4 trillion! One would have expected the leadership to have conserved financial resources for their own need and not given it away to Ukraine to prolong a pointless war in which thousands have died. Yet, faced with devastating forest fires in Hawaii, Biden clubs together an aid package to then with a larger package for Ukraine, compelling law makers to chose both or neither!

USA is on a path to self destruct.

But so is the #2 economy, China. It, too, is heavily indebted. It’s provinces raise money in two main ways. One is by auctioning plots to realty companies, the other is to raise debt through LGFVs (Local Government Financing Vehicles), which is off balance sheet, so not reflected in China Government debt figures. Provincial Government debt is estimated by IMF to be at $ 9.5 trillion, half its GDP. Revenue from land auctions has sharply declined as its realty sector, accounting for 31% of GDP, has collapsed. After realtor Evergrande defaulted, Country Garden, the next biggest, has also defaulted. They can’t pay for land parcels. As a consequence, Provinces are running in deficits. Evergrande just filed for bankruptcy protection in USA.

China’s exports fell14.5% in July, after a 12.4% fall in June a blow to its export dependent economy. Exports account for 20% of GDP. Several foreign companies have relocated to other countries. Foxconn, eg, is going to manufacture IPhone 15 in Tamil Nadu, India. This has increased youth unemployment so high that the Government has ordered its Bureau of Statistics not to reveal figures. China is also facing devastating floods causing damage to lives and property, and also its agricultural crops. China’s financial situation is bad; it’s civil servants have got their pay cut by 30%+.

China’s biggest problem is it’s demographic profile. Because of its earlier one-child policy, the male-female ratio has been skewed in favor of the former, and it now has become an aging society. It is also witnessing deflation, similar to the one faced by Japan, which resulted in slow growth.

China, too, is on a path to self destruct.

With the two leading economies facing their own walls of problems, who would be the engine for growth? The #3, Japan, has low growth due to a stagnant and aging population. #4, Germany, is in recession, shorn of cheap Russian energy.

The big worry for investors is the possibility of yet another senseless war, say, by China seeking to takeover Taiwan, a long stated goal.

Last week the BSE sensex fell 374 points, to close at 64948.

India is getting the benefit of increased FDI, due to exit of companies’ manufacturing facilities out of China, and increased FII flow, due to India having the highest economic growth of any large economy. However, as argued above, the two largest economies are on a self destruct path. The continuation of the Ukraine war is leading to wasteful, non productive, expenditure on weapons, and the cancellation of the grain deal, combined with the weather related destruction of crops in China and elsewhere, are threatening famine and food inflation. So, though the FII may be feeding the bull, these factors may give him a bellyache, at some time. Till then, enjoy the ride!

Picture Source: :https://www.reddit.com/r/terriblefacebookmemes/comments/tnp4cd/one_of_ben_garrisons_cringe_comics_again/?rdt=3314https://www.reddit.com/r/terriblefacebookmemes/comments/tnp4cd/one_of_ben_garrisons_cringe_comics_again/?rdt=331

Comments may be sent to jmulraj@asiaconverge.com

COMMENTS