India’s rupee ranks poorly when compared with other countries

By RN Bhaskar and Sakeena Bari Sayyed

Image sourced through: Copilot

The rupee is being battered. Yet, not a week goes by without some government spokesperson talking about India as a leader capable of guiding the destinies of the entire world. That story is becoming stale. It has been told too often. And it flies in the face of facts. The weakening rupee is the best indicator of the malaise. India needs a better statement that has greater credibility.

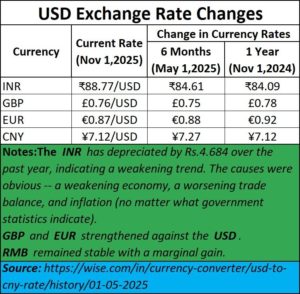

Most charts put out by money managers show that during 2025 the rupee has become Asia’s worst-performing currency. When currencies tumble in value and perception, the causes are not very difficult to find. They usually lie in poor governance which in turn leads to flagging economic performance, soaring inflation and debt, and a worsening trade-balance. Sometimes, all these indicators manifest themselves in unison. India unhappily has fallen into this category.

In the final analysis, most common people do not understand trade balance, IIP or per capita income. But they do understand how the value of the rupee is gradually diminishing. They also thank their natural and traditional faith in gold. The gold that economist have often debunked as being a dead asset is now being increasingly adopted even by central banks as part of their reserves. It is now a financial asset.

Nothing underscores the enormous appeal that gold has for people across the world than in the way its prices have soared in recent years. Hence the little gold that even a rural household borrowed money to purchase for a daughter’s wedding has suddenly become an extremely valuable family heirloom. The rise of gold prices is itself a symptom of the corroding confidence in the local currency as well as the possibility of gold becoming a new reserve currency in place of the dollar. Not surprisingly, the largest purchasers of gold worldwide, in recent months, have been central banks and not individuals. Consider for instance, the way China is building two large gold vaults – one in Saudi Arabia and the other in Hong Kong to guarantee any CNY denominated transaction (https://matrixmag.com/chinas-gold-corridor-a-structural-shift-in-the-global-financial-order/).

A very interesting picture emerges when one considers the price of gold in different currencies. For purpose of convenience, we have taken INR, GBP, EUR, USD and CNY. Study the numbers. Observe how the maximum appreciation in gold prices has been with the Indian rupee. Thus, while gold prices climbed 47.06% in Dollar terms, they climbed 55.25% in Rupee terms. It is evident that the Indian Rupee has weakened.

The Rupee was thus weaker than even a weakening dollar. Yet, it is sad to see Indian-government-spokespersons emphatically stating that India’s economy has remained robust. This runs counter to the harsh realities faced by businessmen. For a company like Indigo that is the largest in this industry in India, its lease rental costs, fuel, maintenance and servicing must be paid for in forex. Earlier, incomes from domestic passengers were good enough to pay these bills. Now the company faces losses on account of a weakening rupee. That is why it has decided to focus on expanding its overseas services so that it can earn more in foreign exchange.

The Rupee was thus weaker than even a weakening dollar. Yet, it is sad to see Indian-government-spokespersons emphatically stating that India’s economy has remained robust. This runs counter to the harsh realities faced by businessmen. For a company like Indigo that is the largest in this industry in India, its lease rental costs, fuel, maintenance and servicing must be paid for in forex. Earlier, incomes from domestic passengers were good enough to pay these bills. Now the company faces losses on account of a weakening rupee. That is why it has decided to focus on expanding its overseas services so that it can earn more in foreign exchange.

For the common resident Indian, this will mean higher inflation rates – no matter what government statistics say. For a government that came to power promising a rate of Rs.40 to a dollar, the present exchange rate is a sharp reminder of how weak the economy has become (https://www.quora.com/Before-elections-Mr-Modi-assured-he-would-bring-the-USD-to-Rs-38-within-a-year-but-it-became-Rs-65-Why-is-this-happening-What-steps-is-Mr-Modis-Government-taking-to-build-the-rupee). Even the prime minister mocked the falling value of the Indian Rupee in 2013-14. At that time it was under Rs.60 to a dollar; however, today it is closer to Rs.90 (https://www.youtube.com/watch?v=4tV7XPG8EmQ).

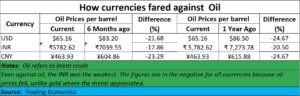

When it comes to oil, India has been a little luckier. Oil prices fell globally allowing the rupee value to appreciate against oil. Had this not happened, India’s balance of trade would have worsened, and its indebtedness would have soared. Oil was one of the few benefits India enjoyed. The picture would have been bleaker but for this development.

How weak is the Indian economy?

How weak is the Indian economy?

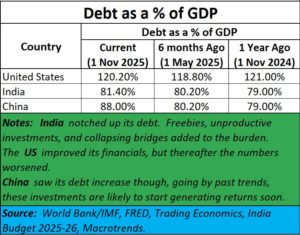

India’s weakness is also evident from the manner in which debt has grown. Though overall, India’s debt to GDP is not as large as that of the US or Japan, the situation is worrisome.

