Derivatives, USA and Armageddon

By RN Bhaskar

In a way, the world has been too gentle with the US. It has allowed that country to play around with other people’s money, to create and abrogate treaties at will, to stoutly deny access to refugees from the middle east, even though it remains the main culprit for stoking the refugee flow. It has been guilty of more war crimes in the world than any other nation, has used weapons of mass destruction more often than others (https://asiaconverge.com/2022/02/ukraine-the-war-that-usa-wants/). Yet, it chooses to brand others as war criminals — through other multilateral organisations. In a way it is akin to an Indian fable which warns of the dangers of allowing a monkey to wield a razor blade. In the end it may end up slashing its own throat.

The Armageddon term may be apt here, even though it appears only once in the Greek New Testament, in Revelation (”And they assembled them at the place that in Hebrew is called Harmagedon.”). it is believed to be the time when God will eliminate all the evil people in the world at one go. That is when the kings of the earth under demonic leadership will wage war on the forces of God at the end of history.

The US created the financial meltdown in 2008. And it is about to create another. In the process, it could self-destruct as well.

The last month has been witness to tumultuous times. Financial markets have been roiled. Everyone is flabbergasted at the manner in which markets have begun see-sawing. Nobody knows that the eventual outcome will be. Only one thing is certain. The small man will get hurt – both in the US, and more so in India.

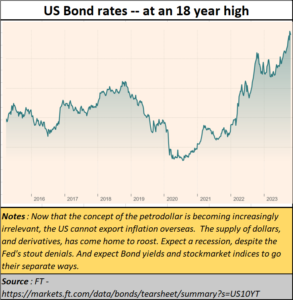

Consider first, a news item on 24 October (https://indianexpress.com/article/explained/explained-economics/us-bond-yield-why-risingexplained-8997263/). Its headlines screamed out US bond yields had hit a 16-year high of 5%. Though they eased to 4.83% sometime later, the fear is that they will begin rising again.

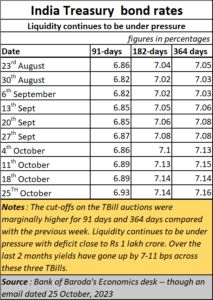

At the same time, in India as well, the 10-year Treasury Bill rates had begun climbing. They were expected to. Last week, these columns had predicted this development (Free subscription — https://open.substack.com/pub/bhaskarr/p/the-indian-governments-urge-to-splurge?r=ni0hb&utm_campaign=post&utm_medium=web). India’s inability to restrain government spending on the one hand, and its failure in roping in private investments, or galvanising exports, have left it vulnerable on many fronts. This includes a worsening import cover, a surging T Bill yield, and inflation which is decimating the ranks of the middle class (Free subscription — https://open.substack.com/pub/bhaskarr/p/the-shrinking-growth-of-the-middle?r=ni0hb&utm_campaign=post&utm_medium=web).

At the same time, in India as well, the 10-year Treasury Bill rates had begun climbing. They were expected to. Last week, these columns had predicted this development (Free subscription — https://open.substack.com/pub/bhaskarr/p/the-indian-governments-urge-to-splurge?r=ni0hb&utm_campaign=post&utm_medium=web). India’s inability to restrain government spending on the one hand, and its failure in roping in private investments, or galvanising exports, have left it vulnerable on many fronts. This includes a worsening import cover, a surging T Bill yield, and inflation which is decimating the ranks of the middle class (Free subscription — https://open.substack.com/pub/bhaskarr/p/the-shrinking-growth-of-the-middle?r=ni0hb&utm_campaign=post&utm_medium=web).

In the US, the situation continues to be dire. Needless expenditure on wars, stoked by the US in the first place, have added to its expenditure and its disdain. Even as recently as two months ago, world renowned investment guru Jeremy Grantham made clear his views (https://www.youtube.com/watch?v=-GlQk_FfD3Q) at the “Bloomberg Wealth with David Rubenstein” on August17 in Boston. He believes that a recession in the US is inescapable. And as treasury yields go up, both on account of the tightening liquidity, and the risk that such investments pose for investors, expect the US to try suck in funds from all over the world. That in turn could exacerbate financial flows to the developing world.

India blues

In India, the first signs are already visible.

On 26 October, Foreign portfolio investors (FPIs) sold domestic shares worth Rs 7,703 crore on Thursday. As Business Standard explained (https://www.business-standard.com/markets/news/markets-tumble-as-fpi-selloff-accelerates-sensex-ends-901-points-lower-123102600973_1.html), India’s benchmarks indices fell for a sixth day on Thursday [26 October], their longest losing streak since February.

It quoted UR Bhatt, co-founder of Alphaniti Fintech, who said that high US bond yields meant that the bond market was expecting further tightening. “If US 10-year bonds are giving 5 per cent on a risk-adjusted basis, no market, including India, is giving that kind of return. And FPIs would rather take that 5 per cent, especially when they are sitting on decent returns from Indian equities.” Bhatt went on to add that “The current level of FPI selling can be managed with domestic flows, but if it doubles or triples, then we are in trouble . . . The real fall in Indian equities may occur when domestic investors will also think on those lines and sell.”

