MARKET PERSPECTIVE

By J Mulraj

June 30- July 5, 2024

The Democrats made a bad bet. It’s backfiring

The first Presidential debate between Joe Biden, Democrat, and Donald Trump, Republican, revealed to a worldwide TV audience just how lost and incoherent the former was. Biden is to come on a TV interview, with ABC’s Stephanopolous, trying to show that he is mentally alert, and so hoping to continue to be the Democratic contender in the November race for Presidency.

Probably worse than Biden’s incoherency in debate was what happened after it was over. He had to be hand held by wife Jill Biden, down a few steps. And then face the unnecessary mortification of being talked down to, like a school kid! Jill, a teacher, loudly congratulated him for answering every question! (as if he sat for an exam). And Joe was grinning away like a kid being given a candy! Goddamn it, Jill, he’s the President of the United States, and not a student at North Virginia Community College, for Chrissakes!

Putin, Xi and other world leaders would lose respect for a President publicly treated like a school kid in this manner!

If Presidents are treated in a schoolmarmy manner, then, perhaps, there would be a modification to the nursery rhyme:

Joe and Jill went up Capitol Hill,

To fetch a trail of voters,

Joe slipped up and cloaked his frown,

And Jill came grumbling after.

The Democratic Party is now in a pickle. Even if it decides to withdraw Biden’s candidacy, they can only persuade, not compel, him to pull out. The party has few alternative prospects, four months before the election. Here is what’s so piquant. The party have received campaign donations on a Biden-Harris ticket. There is around $90 m. in unutilised funds. If they don’t pick Kamala Harris as the nominee, they have to return this money to donors! Moreover if they don’t pick Kamala, but opt for a Caucasian male instead, they may lose some votes, as she meets the nominee’s desired profile! Opinion polls, however, show that she would lose to Trump.

Heightened geopolitical tensions shape trade policies, making the US elections crucial not only for American voters but for future economic growth and hence for stock markets.

Trump got a boost from the US Supreme Court that ruled that Presidents have immunity for official acts, though not for private ones. If Trump were to win, he would enter into a tariff war with China and attempt to hamper availability of chips. China would retaliate by hammering availability of rare earth elements, required ti produce them, over which it has a dominant position. On the flip side, Trump would, in his MAGA (Make America Great Again) attempt, revert to drilling for shale oil, which Biden discouraged, and that would bring down the price of crude oil. He would also, by cutting funding to Ukraine, swiftly end the senseless war, perhaps leading to a resumption of supply of Russian energy to Europe. That, if it happens, would reduce Russia’s economic dependency on China. It was Biden’s horribly poor foreign policy of provoking the Russian invasion, and then asking EU not to buy Russian energy, that brought Russia and China, America’s biggest adversaries, together.

In other elections, UK has veered to the left, with the Labour Party winning in a landslide, whilst France is veering right, with Marie La Pen showing she’s mightier than the sword.

The BSE Sensex crossed 80000 last week, ending at 79996, up 964 over the week.

The Sensex hit the 10000 mark in Feb 2006. Subsequent slabs of 10000 point rises took 20 months (to 20K), 91 m (30k), 50m (40k), 20m (50k), 8 m (60k), 27 m (70k) and 7 m (80k).

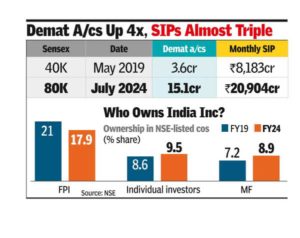

The chart below can help explain the Indian bull on steroids.

The number of demat accounts (every investor must open one) is 151 million, up from 36 million five years ago. These retail investors have enrolled for SIPs, or Systematic Investment Plans, under which they commit to a fixed monthly investment flow to a mutual fund. Currently the amount is ₹ 209 billion every month (USD 2.5 billion). This huge, and growing, flow of household savings into equities, via mutual funds, is propelling the bull run, irrespective of selling pressure by foreign institutional investors.

The number of demat accounts (every investor must open one) is 151 million, up from 36 million five years ago. These retail investors have enrolled for SIPs, or Systematic Investment Plans, under which they commit to a fixed monthly investment flow to a mutual fund. Currently the amount is ₹ 209 billion every month (USD 2.5 billion). This huge, and growing, flow of household savings into equities, via mutual funds, is propelling the bull run, irrespective of selling pressure by foreign institutional investors.

Now get this – 151 million is less than 11% of total population. So the number of demat accounts will keep growing for decades. And, with it, the flow of household savings into the market. This demand for stocks will be partially met through IPOs, but will result in higher PE multiples for well managed companies with sustainable businesses.

Consider the recent monthly. tariff hike by Reliance Jio of a bit over ₹ 30 per month. It has 467 million subscribers. This works out to an additional revenue (and profit) of ₹ 168 billion a year!

This is, in essence, the India story. The consumer market of 140 b people, though price sensitive, is huge and so a marginal hike in selling price translates to a huge gain in profits, if quality of goods or service is good.

The Indian stock market can see a downturn only if triggered by an external factor. Either a serious escalation of a war. Or an event like the failure of the banking system due to, say, a collapse of commercial real estate. Otherwise the Indian bull can sip on the fodder provided it by 151 million investors, and growing.

Picture Source: https://www.bloomberg.com/news/articles/2023-05-15/bidens-disclose-modest-outside-income-to-us-ethics-agency

Comments may be sent to jmulraj@asiaconverge.com

COMMENTS