New trade blocs form, India remains on the fringes

RN Bhaskar

Suddenly, gold has become important. It always does, when there is economic uncertainty, and high inflation. While it is early days to talk about inflation, everyone knows how uncertain the world has become. Israel is haemorrhaging (Free subscription — https://open.substack.com/pub/bhaskarr/p/global-fragmentation-new-alignments?r=ni0hb&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true) and so is Ukraine. The latter is on the verge of a total collapse.

Both countries have been facing this crisis because of one player, the US.

In the case of Israel, the US continues to be an abettor, complicit in war crimes. It continues to supply Israel with arms, even though there is enough evidence before the courts in The Hague that Israel is using them to exterminate the people of Gaza. As analysts have pointed out, Israel has been practising apartheid for long – discriminating between its Jewish population and the Palestinians who remain occupiers of their lands. It appears that Israel now wants to do away with both the Palestinians, either by driving them away, or by making conditions difficult for them to stay on in Israel. If that works, it will do away with two inconveniences. It does away with the charge of apartheid. If that does not work, it seems to be working on exterminating the Palestinians – first through guns, missiles, and bombs, and now through mass starvation as well. It has bombed homes, hospitals, and schools, without creating alternative homes, hospitals, and schools for those affected. Eventually, it believes it can create a greater Israel bringing the lands of Gaza and the West Bank under State control. And yet, the US continues to support these crimes.

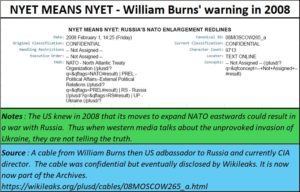

In the case of Ukraine, the role of the US has been more devious, and covert. It instigated the war. This is evident from the way the US ignored warnings from every sober-headed analyst – that the consequences of allowing NATO to expand eastwards would be catastrophic (https://asiaconverge.com/2022/03/the-ukraine-crisis-this-is-the-way-the-world-ends/). One of the most memorable warnings was that by William Burns who was then the US ambassador to Russia (from 2005 to 2008) and is currently the director of the CIA.

On 1 February 2008, he sent a highly confidential cable to his government telling it “Nyet means Nyet” (https://wikileaks.org/plusd/cables/08MOSCOW265_a.html). The cable was eventually made public by Wikileaks.

It then was later picked up by Robert Wade who wrote in Le Monde on 15 March 2015 (https://eprints.lse.ac.uk/61428/1/Wade_Ukraine_crisis_is_not_what%20it_seems.pdf). These are things you will not find in The Economist and the New York Times, both which I used to admire enormously in the past.

It then became clear that the US had already made up its mind to allow NATO to expand eastwards and encircle Russia. This was in blatant violation of the agreements the US had with Gorbachev – and which First Secretary Baker made memorable with the words “not an inch eastward” (https://asiaconverge.com/2022/07/the-ukraine-usa-nato-russia-papers/). The US control over the media narrative was so strong that, today, almost everyone believes that it was Russia that was the aggressor. As Jeffrey Sachs, Director of the Center for Sustainable Development at Columbia University, puts it – neither the Europeans nor the Americans were keen to let the public hear him speak because they did not want them to hear the truth – hear timeline 4:58 onward — https://www.youtube.com/watch?v=l9LT8RRO8Ug).

But let’s go to trade. To get a better perspective of the situation, one must listen to Ravi Boothalingam, Founder and Chairman of Manas Advisory. In 2021 he explained (https://asiaconverge.com/2021/12/india-china-the-long-view/), how both India and China, when they became nation states, were way down the global economic rankings. The GDP of India was a little higher than that of China. “Almost 30 years later, by 1979, China had caught up with India, though its human development indicators had already surpassed India. Some 40 years later, just before the pandemic hit the world, China’s GDP was five times the size of India’s and per capita as well by the same multiple. By 2022 it is expected to be almost six times.” He points out how most developed countries focussed on trade with their neighbours as a good launch pad. India preferred to look to the West.

This is exactly the message that enlightened thinkers like Kishore Mahbubani (https://mahbubani.net/) have been making. He is Distinguished Fellow at the Asia Research Institute (ARI), National University of Singapore (NUS). He too explains that the real growth of trade is in the east, lead primarily by China (another country which the US has been trying to pull down).

In a talk (https://www.youtube.com/watch?v=TF3ksZcRa4s) on 29 September 2023, before the Polish Institute of International Affairs (PISM) he points to the big mistakes Europe made in not looking to the east [India is guilty of the same error], but remaining confined to its own region and the West. Consequently, it missed out of the biggest growth that was taking place.

In just 10 years, ASEAN registered a 44% growth in GDP.

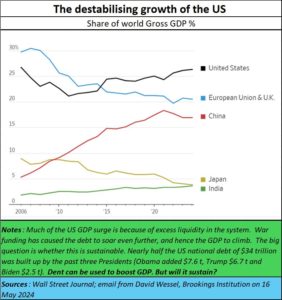

Yes, the US also grew, but it was a growth financed by debt, and not by internally generated revenues that were used to finance capital formation and jobs. Nearly half the US national debt of $34 trillion was built up by the past three Presidents (Obama added $7.6 trillion, Trump $6.7 trillion and Biden $2.5 trillion). Dent can be used to boost GDP. As a result, when the US finally begins to suck in the excess liquidity, it will rock the entire world. Demand will slump, affecting the fortunes of countries which depend on the US. That will be the case with India too, as it depends excessively on the US.

