Economy indicators defy GST growth

By RN Bhaskar

Image generated through https://deepai.org/machine-learning-model/text2img

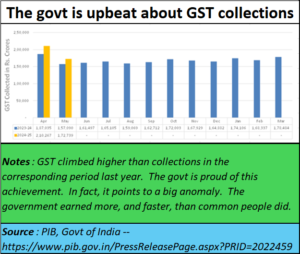

On 1 June 2025, the government announced that its GST collections had climbed 10% year-on-year (https://www.pib.gov.in/PressReleasePage.aspx?PRID=2022459).

Illusion of strength and health

Illusion of strength and health

It said that the GDP growth was “driven by a strong increase in domestic transactions (up by 15.3%) and a slowing of imports (down 4.3%). After accounting for refunds, the net GST revenue for May 2024 stands at Rs.1.44 crore, reflecting a growth of 6.9% compared to the same period last year.”

The government’s statements were full of half-truths.

Imports down, but so were exports

Imports down, but so were exports

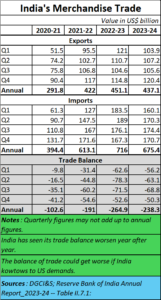

For instance, imports climbed down, yes. But so did exports. The result was a worsening trade deficit (free subscription — https://bhaskarr.substack.com/p/india-prognosis-2024). The government’s statements reflected none of this.

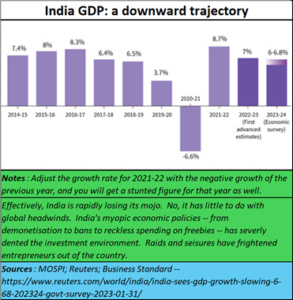

Likewise, the country’s GDP growth rates were also sliding. This was another fact that the government did not care to mention.

So, when both GDP growth and the balance of trade worsen, can the GST growth be presented as a sign of strength. It also raises the question – then why did the GST collection continue to grow?

For years, these columns have pointed out that the biggest contributor to GST growth has been the government’s largesse to select states and to the rural sector. The wonderful thing about GST is that as soon as the money reaches the hands (or accounts) of the recipients, it gets spent. That is where GST kicks in. Thus, for every rupee given out, the government gets back at least Rs.12, maybe much more. So, the more the government splurges, the more GST it gets.

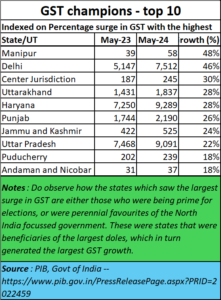

The best evidence of this can be found from the government’s own figures. Look at the states that witnessed the highest surges in GST collections.

Almost all of them are those who were being primed for elections. Or, they were perennial favourites in North India. These were states that were beneficiaries of the largest doles, which in turn generated the largest GST growth. The grants could be for roads, or bridges, or building new cities.

Therefore, if GST collections go up, it is not because of any strengthening of the Indian economy. It is more a manifestation of the way the government splurges taxpayers’ money.