Sadly, India’s debt has been growing not because of investments in productive areas. That would have led to a surge in GDP, and would be welcome. Instead, India’s debt has climbed because of not-so-productive uses of money. The government has splurged on subsidies and freebies, and on projects that have little economic value (https://asiaconverge.com/2019/04/doles-elections-corruption/). Though the government tries to explain away these expenses as social development costs, the truth is not as rosy. Subsidies and freebies eventually teach a population not to work. Thus, these freebies have blighted an entire generation severely eroding the much-touted demographic dividend that the country could have enjoyed.

A good example of investments in not-so-productive asset creation can be found in the way the government prioritized the Eastern Dedicated Freight Corridor (DFC) which runs from Haryana to West Bengal. It was prioritized over the Western DFC which promised significantly higher returns (Free subscription- https://bhaskarr.substack.com/p/indias-two-dfcs-politics-trounces). The western DFC was conceived of in 2006 by the then Prime Minister Manmohan Singh and Shinzo Abe, the then PM of Japan. It was to run from Haryana to JNPT and was later extended to be terminated at Dighi Port. It was to be financed entirely by Japan and would have reduced logistics costs significantly for India (https://asiaconverge.com/2011/02/dmic-delhi-mumbai-corridor-will-create-new-best-class-cities/). Moreover, 24 industrial cities were also to be developed on either side of this DFC (https://asiaconverge.com/2011/02/dmic-delhi-mumbai-corridor-will-create-new-best-class-cities/). This was overlooked primarily because Uttar Pradesh and Bihar had larger populations that would soon be required to vote. Therefore, an economically viable project was shelved in order to favour a politically appealing one.

There is a third reason why India’s investments will not generate returns. It is because they were built shoddily in spite of having huge time and cost overruns (Free subscription- https://bhaskarr.substack.com/p/a-bridge-too-far?utm_source=publication-search).

The result was that India’s per capita income remained low even though it has grown marginally over the past one year. It is absurd to promote India as the third most powerful country in terms of GDP if its per capita income remains one of the lowest (Free subscription- https://bhaskarr.substack.com/p/india-needs-to-look-beyond-gdp).

This number could have gone up, had investments been productive. Today, India must service this high debt through interest payments leaving very little money for productive investments.

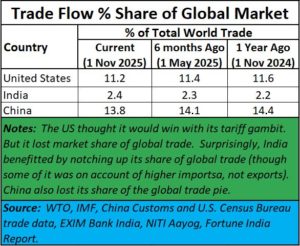

The failure to invest in projects that could have increased efficiency and reduced logistics costs (that is precisely what the Western DFC promised to achieve) has only rendered India less competitive in global markets. India’s share of global trade is pathetically minuscule compared to the shares of countries like USA and China. India’s share of global trade has increased marginally. But it continues to remain a very insignificant player.

This could have changed for the better, had India begun diversifying its export markets to the ASEAN region. The fact is that India did become part of the ASEAN trade bloc but failed to make any impact. Economists point to two reasons that prevented India from growing faster. One was the fatal fascination with Western countries (not withstanding political slogans against colonialism). A second reason was possibly because many of the Southeast Asian countries were Islamic. That could have influenced the decision making by many Indian politicians who are driven by ideology and not by economic sense (https://youtu.be/_9qzFctBV7c?si=LEs790lUXJ_tI7Ve).

The cumulative effect of all these factors has resulted in a weakening market (poor purchasing power), weakening exports, growing debt and a weakening currency. That is why statements by politicians about how strong India’s fundamentals are can be called misleading.

India had the potential for much more. India can be a formidable player if only the government has a vision. Its neglect of education and skill development (ideology gets pushed even in centres of excellence) have caused the QS ranking of the best Indian universities to fall (https://indianexpress.com/article/education/qs-asia-rankings-2026-indias-top-iits-slip-as-universities-from-china-singapore-surge-ahead-10345225/). Poor education has made much of India unemployable. Falling educational standards will only blunt India’s edge in global markets.

Conclusion

India needs to focus on ways to improve development and economic growth. It must learn to be more discerning in announcing projects and more demanding when it comes to accountability. Only then can it hope to make its currency appreciate. At present, the weaker currency neither galvanizes exports nor helps improve the small man’s purchasing power. This must stop.

===============

Do view my latest podcast on the way contaminated cough syrup was allowed to be sold to unsuspecting patients causing deaths. The police found a scapegoat in a doctor, who prescribed a drug that was certified to be safe. Both the government and the bureaucrats are protecting irresponsible drug inspectors. In India, governance is crumbling. And human life is cheap. You can find the podcast at https://youtu.be/iN4gV1KIcrE

———————–

And do watch our weekly “News Behind the News” podcasts, streamed ‘live’ every Saturday morning, at 8:15 am IST. The latest can be found at https://youtube.com/live/IzkjheXJhc4

===================

COMMENTS