MARKET PERSPECTIVE

By J Mulraj

NOV 5-11, 2023

How will emerging technologies help?

The price of money, namely, the interest rate is, arguably, the most important factor in any financial decision. It determines the viability of an investment decision, or the wisdom of a consumption one. A project, viable at a lower interest rate, would become unviable at a slightly higher rate. Consumers will defer the purchase of a car for similar reasons. Since both capital investment and consumption determine economic growth, the interest rate becomes an important factor.

After the dotcom bubble burst in 2001, the Fed Chairman, Alan Greenspan, cut the Fed funds rate thrice, between Dec 2001 and June 2003, by a total of 1%, in order to ensure the economic recovery. The Fed funds rate dropped to 1%.

It worked to stimulate the economy. US GDP grew 3.9% in 2004. But the low interest rate spurred a boom in housing.

So, in 2004, Alan Greenspan, in order to cool the housing market, raised the Fed rates with 11 hikes of 25 bips each (0.25%), between June 2004 to June 2006, bringing the Fed funds rate to 5.25%. Coincidentally, that’s where it is, now.

The 11 rate hikes succeeded in collapsing the housing market, but led to high levels of unemployment. So the Fed started a down cycle, but it could not prevent the global financial crisis of 2008.

Ben Bernanke, now Fed Chairman, reduced interest rates by 2% in 3 tranches, bringing the Fed funds rate to 0-0.25% in Dec 2008.

Fast forward to now, and Fed Chair Jerome Powell has raised the Fed funds rate in a series of rate hikes, to 5.25%, the same level as in 2006, before the GFC (global financial crisis).

So, interest rates have their up cycles, followed by their down cycles. These are efforts by the Federal Reserve to curb inflation or to stimulate growth. Now, however, Fed Chair Jerome Powell is willing to keep rates higher for longer, determined to bring down inflation to the targeted level of 2%. Watch this video .

Can he?

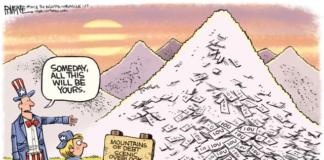

What Powell is attempting seems like trying to cross the Niagara falls, on a tight rope, wearing stilettos! Higher interest rates on US Government debt of over $ 33 trillion, has already resulted in interest payments crossing, for the first time, the $ 1 trillion mark!. In 2022 the largest item of expenditure in the US budget was Social Security ($ 1.2 trillion), followed by Defense ($ 751 b), Medicare (7487), Medicaid (592). So, with a 5.25% Fed fund rate, the US will spend more on interest than on any other item except Social Security.

This is untenable, as expressed by falls in both bond and stock markets. But bitcoin rose, in anticipation of, and as a hedge against, a falling $. Politically, the Republicans, who control the House, are insisting, rightly so, that the US Government draws up a plan to cut spending, before they agree to raise the debt ceiling. A failure to reach an agreement on raising the ceiling will result in a Government shut down. Not the best of time, in the midst of an ongoing crisis between Israel and Hamas, and the omnipotent risk of another between China and Taiwan, to shut down the leading Government of the world.

High debt, together with high interest rates, are a chakravayuha from which an escape seems impossible. Chinese manufacturing had, earlier, helped curb inflationary trends. But the ongoing trade dispute between Us and China, the two largest economies, and the resultant trend towards deglobalization, make it harder to reach the targeted level of 2% inflation. So US interest rates should remain high for longer.

Both GDP growth, combined with a reduction in costs, will be driven by new technologies.

In energy, nuclear fusion holds out great promise of an era of abundant, clean energy, at low cost. This, though, may take a decade for commercialization, but progress is being made. Till then, other energy sources would act as a bridge. Other than renewable energy, modular nuclear reactors are a good candidate.

Productivity gains in manufacturing would come from the technological developments in AI, robotics, IoT, 3D printing and others. In transportation, electric cars, and, soon, hydrogen cars, will cut cost of transportation and emissions. Autonomous vehicles, in a few years, combined with TAAS, Transportation As A Service, will free up spaces reserved for parking, to be used for parks or residences or commercial spaces.

The cost of healthcare will come down due to the developments in protein folding. Medicare and Medicaid are #4 and #5 on the list of US Government expenditure. In the field of animal agriculture, new technologies of cellular agriculture and precision fermentation can reduce both land and water usage significantly.

So, the technology enabled future is enticing.

Enticing, provided the global polity stops behaving like ostriches and pulls their collective heads out of the morass of hatred, conflict and jingoism, and learns, again, that cooperation works best.

Last week the BSE Sensex rose 622 points to close at 64985.

The immediate future is bleak. The Hamas-Israel conflict is potentially explosive. Hopefully the Ukraine conflict may end, especially if it’s unable to get further financial and military support. But China May attempt a misadventure over Taiwan. The higher for longer interest rate policy of the US Fed is not bullish either. Discretion is the better part of valor!

Picture Source: https://www.scienceabc.com/nature/animals/why-giraffes-have-a-long-neck.html

Comments may be sent to : jmulraj@asiaconverge.com

COMMENTS