Can the government be wiser than the markets when it comes to capital allocation?

By RN Bhaskar

Economists are generally agreed that governments can be terribly poor in allocation of resources for economic development.

Yes, there are exceptions. When a nation is in dire straits, like India was at the time of its independence, government allocation of funds can make sense. But it must be for very specific purposes, and for a limited period. Hence, the government’s decision to import Russian technology for steel making or for pharmaceuticals was a good idea then.

But, governments must step aside later and let businessmen take over. If not, a command control economy can be an extremely painful way to grow. Russia is a classic example. China grew when it allowed businessmen to decide what they wanted to do, and how they wanted to grow.

PLI and government limitations

PLI and government limitations

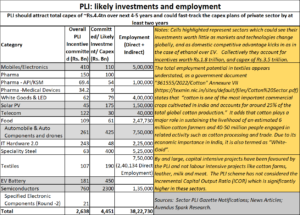

Some of the most eminent economists have been severely critical of the government’s decision to launch its PLI (performance linked incentive scheme) scheme (https://asiaconverge.com/2022/10/pli-and-the-indian-economy/), India’s central planners suddenly began thinking that they know what the country needs. The government decided to create incentives for specific parties and for specific industries. It created, and recreated norms which could cajole India along a certain path.

On paper it looks good. But there are big problems. First, it is a type of backdoor nationalisation and the reintroduction of a licence raj (Free subscription — https://bhaskarrn.substack.com/p/can-india-become-3-in-the-world-by?sd=pf). Second, is the shrivelling of the country’s middle class as a result of several flawed policies (Free subscription — https://open.substack.com/pub/bhaskarr/p/the-shrinking-growth-of-the-middle?r=ni0hb&utm_campaign=post&utm_medium=web),

But there could be other bad decisions as well.

They point to how unwise governments can be when they try to steer an economy as complex as India into doing things that should have been left to businessmen. Entrepreneurs are better equipped to assess risks. Banks and venture funds too have the same quality in varying degrees. They are hard nosed money people, who ensure that money is invested stage -wise. They keep an eye on market trends and back off the second they sense a change in business potential. Governments lack that ability. They often mix up politics and good policies. There is too much of pride and power that gets in the way.

Flawed investment decisions

Many of the government’s PLI programmes — for mobile electronics, Solar PV, Telecom, Automobile & Auto Components and drones, EV Battery, and semiconductors — could be in trouble. Collectively. the distressed sectors account for government incentives worth Rs. 1.8 trillion and a cumulative capex of Rs.3.5 trillion. That is not a small amount of money. It represents almost three-fourths of the total capex expected from these sectors. And the time and opportunity losses could be worth a lot more.

This article plans to look at just some of the sectors, which point to the ineptness of a government to look at so many sectors at the same time, and push investments in a specific direction.

Semiconductors

The decision to get into semiconductors appeared to be a good move. But few looked hard enough at the determination of the Chinese and the skill sets they possessed to do things that took the entire world by storm (https://www.youtube.com/watch?v=jdQTqD0kT-w). The US thought that by sanctioning all the producers of the most sophisticated computer chips, it could checkmate China.

To ensure that China did not make the chips, it even forbade manufacturers of lithographic machines – the latest technology for etching circuit designs through a lithography process – from selling such machines to China. Hence, it put pressure on companies like Taiwan Semiconductor Manufacturing Co. Ltd. (TSM), Intel Corp. (INTC), Qualcomm Inc. (QCOM) and Broadcom Inc. (AVGO) not to have any dealings with China or its intermediaries.

The US was one more government that thought it could direct the way business should be done. And it began prodding countries like India and Mexico to begin setting up fabs (fabrication units in their respective territories) to create alternative production centres. The Indian government, expectedly, strutting with pride at its newly discovered strategic importance, began incentivising companies to make semiconductors in India. This was India’s high-bid stakes to enter the global semiconductor race (https://www.ft.com/content/cbd50844-853e-4435-8028-f581d536a89a).

It began wooing companies like Foxconn (https://the-ken.com/the-nutgraf/india-bets-on-chips-but-who-is-putting-money/) to inter India and set up manufacturing facilities here. Not to be left behind, the state government of Gujarat (favoured by the present government) announced its own semiconductor policy with huge subsidies (https://economictimes.indiatimes.com/news/india/gujarat-announces-semiconductor-policy-with-heavy-subsidies/articleshow/93166497.cms). The Government even decided to open fully the spigots when it came to investing in Micron’s $2.7 bn project (https://business.outlookindia.com/corporate/micron-set-to-break-ground-for-semiconductor-testing-and-assembly-plant-in-gujarat-report). It agreed to meet 70% of the capex.

And then, last month, China unveiled its latest Huawei phones, touted as being better than the best product Apple had on its shelves. More importantly, this phone was also claimed to be immune to Pegasus, the notorious phone tapping and spying software. China decided to develop its own OS (operating system) for its phones and tablets, thus becoming free from the perceived limitations Android and Apple backbones. Expect the US companies to now lose market shares as well.

But more importantly, last fortnight, China announced that it had developed its own lithographic chip design machine, which just a handful companies in the world could produce. More worryingly, it said it had begun mass production of these machines, throwing to the winds the US plans of ring-fencing China (https://www.youtube.com/watch?v=EufGXGTy9x8).

The US’ plan on sanctioning China was falling apart. Just like it failed to contain Russia, which emerged stronger after the US sanctions following the Ukraine clash (https://asiaconverge.com/2022/07/the-ukraine-usa-nato-russia-papers/). And in its wake, India found its plans turning into projects that were rapidly losing bankable status with lenders and investors alike. Its plans for electronics, semiconductors and telecom are also falling apart.

