Stressed assets: Scamsters try to squeal their way out

Over the last fortnight, most headlines talked about Raghuram Rajan, Governor, Reserve Bank of India (RBI), deciding to go back to academics after his term with the RBI got over this September. Attention then moved on to people who were clamouring for a reduction in borrowing rates. That was before attention shifted to Brexit.

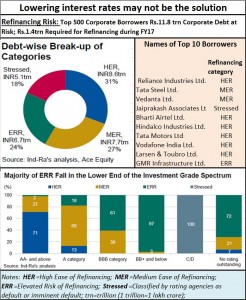

But few bothered to cross-check such demands with the actual state of the banking sector. A brilliant report by India Ratings (IndRa) provided the numbers that market watchers wanted to have. It showed that just 240 of the top 500 borrowers accounted for a whopping 42% , or Rs.11.8 trillion of the total outstanding debt of Rs.28.1 trillion.

But few bothered to cross-check such demands with the actual state of the banking sector. A brilliant report by India Ratings (IndRa) provided the numbers that market watchers wanted to have. It showed that just 240 of the top 500 borrowers accounted for a whopping 42% , or Rs.11.8 trillion of the total outstanding debt of Rs.28.1 trillion.

These 240 borrowers belong to the Stressed and ERR (Elevated Risk of Refinancing) categories and will remain exposed to significant refinancing risk during FY17. The IndRa report mentions that almost Rs.5.1 trillion comprises stressed assets, with another Rs.6.7 trillion at risk. The ratings company believes that Rs.4.6 trillion of the 6.7 trillion could already be delinquent. That could put stressed assets at around Rs.9.7 trillion!

What is equally relevant is that the ‘better-off’ corporates which fall into the HER and MER categories (HER=High Ease of Refinancing; MER=Medium Ease of Refinancing) were those who had learnt to become less dependent on the domestic banking system. They had the ability to access domestic capital markets or significantly tap foreign currency markets. It is mostly companies which fall into the ERR and Stressed categories which are significantly leveraged and continue to have a high dependence on the domestic banking system (http://www.freepressjournal.in/editorspick/npa-albatross-around-banks-neck-rn-bhaskar/857767).

Watch the chart alongside, and you will find that most of the ERR companies are also those that do not even enjoy a high credit rating. Clearly, some people in the banking sector threw caution and prudence to the winds Today, these are the very companies that are clamouring for lower interest rates!

In fact, while the IndRa report is silent about it, anecdotal data shows how these companies have raised large sums through other unfair means. They have raised money through serial public offerings; have merged and demerged companies using methods that give promoters more access to money than other shareholders; some have also delisted the shares of their companies just when they were about to become profitable. These are the companies that have pledged almost all their shares with banks, thus exacerbating the pain of the lenders.

Even the mutual funds industry has not been spared. As the IndRa report points out, the top 10 mutual funds houses have an exposure of Rs. 670 billion (or 5.7% of the Rs.11.8 trillion) in the top 500 corporates. This does not include dubious accounting practices — like inflating capital costs and routing of funds to show them as promoters’ equity — that many industrialists are known to adopt. Promoters of such companies are hollering the loudest for a relaxation in lending norms and for reducing borrowing costs.

In fact, speaking at an Assocham meet in Bengaluru, Rajan blamed the slowdown in credit growth to stress in public sector banking (PSBs) and not because of high interest rates. “…what is required is a clean-up of the balance sheets of public sector banks, which is what is underway and needs to be taken to its logical conclusion.”

The RBI had noted such developments with alarm even before Rajan became governor of the central bank. deputy governor, RBI, K.C.Chakravarty, began disclosing figures of the surge in bad debts in July 2013. Strangely, nobody in the government – not the finance ministry, nor the chief economic advisor, not even the Planning Commission – cared to voice similar concerns.

As governor, RBI, Rajan blew the whistle a bit louder. Then, as he himself admits, “…one reason the RBI was historically reluctant to lock itself into an inflation-focussed framework is because it feared government over-spending would make its task impossible . . . . . I certainly believe that the responsible recent budget did create room for the RBI to ease in April.” The UPA failed in stemming bad loans. The present government is doing precisely that.

Thus, the present government and the RBI have helped most common depositors protect the value of their money by keeping inflation rates lower than bank deposit rates. Earlier, only the rich – corporates and other businessmen – benefitted. High inflation reduces the value of the principal amount that they borrow. And the price is paid by countless millions of middle class tax payers who watch their savings shrink as inflation eats into them.

Not surprisingly, these corporates, who have got used to easy money, do not like being hauled over the coals for not repaying their loans. They want the old system of largesse and loot to be reintroduced. Mercifully, the government has refused to do this. It wants to wring the existing easy money policy to the point where businessmen begin to respect money and use it more wisely and profitably. The surge in corporate profits, notwithstanding this tight money policy, testifies to the success of this strategy.

One only hopes that the government sticks to this path of cleansing the system, and turns a deaf ear to cries for an interest rate reduction.

——————————————–

Clarification: India Ratings clarifies that the top 10 mutual funds (MF) exposure in the top 500 corporate borrowers is Rs.670 billion. These MFs are fairly placed because MF exposure worth Rs.642bn or 96% is in in HER and MER category. Exposure in ERR and stressed corporates stands at Rs.27.7 bn or 4.1% of the total exposure (0.23% of 11.8trn).

COMMENTS