India’s Budget 2024 and Economic Survey suggest trouble ahead

By RN Bhaskar

The Economic Survey was tabled before the Parliament on Monday 22 July 2024. The next day, the finance minister tabled her Budget proposals. If one goes by the hype surrounding both announcements, India should be cheering. But . . . there could be trouble ahead.

Take some of the budget proposals.

The Budget is supposed to be much more than an accountant’s balance sheet. It is meant to signal to the world that the government wants to make India a business- and investment-friendly place. But the provisions of the budget do quite the opposite.

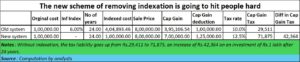

Let’s look at capital gains. The government claims to have streamlined long-term capital gains from three time-slabs to just two. One is holding listed financial assets such as shares and equity mutual funds for a period of 12 months, and the other, for unlisted financial assets and assets such as real estate and gold for 24 months. But it has also removed the key benefit that investors had – indexation.

Short term capital gains tax has been hiked from 15% earlier to 20% and long-term capital gains tax has been hiked from 10% earlier to 12.5%.

So, on the one hand the government wants the private sector to invest in companies and the capital markets, and on the other it has begun taxing them higher.

Worse, for the second year in running, the government has loaded more taxes on the few Indians who actually pay income tax – only 2.2% of adult population are income taxpayers. The entire corporate sector pays less taxes than individuals.

Worse, for the second year in running, the government has loaded more taxes on the few Indians who actually pay income tax – only 2.2% of adult population are income taxpayers. The entire corporate sector pays less taxes than individuals.

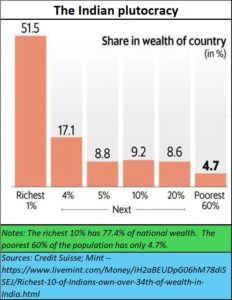

True, long-term tax on stocks and equity mutual funds has been exempted for sums up to 1.25 lakh a year. So, the lowest category of investors has been spared, but not the middle class or the wealthy class. A nation’s health is often judged on the basis on the comfort and wellbeing of the middle class. People in this segment are being squeezed savagely (https://asiaconverge.com/2021/04/shrinking-middle-class-roil-india-badly/). As one analyst put it excellently, “The government has actually introduced estate duty clandestinely, for all, not just for the wealthy.” Thus, India remains a highly unequal society, which the Budget does not address at all.

True, long-term tax on stocks and equity mutual funds has been exempted for sums up to 1.25 lakh a year. So, the lowest category of investors has been spared, but not the middle class or the wealthy class. A nation’s health is often judged on the basis on the comfort and wellbeing of the middle class. People in this segment are being squeezed savagely (https://asiaconverge.com/2021/04/shrinking-middle-class-roil-india-badly/). As one analyst put it excellently, “The government has actually introduced estate duty clandestinely, for all, not just for the wealthy.” Thus, India remains a highly unequal society, which the Budget does not address at all.

Now all property sales will involve a tax without indexation. This is going to hurt investments in the real estate sector. Or it will thus mean a larger share of black money transactions. Charming way to grow the economy.

Jobs and internships

Just listen to what Jayant Chaudhary Minister of State (Independent Charge), Ministry of Skill Development, and Entrepreneurship has to say in his address on 24 July 2024 on the government’s proposals for creating jobs and improving skills (https://pib.gov.in/PressReleaseIframePage.aspx?PRID=2036246) .

- Nirmala Sitharaman, has unveiled the Prime Minister’s package, comprising five key schemes and initiatives aimed at creating substantial employment and skilling opportunities. This ambitious package is set to benefit 4.1 crore youth over the next five years, backed by a central outlay of Rs.2 lakh crore.

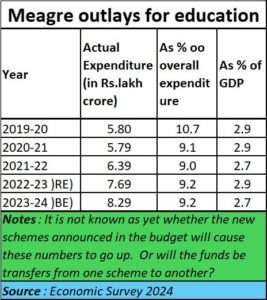

- the budget has allocated Rs.1.48 lakh crore specifically for education, employment, and skilling, underscoring the government’s commitment to these vital areas. It is important to check this numbers against the allocations for education over the past few years (see below). It is not known whether these allocations will be over and above the existing allocations for education – which are shrinking – or whether they will be transfers from other schemes to the newly announced ones.