EVs and batteries

A similar story could unfold on the EV and battery front.

India just refused to look into the reasons that caused the Swiss to consider banning EVs (electric vehicles) in Switzerland (https://www.livemint.com/auto-news/switzerland-mulling-a-ban-on-evs-here-s-why-11670301662721.html). Speak with major fund managers in the U.S. They have begun accepting publicly that they would rather wait for an ethanol or a hydrogen car, rather than buy an EV. Reasons include batteries exploding and causing fires (https://www.livemint.com/auto-news/switzerland-mulling-a-ban-on-evs-here-s-why-11670301662721.html), the high cost of EVs compared to conventional vehicles, and inadequate data on the eventual pollution caused by EVs – either in making the batteries or in disposing them when they cease to be useful.

The battery disposal issue could have been easily made manageable if the government had promoted the battery swapping policy, which was originally recommended by Shai Agassi of Better Place (https://en.wikipedia.org/wiki/Better_Place_(company)). That would have helped create central battery sale and old batter collection infrastructure, with central charging stations.

Instead, the government, allowed multiple charging points to be created across the country. That will make collection of old batteries easier, and would not have risked explosions at various charging points manned by persons who were not trained in handling batteries. trained

Just last week, the WSJ carried an article stating, “Firefighters called to extinguish an electric-vehicle fire are discovering the surest approach is to stand back and watch it burn.” (https://www.livemint.com/auto-news/best-way-to-extinguish-a-flaming-electric-vehicle-let-itburn-11699440375218.html).

Why is ethanol not being promoted?

Why is ethanol not being promoted?

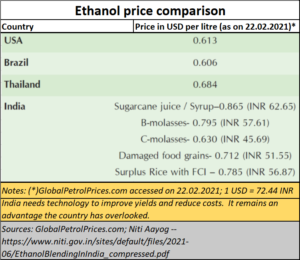

India has an advantage in promoting ethanol blended fuels which could make vehicles run. That would reduce the carbon footprint on the one hand, and would also allow for reduced imports and pollution. But the government has continued to drag its feet on this policy too, possibly because its PLI has a scheme for EVs not for ethanol.

Lots of work needs to be done on this front. For one, India’s ethanol is still quite expensive, despite the no tax agricultural income benefit that sugarcane growers enjoy.

Indian ethanol faces two problems. First, ethanol production needs to be enhanced significantly. Second, it is quite expensive. These issues were articulated quite succinctly in 2021 by Niti Aayog (https://www.niti.gov.in/sites/default/files/2021-06/EthanolBlendingInIndia_compressed.pdf). But the government prefers to keep it on the shelves, because it has already invested huge money on EVs.

There is also the problem of on-again-off-again policies that the government confronts agriculture with, especially sugarcane which in turn helps produce ethanol (https://www.business-standard.com/economy/news/elections-to-ethanol-blending-sugarproduction-drop-weighs-on-stakeholders-123050200748_1.html).

Together such approaches have prevented the ethanol blending industry to really take off in a big way.

In any case, there are many other reasons that make people wonder if the EV is nearing its expiry date (https://www.youtube.com/watch?v=8P95NFlAnmY).

It is quite possible that a lot of investment earmarked for EVs and batteries will also turn sticky.

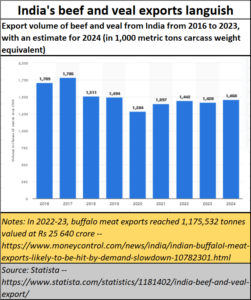

Then look at some other agro based industries that the government hasn’t even looked at for PLI. It has ignored leather exports – important for India because a lot of its produce gets exported, and it employs a huge number of people.

Ditto with beef exports. Even cotton.

Ditto with beef exports. Even cotton.

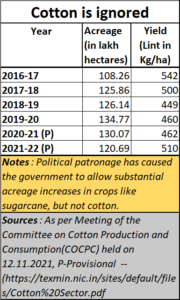

Or look at the way cotton continues to languish with one of the lowest yields in the world.

Cotton employs more people than all the PLI schemes are expected to employ cumulatively. A bit of investment is needed in laboratories that could help develop new cotton varieties which help enhance yields and values. That would be good both for employment and exports (Free subscription — https://open.substack.com/pub/bhaskarr/p/indias-gdp-and-the-textiles-sector?r=ni0hb&utm_campaign=post&utm_medium=web).

Cotton employs more people than all the PLI schemes are expected to employ cumulatively. A bit of investment is needed in laboratories that could help develop new cotton varieties which help enhance yields and values. That would be good both for employment and exports (Free subscription — https://open.substack.com/pub/bhaskarr/p/indias-gdp-and-the-textiles-sector?r=ni0hb&utm_campaign=post&utm_medium=web).

But once again, the government’s obsession with the PLI has made it blind to such possibilities. As a government paper “361555/2022/Cotton” Annexure VII states (https://texmin.nic.in/sites/default/files/Cotton%20Sector.pdf ) “cotton is one of the most important commercial crops cultivated in India and accounts for around 25% of the total global cotton production.” It adds that cotton plays a major role in sustaining the livelihood of an estimated 6 million cotton farmers and 40-50 million people engaged in related activity such as cotton processing and trade. Due to its economic importance in India, it is also termed as “White-Gold”.

India clearly has a blind spot when it comes to agri based industries which are more relevant to this economy.

Effectively, expect India to bleed a lot more in the coming years. The government may begin to look like a Santa Claus with an empty sack. Its belief that it can allocate capital for economic development better than the markets could hurt the economy grievously.

COMMENTS