The FM should look at the causes – Interest rates are the symptom

RN Bhaskar

In recent days the Finance Minister, N. Sitharaman has made public statements about the need for banks to lower lending rates (https://timesofindia.indiatimes.com/business/india-business/interest-rates-need-to-be-far-more-affordable-fm-nirmala-sitharaman/articleshow/115431945.cms). She said that the rates need to be made affordable, and that people had begun to find them very stressful.

Of course, everyone would love interest rates to be low. But the fact is that every country does not have the luxury of low interest rates. Usually, it is not the fault of banks, but of government policies which create conditions for interest rates to soar. Bankers are actually victims of an environment entirely created by governments. India too has done that. Especially the finance ministry.

The real causes

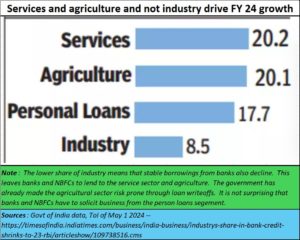

- The lack of industrial demand over the last 5 years has removed the corporate sector as a source of credit demand (free subscription — https://bhaskarr.substack.com/p/india-underperforms). Banks are thus compelled to look for other unsecured borrowing and even refinancing of their funding sources so that they can make some money at the end of the day.

- The banking and NBFC sectors have turned to the retail sector (more specifically to the retail unsecured credit sector) for succour.

- Most NBFCs fund very basic consumption and healthcare in the urban and rural areas (in some cases, supplanting the village money lender). This was to be the job of the government, which it did not fulfil. So, who will fund healthcare? And work on ways to price the risk factor?

- Unemployment has driven many to seek personal loans – either through pawning of gold, or as unsecured borrowings. The role of the NBFCs in helping them out has been incredible. Unemployment is a direct result of ill planned government policies. And this is before the slashing of jobs takes place because of AI.

- Indian Fintechs disbursed Rs 146,517 crore in FY23-24, 49% more than the previous year. A chunk of this would be for servicing loans outstanding at the end of FY23 and for paying fees for refinancing a portion of those loans.

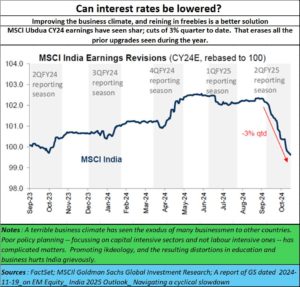

- Government social spending (read freebies) has been climbing. Unproductive and uncontrolled government expenditure invariably results in high inflation. The government’s budget papers show that it had 740 central sector (CS) schemes and 65 Centrally Sponsored (CSS) schemes. They accounted for annual expenses of Rs.15.16 lakh crore and Rs.5.1 lakh crore respectively.

- None of this showed up in the country’s fiscal deficit as a % of GDP because of three reasons.

- There are reasons to believe that GDP numbers have been inflated somewhat

- The second is a point made by Arvind Subramanian (https://www.business-standard.com/economy/news/union-budget-2024-25-three-macro-puzzles-and-policy-implications-124071901345_1.html). He points out how it is hard to reconcile weak household consumption, weak household incomes and rising unemployment with strong GDP growth.

- The third reason is the way the government splurge was financed through generous dividend transfers by PSUs and even the RBI. Once again, when the government throws out money that can be sloshed around, inflation will become inescapable. Interest rates only reflect the inflation rate and the depreciation of the Indian Rupee. To reduce interest rates, deal with the causes that trigger inflation.

In fact, the crisis in the NBFC sector has already begun, even without the RBI stepping in. Economic distress is causing more loan repayment default than poorly planned loans. Just recently, Goldman Sachs took a final write-down due to its exposure to consumer finance Fintech Greensky (https://www.cnbc.com/2023/06/23/goldman-sachs-faces-writedown-on-david-solomons-greensky-deal.html). By the time it had put Greensky out of its misery, Goldman Sachs lost $3 billion.

The situation could worse, as easy money becomes more scarce — thanks to a meltdown in the markets.

For the past few years, the government was overly focussed on the stock markets. Almost every financial institution, over which the government had some degree of control, was persuaded to stay invested. When such signals are given out, private money too begins to flow into the markets, abetted by FII friendly rules at GIFT City.

Manufacturing was forgotten. When it was remembered, it was to push through favoured deals, often capital intensive. Not surprisingly, many capital intensive plants have been underperforming (https://www.business-standard.com/industry/news/india-s-manufacturing-under-performance-a-new-clue-from-multi-plants-124100701222_1.html).

The easy money conditions buoyed up an IPO market. Money was circulated from speculative earnings into an equally speculative IPO market.

Now this is coming undone.

That could mean several things:

- With money becoming scarce, getting loans easily will become difficult.

- Given the unemployment scenario, expect more jobs to get slashed.

- Given the government’s own penchant for increasing import duty rates, expect the cost of doing business in India to continue soaring. So, even while India added an unprecedented 16GW solar capacity in the first nine months of 2024 (https://mailchi.mp/mercomindia.com/mercom-india-clean-energy-news-roundup-4936763?e=37ba32d7a6), people forget that much of this was at project costs that were double those of other countries (https://www.energetica-india.net/articles/why-solar-module-prices-are-rising-in-india) , because of the high and cascading burden of import duty and GST. These rates were dropped only in September this year. Even GST can cause interest rates to climb.

- So, why blame the NBFCs and banks. Has the government considered the 3.5% monthly rate of interest that some credit card companies charge for borrowings and delayed payments. Why not compare those rates with the ones NBFCs charge?

Together all these factors will push up interest rates even further.

Don’t demand lower interest rates

If the FM forces interest rates down, expect three things. Savvy money market players will borrow in rupees and send the money out through hawala, because they know that the rupee will value will continue to depreciate. That will further stoke inflation and even unemployment. People forget that if you artificially manage interest rates, you will affect exchange rates.

Instead, do the following:

- Curb the temptation of announcing schemes and largesse to voter constituencies.

- Keep import duty rates low, like they were during Atal Behari Vajpayee’s prime ministership.

- Show better time and cost management for infrastructure projects, since the government is a big financier for this sector. Most infrastructure projects have witnessed huge cost escalations (free subscription — https://bhaskarr.substack.com/p/indias-big-infrastructure-investment).

- Hold on leash the hounds that have made the lives of businessmen difficult. Improve the business environment with fewer compliances, and more consultative approaches.

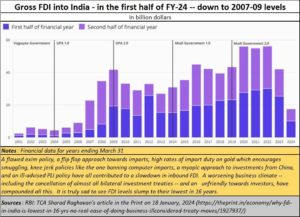

- Make it easy for foreign investments to flow in. Banning Chinese investment only ended up hurting wannabe startup projects, hence employment and wealth generation. Banning communication platforms that businessmen use – like WeChat – makes doing business a bit more cumbersome.

- Such measures will help improve foreign direct investments (FDI) which in turn will create more enterprises, more wealth, more jobs. The situation is pathetic today.

- Promote labour intensive industries, even at the risk of alienating existing capital-intensive industries.

Do the above, and interest rates will automatically fall. Even the economy will prosper.

===================

Do watch my latest podcast on BRICS and gold at https://youtu.be/mGGn01MKqOY

COMMENTS