- Another initiative provides a one-month wage upon joining the formal workforce, supported by a direct benefit transfer (DBT) equivalent to one month’s salary (up to Rs.15,000) disbursed in three instalments. With a salary cap of Rs.1 lakh per month, this scheme aims to support 210 lakh youth entering the workforce for the first time.

- Over the next five years, 1,000 ITIs will be modernized through a hub-and-spoke model, supported by a total outlay of Rs.60,000 crore. This initiative includes a new Centrally Sponsored Scheme, developed in collaboration with states and industry, to ensure that skilling outcomes meet high standards of quality and relevance. The budget breakdown is as follows: Rs.30,000 crore from the Government of India, ₹20,000 crore from state governments, and Rs.10,000 crore from industry contributions, including CSR funding. The upgrade will involve redesigning existing courses, introducing new ones, and offering specialized short-term programs at hub ITIs. Additionally, the capacity of five national institutes for trainer training will be augmented. This program is set to benefit 20 lakh students

The above statements indicate the following.

The above statements indicate the following.

- That the government expects 210 lakh – or 21 million — new jobs to be created. This is definitely higher than the 8 million jobs the Economic survey says India needs to create each year. But, India has not created jobs for the past 10 years. That number has not been provided. Moreover, if these young people do not have the benefit of good school education, they will still remain largely unemployable. Even if the government meets its targets – which is highly unlikely – the unemployability factor will continue to haunt this country. It is better to begin with quality education first.

- The government plans infusing Rs.60,000 crore into ITIs. The truth is that most it is have not been functioning well, compelling the previous government to hand over some of these it is to better manages vocational institutes in the country. Since government funding for such takeovers has not been adequate, such offers for helping distressed ITIs has not been forthcoming. The best vocational managements are with the Aga Khan Trusts and Don Bosco. But, presumably, as they are not Hindu organisations, this government has not asked them to help run vocational education centres more effectively. That is sad, even stupid. If the best in India cannot train Indian youth, the country could see more pain on the employment front.

- The Budget does not specify whether these allocated sums will be in addition to the Rs.8.29 lakh crore already allocated to education. If yes, then the sum still represents barely 2.5% of GDP. That would mean that the schemes are just meant to pull wool over the eyes of the public. When it comes to education, the need is not there for new schemes, as much as monitoring performance outcomes of students, teachers and even education institute managements (Free subscription — https://bhaskarr.substack.com/p/the-ecstasy-and-agony-about-the-indian?r=ni0hb&utm_campaign=post&utm_medium=web&triedRedirect=true). As the ASER reports pointed out, when more than 50% of students in Class V cannot read the texts of students of Class II, the need for measuring outcomes is crucial. Else good money will be poured over bad, and the problem of unemployability will continue to loom large.

No focus on labour intensive industries

The biggest value add for Indian exports comes from those industries that are labour intensive. The value add from engineering and electronics sectors is meagre.

That is why the government should be promoting leather, beef and garment industries – both for domestic as well as for export markets (Do look up https://asiaconverge.com/2021/05/agenda-1-dont-meddle-with-the-dairy-sector/ and (Free subscription) https://open.substack.com/pub/bhaskarr/p/kuriens-amul-can-legends-be-erased?r=ni0hb&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true). But the government has been focussing on pushing its PLI (production linked incentive) schemes. The budget makes no mention of incentives to be granted to these sectors which would address both the unemployment and the export shortcomings.

Pushing gold underground

Similarly, the government should be promoting domestic goldsmiths, because when diamonds are studded in gold jewellery, the value-add jumps up from a few percentage points to as much as 20-30%. But regulations that the government has introduced have hobbled this industry.

As this author has pointed out in his article (Free subscription: https://open.substack.com/pub/bhaskarr/p/how-south-india-bankrupted-the-roman?r=ni0hb&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true) and in a podcast (https://www.youtube.com/watch?v=ibJJXeGyZxA&t=33s), India has always been a tremendous earner of gold which has been brought to the country. The only time when this skill was stumped, was when the British plundered Indian treasuries and businesses. After the British left, the Indian government pushed gold underground. This was done first by the obnoxious Gold Control Act. Later, after it was abolished, this government which hiked tariffs on imported gold to well over 18%. Today, much of the gold trade remains underground.

