Chest thumping and masks can confuse economic policy analysts

By RN Bhaskar

Governments, world over, have a habit of setting the narrative to show the prettier side of economic development. In India it should be a bit more worrisome, because they mask the real crises the government should be addressing. Typically, the government chooses to impose ideological solutions, rather than sound economic ones. The absence of a public debate on these issues makes the situation even more intractable.

Surging tax collections

Surging tax collections

Most media sources headlined the government announcement of the surge in direct tax collections (https://economictimes.indiatimes.com/news/economy/finance/indias-net-direct-tax-collections-surge-182-in-decade/articleshow/114310061.cms). There was a robust growth in personal income tax, though corporate collections also climbed at a slightly lower pace. Much of this could be attributed to better compliance by India’s taxpayers because of better data mining and identification of leakages. But it was also because of two other factors. A booming stock market must have made the government earn huge taxes from capital gains. Moreover, tax rates had climbed. The imposition of tax was heavier on indirect taxes, especially GST and customs duty.

The govt becomes richer, but not the people

The govt becomes richer, but not the people

They surge in tax collections helped conceal the fact that people’s incomes hadn’t gone up that much. Thus, like the GDP story, the government likes to tell with a great deal of chest thumping each time, how tax collections have surged. But the fact is that as population numbers rise, India benefits from GDP and tax growth, even though people don’t earn that much.

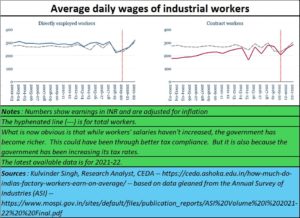

The average factory worker earned Rs.563 as a daily wage in 2021-22. This has been admirably brought out by Kulvinder Singh, research analyst at CEDA (https://ceda.ashoka.edu.in/how-much-do-indias-factory-workers-earn-on-average/) using information that is available from the government’s Annual Survey of Industries (https://www.mospi.gov.in/sites/default/files/publication_reports/ASI%20Volume%20I%202021-22%20%20Final.pdf).

Unfortunately, this data conceals the number of people who have lost jobs, on account of the slowdown that politicians does not like to talk about. It wants the mask not to slip. Nor does it address the huge unemployment plaguing India. As the article points out, “Workers employed directly by factories earned INR 586 as their daily wage on average – but while male workers earned INR 630, female workers earned only INR 389 on average.”

Once again, there is a mismatch between all the statements made by the government about promoting equality for women and the data on earnings.

Poverty continues to ravage India

Poverty continues to ravage India

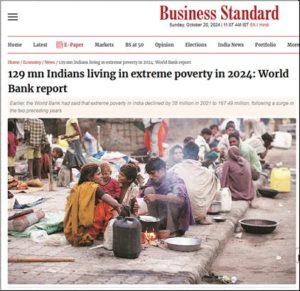

As Business Standard points out (https://www.business-standard.com/economy/news/129-million-indians-live-in-extreme-poverty-in-2024-says-world-bank-124101501137_1.html), “Almost 129 million Indians are living in extreme poverty in 2024, on less than $2.15 (about Rs 181) a day, down from 431 million in 1990. So, while there was an improvement in poverty numbers compared to 1990, the fact is that India has not been able to address either the issue of poverty, or of wealth inequality. As I pointed out in my recent podcast (https://www.youtube.com/watch?v=yGA3fLEacGc) , India fared miserably in stemming the surge in poverty and in preventing the middle class from shrinking, during Covid times. It succeeded in protecting the wealthy but not the weaker sections.

The Business Standard news item was based on a report by the World Bank on Pathways Out Of The Polycrisis (https://www.worldbank.org/en/publication/poverty-prosperity-and-planet). The report does not mention this explicitly, but the two key requirements for India are the urgent need to revamp education on the one hand, and making the investment climate a lot more business friendly. More on this can be found in my podcast referred to at the end of this article, as well as from (free subscription) https://bhaskarr.substack.com/p/india-spurns-its-advantages .

The Business Standard news item was based on a report by the World Bank on Pathways Out Of The Polycrisis (https://www.worldbank.org/en/publication/poverty-prosperity-and-planet). The report does not mention this explicitly, but the two key requirements for India are the urgent need to revamp education on the one hand, and making the investment climate a lot more business friendly. More on this can be found in my podcast referred to at the end of this article, as well as from (free subscription) https://bhaskarr.substack.com/p/india-spurns-its-advantages .

Slowdown

Slowdown

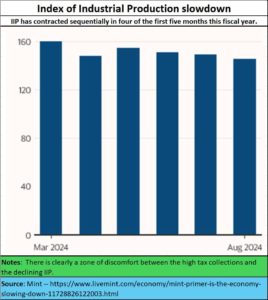

The surge in taxes also flies in the face of the obvious slowdown in the Index of Industrial Production (IIP). What remains to be seen if the surge continues next year. The RBI is confident of the GDP growth being maintained. But there are indications that growth will be under pressure. The decline in the IIP is just one indicator.

A worsening investment climate

A worsening investment climate

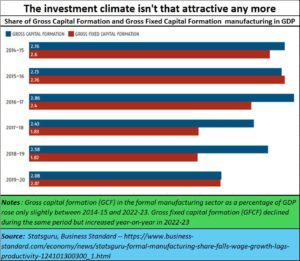

More money appears to be going to the stock market than towards manufacturing. This has obvious implications. It is quite possible that income tax collections will remain high because of stock market gains. But is this sustainable? At these high levels, there are many who believe that there could be a crash. That will see some of the tax gains decline.

Even so, if money is diverted from manufacturing to the stock markets, there is a good possibility of the unemployment numbers remaining high, and capital formation numbers falling further than in the chart above.

Both are bad for India, both politically and economically.

India needs to become market friendly. It needs to work on policies to ensure that investment comes into manufacturing quickly. Agriculture needs to be revived as well.

Merely telling fables of a glorious future, or a Viksit Bharat, just won’t do. A better economic and investment policy is required urgently.

It is quite possible that a big prod will come from the forthcoming BRICS summit. More on that later.

=======================

Do watch my latest podcast on Three blunders that the India has made at https://www.youtube.com/watch?v=7l9FEn0a718

=======================

COMMENTS