India’s trade vulnerabilities are well known. Its balance of trade is ballooning. Its exports are dipping. Even foreign direct investments are touching decadal lows (Free subscription — https://bhaskarr.substack.com/p/fantasies-about-indias-economy-might and https://bhaskarr.substack.com/p/can-india-be-the-global-growth-engine?sd=pf) .

What is worse, it remains fixated on the US, UK, and the EU instead of focussing on the ASEAN region where the growth actually takes place. It refuses to learn from Vietnam which registered a growth in GDP of 138% during the past 10 years (free subscription — https://bhaskarr.substack.com/p/is-india-spooked-by-china). Vietnam, despite having fought four wars with China, continues to woo Chinese technology in defence and telecommunications. It also laps up such technologies from the US as well. And it opts to trade with everyone. It does not mix sentiment or ideology with business.

India, on the other hand, continues to be spooked by China – banning Chinese investments in startups, and in the telecom sector. It delays the issuance of visas for Chinese businessmen keen on coming to India. And now that China has become the world’s second most powerful country, The ASEAN’s rise is relentless, and the most powerful country is losing ground rapidly, India may have to reassess its relations with the entire Eastern world.

Just look at the number of ministers who always find a reason to fly to the West, instead of flying to the East. Instead, India has shown is wiliness, even keenness, to allow New Zealand to send its dairy products into India. This is even though the dairy industry in India is its greatest success. Do the ministers want to wreck India? For more details do look up https://bhaskarr.substack.com/p/kuriens-amul-can-legends-be-erased.

As a result, when the crisis hits the US, India is likely to be savaged.

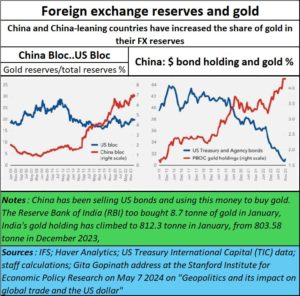

As Gita Gopinath, First Deputy Managing Director at the IMF stated in her address at the Stanford Institute for Economic Policy Research on May 7 2024 (her video presentation can be viewed at https://www.youtube.com/watch?v=1otqrbfk1Ck&t=1sm and a detailed note at https://www.imf.org/en/News/Articles/2024/05/07/sp-geopolitics-impact-global-trade-anddollar-gita-gopinath) Gold reserves of the China block have been increasing. “This suggests that gold purchases by some central banks may have been driven by concerns about sanctions risk,” she explains.

It must be borne in mind that the US rocked the world with the financial crisis in 2008. It is now rocking the world with sanctions, and very soon with the huge debt burden which continues to grow larger exacerbated by its expenditure on war in Ukraine and Israel.

Not surprisingly, almost every country in the world is seeking refuge in gold.

Without a doubt, the US remains the dominant global currency, but its share of forex reserves is slipping worldwide – it has slipped to just around 60%. China, sensibly, has been selling its dollar holdings to purchase even more gold, making it the world’s biggest gold purchaser last year.

India, ASEAN, and the US

While free trade made the UK rich, and then the US, both are now against free global trade. Non-tariff as well as tariff barriers have fragmented world trade. Moreover, as explained in the earlier article, the largest number of trade disruptions took place when the US became the global hegemon (free subscription — https://bhaskarr.substack.com/p/global-fragmentation-new-alignments). Clearly, the world is better off when the US is not at the top of a uni-polar world.

But with BRICS accounting for 11 countries now, and expanding, it won’t be long before the ASEAN and BRICS begin to dominate global trade. Israel has become a near pariah in the global markets (https://www.youtube.com/watch?v=pgVSbjs853I), and the EU is squirming when confronted with what is happening in Gaza. It has watched its own fortunes vanish ever since it listened to US’ advice and joined it in the war against NATO (https://asiaconverge.com/2022/11/germany-tries-to-bounce-back-after-ukraine/). It is still trying to get its voice back and resume trade with Russia. That would be the fastest route to economic recovery for the EU.

India’s options

IndIa will have to seek out new trading partners. This is even while its trade volumes with China increase. China has remained India’s largest trading partner (https://economictimes.indiatimes.com/news/economy/foreign-trade/china-overtakes-us-to-become-indias-top-trading-partner-in-fy-2023-24/articleshow/110049223.cms).

Similarly, India’s exports to the US have also increased (https://indianexpress.com/article/business/india-exports-rise-to-usd-41-bn-in-feb-highest-in-11-months-9216443/).

But despite all this, India’s balance of trade is growing, its total exports are slipping, and its foreign direct investment (FDI) is testing painful lows. Moreover, contrary to western media reports, China is on the rebound (Free subscription — https://open.substack.com/pub/bhaskarr/p/resurgent-china-despite-the-myths?r=ni0hb&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true)

Clearly, geopolitics will now shape India’s politics and policies. As Shyam Saran, former foreign secretary and honorary fellow, Centre for Policy Research puts it (https://www.business-standard.com/opinion/columns/geopolitical-challenges-for-next-govt-124051401533_1.html): “The US would have become a more diminished power. Its domestic politics has become more fragmented and more polarised than before. The US stand on the Israel-Hamas war has divided American society to a degree not seen since the Vietnam War. President Joe Biden is neither able to restrain Israel nor deny military and economic support to it. In Europe, Russia is making important gains in its war against Ukraine with the US caught in a serious dilemma — it does not want an escalation that demands direct intervention by the North Atlantic Treaty Organization (NATO), but Ukraine losing the war, or settling for an unequal peace, would deliver a grievous blow to American credibility.”

The cozy world of yesterday is dead and gone. India must decide which fragment it want to belong to.

============

Do watch my latest podcast in English on Who made Bombay rich at https://www.youtube.com/watch?v=YfIhgfXU9DI

COMMENTS