The recent budget has brought down this import duty to 6%. But there are fears that the government will increase the GST, to make up for the lost revenue. Moreover, even after the reduction, the total charge on imported gold is around 10% inclusive of GST. As mentioned earlier, gold smuggling becomes attractive when the charges on imported gold cross 5%. At 10% gold smuggling is still lucrative. This smuggling activity is paid for in foreign exchange that is purchased on the black market or hawala. That further weakens the Indian rupee. The budget has yet to address this.

The gold industry’s woes do not end here. As James Jose, past secretary, Association of gold refineries and mints, points out, the industry still reels under the impact of the inverted duty structure — raw material gold dore is imported at 5.35% and finished product bullion is imported at 5% under India-UAE CEPA. There is an urgent need of granting a level playing field for gold refineries. The Union Budget ignores this. If this situation continues, then dore importing refineries may be left with no option but to close their operations, against the onslaught of concessional bullion imports under the CEPA.

India is rapidly becoming a market for gold imports – smuggled in, or through CEPA infirmities. So, while the government talks about Atma Nirbharta (or self-reliance), the opposite is happening. Regulations have hurt the gold loan industry as well.

Then there are the policies that are hurting agriculture. To save this vital sector which employs over 50% of India’s population, the government must first ban agricultural imports either through tariff or non-tariff barriers. India appears to be keen on promoting foreign traders and importers than protecting India’s own farmers (https://www.youtube.com/watch?v=IKZjbZACiwc). Also remove the ban on futures so that farmers can discover prices and decide which crops to grow. Don’t make them depend on subsidies.

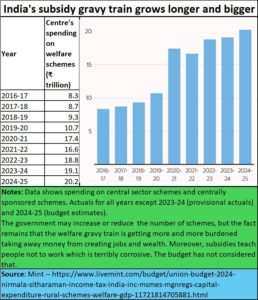

Finally, the issue of subsidies rankles. The issue of subsidies has not been fully understood by many of India’s policymakers. It has been dealt with more clearly in the article that can be found at (Free subscription) https://bhaskarr.substack.com/p/rbi-seeks-to-conceal-govt-deficit?sd=pf . The article points out why it was wrong on the part of the RBI to bail out the government with his over-generous dividend transfer of Rs.2.1 lakh crore.

Essentially, subsidies during a crisis, for a very limited period, can be justified. But when extended, they teach people not to work. They can cripple an entire nation.

The government’s penchant for doles and new schemes for social welfare also amount to subsidies. The government may claim that as a percentage of GDP this has gone down. But that could be misleading. India’s GDP appears inflated, as an article by josh Felman and Arvind Subramanian points out (https://www.business-standard.com/economy/news/union-budget-2024-25-three-macro-puzzles-and-policy-implications-124071901345_1.html). Borrowings can boost GDP, as can dividend transfers. The fact is that the money released by way of subsidy or grants is essentially unproductive expenditure. It takes away money from the creation of jobs.

Two more flaws

The Economic Survey has been released without the statistical supplement. When governments conceal or delay the information that people require for analysis, there is a fear that there is much to hide. It suggests that things are much worse than is being claimed. While this is not a budget requirement, all budgets are based on information inputs. Anything that prevents analysis is therefore unwise, even anti-national.

Lastly, do remember that a budget is meant to strengthen a country, not weaken it. By taxing people more – either through the removal of indexation or increasing taxes, or through the splurge of money on non-productive areas – the government weakens the nation. Most importantly, India needs more jobs.

These jobs can easily be got through the creation of a sensible policies on

- on rooftop solar (Free subscription — https://open.substack.com/pub/bhaskarr/p/a-new-policy-direction-for-solar?r=ni0hb&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true);

- giving tax incentives to managements to start nursing schools and hospitals – free subscription — https://bhaskarr.substack.com/p/indias-dreams-of-being-a-global-power .

- Such moves could help the government boost manpower export of nurses and create a domestic boom in medical tourism.

- Give tax breaks and funds to schools that perform well on outcomes, to start many more good schools and colleges. This way, the government enhances employability, exports, and a well-educated population.

Such measures are missing from the budget. Thus, despite a few good measures like the abolition of angel tax, the budget lacks vision, or even commitment to a stronger India.

===================

Do watch my latest podcast at https://www.youtube.com/watch?v=IKZjbZACiwc

COMMENTS