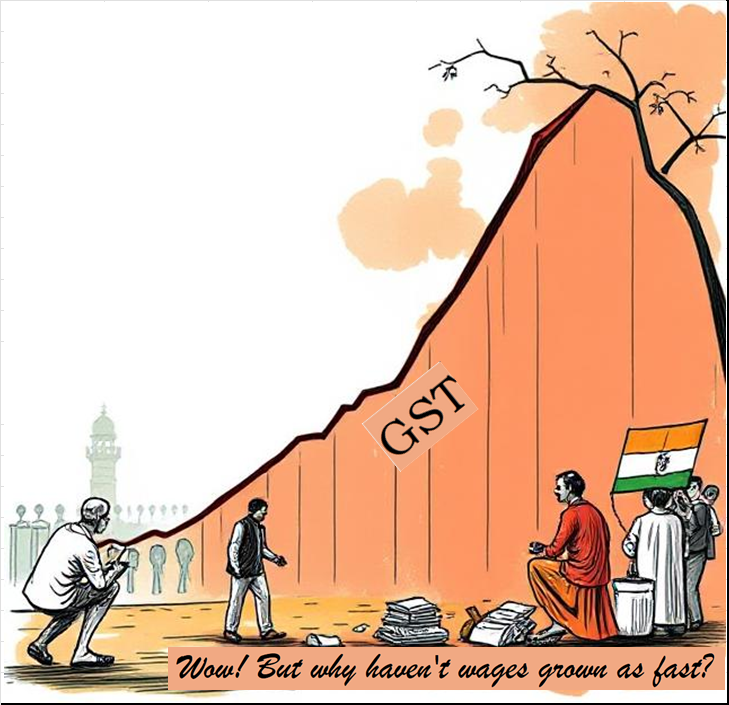

What makes the GST story extremely sad for India is that even while the government is proud of its tax collection achievements, it has failed to realise the immense irony of the situation. What does one do when the government grows richer faster than its own people>

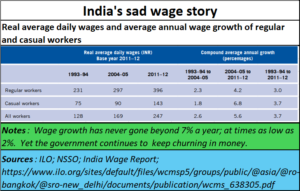

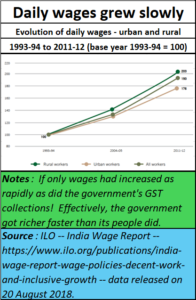

Look at the two charts from the ILO, which were released by the International Labour Organisation (https://www.ilo.org/publications/india-wage-report-wage-policies-decent-work-and-inclusive-growth). Unfortunately, both have shown data not beyond 2012 – possibly because the relevant was not forthcoming from the government of India.

But the trend lines draw the same conclusion. Wages have growth very slowly, both in urban and rural areas.

A digital representation of this information is more revealing. It shows that daily wages as well as annual wages have not grown as fast as the government’s GST collections.

A digital representation of this information is more revealing. It shows that daily wages as well as annual wages have not grown as fast as the government’s GST collections.

And anecdotal information collected from the roadside confirms that wages haven’t even kept pace with inflation. Unemployment would obviously push family incomes lower, because not enough earning members would be there. Result, India has a shrinking middle class (free subscription — https://bhaskarr.substack.com/p/the-shrinking-growth-of-the-middle).

That would explain the rise of population share in rural areas – because living in rural areas, especially with relatives – can make more sense than living in urban areas. The numbers of people going back to agriculture has been swelling (https://asiaconverge.com/2022/12/the-government-prevents-farmers-from-being-self-reliant/).

Freebies are not the solution (https://asiaconverge.com/2019/04/doles-elections-corruption/). They end up teaching the recipients not to work, which could prove to be a disaster later. The present policies of freebies and doles may work for short-term political survival, but they destroy a nation. Consider, how even in the worst of times, China refused to grant cash subsidies. It knows quite well the opiatic power of subsidies. They destroy an entire generation.

The answer lies in being business friendly. India needs to create an environment where its businessmen opt to stay in India rather than leave India (https://asiaconverge.com/2023/10/india-stunts-its-middle-class-growth/). But to do that, it must prevent the reckless raids and seizures (aimed reportedly at anyone who had directly or indirectly funded opposition parties). It must improve the judicial system which allows for prosecution of government officers, even policemen. This means that it must not attempt to assuage public perception by merely suspending government offices, even policemen, but also dismiss them. The further spread of contagion must stop.

But it is unlikely that the government will do all this.

As a result, fresh investment into India will remain patchy and meagre. It will worsen the unemployment situation in India (https://asiaconverge.com/2024/01/niti-aayog-and-its-poverty-calculations/). And it will push the country into further poverty, instead of promoting a Viksit Bharat (a prosperous India).

India’s rapid GST climb may be good for financing doles, just as high dividends from public sector units (PSUs) and even the central bank (RBI).

India is being pushed down the poverty rabbit hole. This must be stopped and even reversed. The focus must be on income growth and employment growth. Unless the government does this, the continued surge in GST numbers will only rankle the well-informed. India deserves a better alternative.

=================

Do view my latest podcast on the India-UK FTA? You can view it at https://youtu.be/psqQbDojKhY

———————–

And do watch our daily “News Behind the News” podcasts, streamed ‘live’ every morning, Monday through Friday, at 8:15 am IST. The latest can be found at https://www.youtube.com/live/Jv-AQ2FqOa4?si=BNNiGo1f_Kkccigh.

——————————-

COMMENTS