With many Indian high networth individuals (HNIs) already opting to leave this country, this danger cannot be ruled out, unless the government learns to be more investor friendly (Free Substack subscription: https://bhaskarrn.substack.com/p/earlier-it-was-diamonds-will-it-now?sd=pf).

Maybe, yes. This is because, unknown to many, the world is sitting on a pile of derivatives that could total to $1 quadrillion says Global Research (https://www.globalresearch.ca/great-taking-they-plan-own-all/5834686). One quadrillion is a number seldom used, but it means 1,000 trillion or one followed by 15 zeros. Over three quarters of these are dollar designated. As we shall see later, the crisis that confronts the US is huge.

Prima facie, this number looks absurd. This is on account of two reasons.

First, after the financial meltdown of 2008, one would have expected bankers to be extremely cautious about derivatives. But looks like greed can often overwhelm good sense and caution.

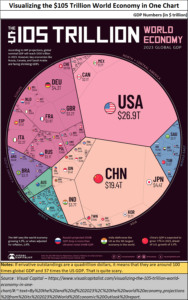

Second, because the entire world’s GDP totals just $105 trillion. Could the world be foolish enough to allow derivatives to swell to 10 times its collective GDP?

This is when it is wise to check out these numbers with those of the Bank for International Settlements (BIS) the world’s comprehensive dataflows for cash, trade and even derivatives (https://www.bis.org/).

BIS databases. which have separate charts for each type of transaction, suggest that the number could be as large as $1 quadrillion, maybe even larger. In just one type of derivatives, OTC (over the counter derivatives), BIS data shows that the outstanding volumes is currently over $700 trillion. Add to this number the outstanding for other types of derivatives, which would include derivatives relating to every possible type of investment asset, including equities, commodities, bonds, and currency. Together, they could easily cross the figure of $ 1 quadrillion. The US Fed had clearly ignored the famous remark of Warren Buffet, when he described derivatives as “weapons of financial mass destruction,”

BIS databases. which have separate charts for each type of transaction, suggest that the number could be as large as $1 quadrillion, maybe even larger. In just one type of derivatives, OTC (over the counter derivatives), BIS data shows that the outstanding volumes is currently over $700 trillion. Add to this number the outstanding for other types of derivatives, which would include derivatives relating to every possible type of investment asset, including equities, commodities, bonds, and currency. Together, they could easily cross the figure of $ 1 quadrillion. The US Fed had clearly ignored the famous remark of Warren Buffet, when he described derivatives as “weapons of financial mass destruction,”

This is further complicated by another factor. As Global Research points out (https://www.globalresearch.ca/great-taking-they-plan-own-all/5834686), the counterparty risk on all of these bets is ultimately assumed by an entity called the Depository Trust & Clearing Corporation (DTCC), through its nominee Cede & Co. The latter thus becomes the owner on record of all stocks, bonds, digitized securities, mortgages, and mor. But it is seriously under-capitalized, holding capital of only $3.5 billion. That is just not enough to satisfy potential derivative claims of $ 1 quadrillion. That could play havoc with investors, and set the global markets on fire.

Beware the icy fangs of recession

Beware the icy fangs of recession

There is also the ever-looming risk of recession, which Jeremy Grantham warns of. While Grantham is focussed on the US, India could fact several other problems. One is inflation. The second is deficit financing, though a lot of it has got concealed by the government stripping the companies it owns – public sector units — and the central bank of their reserves by collecting huge dividends. That could lead to stagflation.

Moreover, when bond rates rise in the US, they could suck out funds that were earlier marked for India. On the other hand, when yields rise in India, they could make domestic investors more skittish.

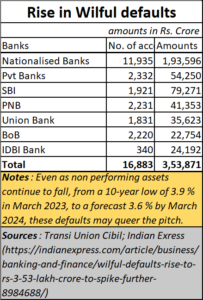

In India, the rise in ‘wilful defaults (https://www.livemint.com/industry/banking/small-loans-spark-big-concerns-as-stress-levelsrise-11698165368049.html) suggests that a significant part of the economy may not be able to sustain itself because of flawed economic policies. In fact, once the 2024 elections are over, and mutual funds and domestic investing institutions are no longer under compulsion to continue supporting the markets, expect a big fall once again. That could further cause a spurt in bad loans.

The present fall is just a warning sign. It is quite possible that the markets will revive temporarily. Political compulsions can keep the market afloat for some time. But the underpinnings remain weak – both for the US and for India. Unfortunately, what happens in the US could end up mauling India savagely.

At present there appear to be few shelters that can protect Indians. That is one reason why, investments in gold will continue to soar. That in turn could firm up gold prices. That, sadly, could leave less money for investment in industry.

It would therefore appear that India will see some rough times ahead. Unless the government moves quickly to undo the damage already done.

COMMENTS