https://www.freepressjournal.in/business/approach-towards-market-regulation-is-headmaster-student-in-india

ANM: Speaking up for brokerages

By Jescilia Karayamparambil & RN Bhaskar

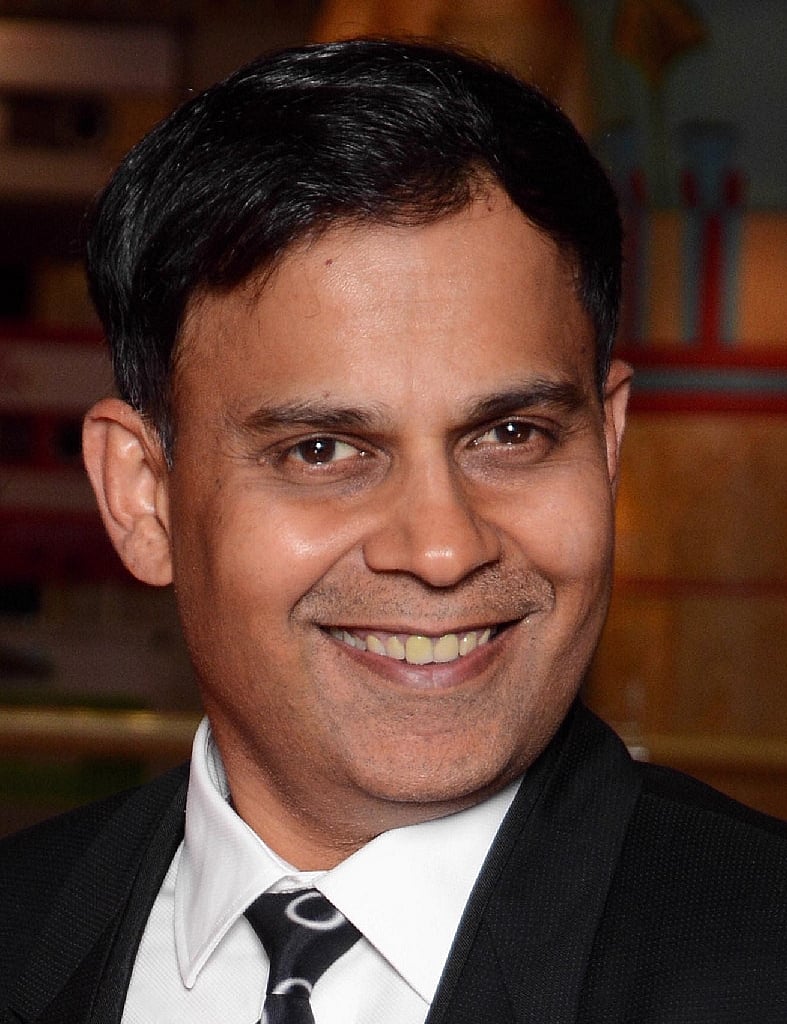

Recently, the stockbrokers’ body, Association of National Exchange Members of India (ANMI), raised concern over the proposal to lower the settlement cycle for completion of share transactions to T+1 [transaction date plus one day]. ANMI, which represents over 900 stockbrokers across the country, stated that the bulk of brokerage firms are not yet ready for this due to the present COVID-19 situation. In an interview, Rajesh Baheti, director at ANMI and Managing Director of Crosseas Capital Services, told Jescilia Karayamparambil and R N Bhaskar about the challenges brokers face.

Edited excerpts:

What has happened with the recent suggestions ANMI gave to SEBI?

Even during the pandemic, several regulatory changes were announced. ANMI and the industry have whole-heartedly supported [many of] the changes — that clients should not hand over the shares to the broker and there can be a direct pledge mechanism.

We did not have a problem with that. But the pace of implementation is a cause of concern. Most of our software vendors are unavailable at their offices (due to the present COVID-19 situation) to be able to modify the software to accommodate the new policy. We would need some time there.

Our issue was more on timing rather than policy.

We support SEBI in case of policies, unless of course, if those policies are doing more harm than good.

How do you see markets play up due to these changed regulations?

Misuse of client funds and securities; and some other regulatory changes — ANMI has whole-heartedly supported them. But we are fundamentally against stopping brokers from lending their own money to clients for intraday trading limits and other facilities,

It is all right to restrict brokers from trying to use clients’ funds as it leads to cheating but makes no sense questioning a business decision of a broker, as long as it is using its own funds.

There is no other market in the world where brokers are forced to collect the entire margin money upfront from the client. In addition, stopping brokers from offering their own funds to their clients is not a right move.

ANMI is asking SEBI to allow the broker to lend his money depending on the client profile. This is how a global market function.

Compared to the rest of the world, where does India’s capital market stand? How is India faring in terms of regulations?

In India, we have a headmaster-student approach in the case of regulations, which is not the case around the world. Around the world, markets are largely self-regulated and a large amount of freedom is extended. However, the consequences of doing something wrong are deeper— punishment is quick and commensurate with the crime.

In India, it is more like ‘I will tell you what you should do and should not do’. There is not much freedom given to participants.

Another issue is that people who are involved in wrongdoings get away lightly. This is unfortunate. The system is such that the person who commits the crime is left easily and the people who have not done any crime have to face the music as the regulations change. That is a difference in the Indian system and overseas.

We need a far better system where [anyone who is] guilty is punished quickly. For instance, some of the high-profile insider trading cases, they have been going on for so long. The system of punishment and justice is slow in India.

In addition, the regulatory system is on overdrive.

Do you expel members from your associations who are involved in wrongdoings?

We have the power to expel members from the association if they are found to be committing crimes against their investors or have been declared defaulters by the exchanges.

We do not have the authority to fine or penalise anyone.

We have expelled members like Amrapali, Karvy among others in the past. We have put some memberships on hold as well.

ANMI has its own checks and balances in place.

What differentiates AMFI and ANMI?

AMFI is a lobbying body of association of mutual funds. So, it comprises all the asset management companies that operate in Indian space but do not have secondary market components.

ANMI is an association of secondary market participants in the country including MNC brokers, FPI brokers as well as large mid-and-small brokerages spread across the length and breadth of the country.

How does ANMI position itself among other broking associations?

Over a period of time, there have been many local associations. For stockbrokers, we are the primary association of India. We follow a democratic process. We cover every kind of member.

Now with SEBI allowing single entities to be members of equity and commodity exchanges, many players are giving up multiple names that they had to carry for so many years.

Tell us about Crosseas Capital Services.

It is largely into proprietary trading and very few select HNI investors.

We are not into institutional broking. Our strategy is based around intraday, hi-frequency positional strategies including algorithms as well as manual training systems. We have gone more from manual to algorithmic.

In terms of volumes, we have been 95 per cent algorithm-based and 5 per cent manual. In terms of money deployment, we are at 60 per cent manual and 40 per cent algorithmic.

The slower you need to churn, the more manual you can afford to be. Wherever the churn rate is very high then the game has completely shifted to algorithms.

In terms of volume, we have been among the top 20 in the country.

As a stockbrokers’ association, what would be some policy-level changes that you want to see introduced?

Quick punishment and disposal of cases are needed. Despite being such a big industry, there is only one securities appellate tribunal in India (at Nariman Point, Mumbai). We don’t even have multiple benches.

We need more courts to dispense justice. We need stronger laws to punish wrongdoers.

COMMENTS