MARKET PERSPECTIVE

By J Mulraj

Dec 14-20, 2024

Improved productivity is the only option left to reduce debt

The G7 countries, (USA, Japan, Germany, France, U.K., Canada and Italy) is a classification of the large Western countries by their GDP. All are democracies. Politicians in democracies prefer borrowing to the unpopular route of raising taxes, lest they be voted out. Some, especially USA, prefer to wage wars, which are both costly and lengthy (the Iraq war and the Afghan invasion cost $ 2 trillion each and lasted over a decade) are funded by debt.

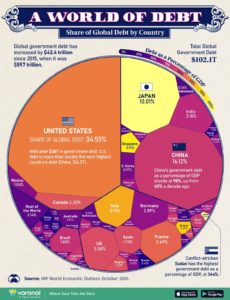

The debt keeps piling on. Total country debt today is $110 trillion, (https://www.visualcapitalist.com/102-trillion-of-global-debt-in-2024/) as shown in the chart below. Total global GDP is $115 trillion.

As re Alasdair MacLeod, Head of Research at Goldmoney, out of the G7 countries, only Germany, with a debt/GDP ratio of 62%, is not in a debt trap. Other countries are. A debt trap is a situation where the borrower needs to keep borrowing more in order to service existing debt. It’s a treadmill he can’t step out of.

After WW II, there was a baby boom, as soldiers returned home and started families. There was, simultaneous increase in automation, which increased productivity of labour. Both, the rise in workforce, and the productivity increase, combined to ensure a virtuous cycle of prosperity. This prosperity was able to sustain, and service, higher debt loads (the chart below has been sourced from https://www.visualcapitalist.com/102-trillion-of-global-debt-in-2024/.

Today, the situation is reversed. The fertility rate (number of babies produced per woman) of most countries, except Africa, is lower than the rate of 2.1 needed to sustain a society. So, unlike the baby boomers, the growth in new entrants to the labour force is lower, and growth in labour productivity is also declining. As per this chart global labour productivity grew by 3.1% in 2007, which fell to 1.03% in 2018 (https://prosperitydata360.worldbank.org/en/indicator/WB+ASPD+dlpe). So, with lower population as well as productivity growth, the GDP growth will be, already is, insufficient to repay debt.

An obvious fix would be to reduce expenditure. The biggest item of expenditure now is interest on past debt; for the US it’s over $ 1 trillion. It cannot default for fear of losing its rating, which makes future borrowing difficult and costlier. The next is Defense, which the arms industry is loath to reduce and the polity prods other countries to war. As they did in Ukraine. After that are the Social Security and Healthcare obligations. For elected politicians these are the holy grail. France lost a Government recently because its erstwhile PM tried to reduce future pension obligations by increasing the retirement age. The French are too fond of joie de vivre to think about their future.

So the only way out of the debt chakravayuha, (a military circular formation which is almost impossible to get out of) is to deploy technology.

This is where companies like Tesla, Boston Dynamics (both American), Toyota (Japanese), Ubtech Robotics (Chinese) and others are developing humanoid robots. They have several advantages over humans, as per this article by me. The robots can be produced and ready for work in a few hours, and cost $ 20000; a human takes at least 18 years after birth to join the labour force and raising him/her costs $300,000 in a developed country. Robots work 24 X 7, without coffee breaks, salary/bonus, coffee breaks/vacations, and the training is in the software.

So, thoughtful scientists, thinking about the future, are solving problems created by foolish politicians, myopically thinking of the present and how they can personally benefit, since they are in power, if they see humanoid robots as the only way out of their debt trap, they will embrace the robots!

For India this will mean that the India story may lose its sheen. The sparkle in the story emanates from India’s demographic profile – its youthful population. Look again at the leading companies making waves in developing humanoid robots; there are no Indian companies, though there are several in the field operating in India, such as Fanuc, a Japanese conglomerate, CynLr, Wipro PARI, Kuka, Tata Automation Ltd., and others.

But it will be difficult for politicians in the most populous country in the world to push for use of industrial robots. The dilemma is that they are inevitable – an idea whose time has come. And denying their usage would significantly reduce India’s competitiveness. Another idea whose time has come is autonomous driving vehicles. This will result in job losses, which is why Ministers oppose it, but, on the other hand, will significantly reduce cost of commute (making a dent on inflation) and significantly also reduce accidents (168000 deaths in 2022 caused by road accidents).

It is well past high time that the Indian leadership concentrate on a vision for the future and not waste time on non-issues of the past.

Sadly our leaders do just that!

It has taken 15 years for a case to settled by none other than the Supreme Court, when any sensible, serious, country would have done it in 5 minutes! The dispute was whether coconut oil is an edible oil, eligible for a 5% GST, and not a hair oil, which bears an 18% rate! Is this really worth spending 15 years of judicial time on, which has a backlog of 50 million cases?

Why not concentrate more on skilling people for different skill sets, changing the primary education system to prepare kids for the future, introducing them to emerging technologies, devote resources and direct effort towards technologies of the future like robotics, mobility, genomics, nano and others, instead of spending 15 years to classify coconut oil, and several other pressing issues.

India should become future ready. It is lacking in several areas.

Last week the BSE Sensex closed at 78041, down 4092 points over the week. Global markets reacted to the US Fed Chair Jerome Powell statement that the number of interest rate cuts in 2025 would be fewer than anticipated. He did, though, cut interest rate by 25 bips.

President Donald Trump will assume office on Jan 20. If he sticks to his threat to increase import tariffs on Chines imports by 60% it would start a trade war. That’s bad news. Global trade accounts for 62.5% of global GDP. Any reduction in trade severely impacts GDP growth, and thereby the ability to service debt. That would make it harder for countries to roll over debt.

One can only hope that wars (both military and trade ones) end and that global leaders learn to jaw-jaw instead of war-war. They are blind not to.

Image created by Bing

Comments may be sent to Jmulraj@asiaconverge.com

COMMENTS