http://www.freepressjournal.in/gold-trade-when-cats-begin-chanting-hymns/783251http://www.freepressjournal.in/gold-trade-when-cats-begin-chanting-hymns/783251

Gold trade: When cats begin chanting hymns

On 9 February, the All India Gems & Jewellery Trade Federation (GJF) issued its ultimatum to the government that 300 associations of the jewellery trade with over 100,000 shops across the country, would observe a day-long token strike on February 10. The reason? They are sore with the government’s decision to make PAN (Permanent Account Number) card disclosures mandatory for gold purchases worth over Rs.2 lakh.

This rule, announced last year, became effective from January 1 this year. GJF spokespersons say that ever since then business volumes had been dented. The slowdown, they said, had affected jobs for millions of workers, artisans and small traders in the jewellery sector across India. Business turnover had dropped over 30% since the imposition of restrictions a month ago.

This rule, announced last year, became effective from January 1 this year. GJF spokespersons say that ever since then business volumes had been dented. The slowdown, they said, had affected jobs for millions of workers, artisans and small traders in the jewellery sector across India. Business turnover had dropped over 30% since the imposition of restrictions a month ago.

The GJF is a national trade body claiming to represent over 6,00,000 players comprising manufacturers, wholesalers, retailers, distributors, laboratories, gemologists, designers and allied services to the domestic gems and jewellery industry. This industry is said to employ a workforce of over 1 crore. The GJF says that the domestic gold industry is estimated to be in the region of Rs.2.51 lakh crore (Rs.2.5 trillion) today with the potential to grow to Rs. 5 lakh crore by 2018. The GJF now wants the PAN disclosure measure to be applicable only for jewellery sales of over Rs.10 lakh. The GJF’s claims are laughable, if not downright repugnant.

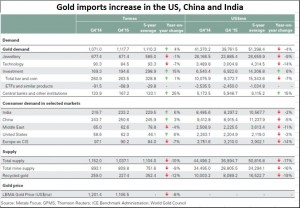

First, data from the World Gold Council and the GJFMS of Reuters show that appetite for gold has not diminished in India (in the US and in China). Even Central Banks collectively were net purchasers. The demand for gold has remained undiminished. True, prices have fallen, and hence the trade has declined in value terms but certainly not in volume terms.

Secondly, someone needs to remind the GJF that many, if not most, of its members have still not adopted fair business practices. The trade has refused to adopt hallmarking of gold jewellery, which in turn guarantees the quality of goods sold. Several investigations have confirmed that the gold jewellery sold by several jewellers is of a quality lower than stated. The customer is thus shortchanged. Some jewellers offer “zero making charges”. Instead, they collect a lot more money surreptitiously by providing gold which is of a quality inferior to what is claimed. Even gold jewellery that has been mortgaged is often returned upon redemption with some of its gold ‘missing’. Officials of the BIS (Bureau of Indian Standards) privately confess that their sample surveys have revealed instances of ‘contamination’.

The contamination is mind-boggling when it comes to silver coins. Anecdotal reports show that as much as half the silver coins sold through jewelers is ‘contaminated’ (http://asiaconverge.com/2014/09/620/). . In gold, contamination is to the tune of 2-10%. With silver coins it is higher, sometimes reaching 75%. Unfortunately, many law-enforcement officials are believed to be hand-in-glove with practitioners of this con.

NCDEX, one of India’s leading commodity exchanges, decided to review the hundreds of gold refineries that dot the entire country, The idea was to identify refineries that could be considered world class, and reliable. The survey – conducted by some of the finest experts from India and overseas – confirmed that only four Indian refineries could qualify as being globally acceptable and trusted. (more on this later).

The poor credibility the gold trade enjoys is one of the reasons why India’s gold exports have been falling year after year for the past few years.

Third, there is a good case for lowering the threshold – to around Rs.50,000 – for making compulsory the disclosure of PAN details. This is because anyone purchasing gold jewellery worth more than Rs.10,000 would be expected to file income tax returns. That they do not is itself an irregularity (even illegality) that needs to be curbed. Filing of income tax returns for any income earned is mandatory, even if there is no tax obligation. Thus, as Thomas Picketty, noted economist, pointed out last month, India’s “tax-to-GDP ratio of less than 11 per cent is insufficient to meet its challenges of inequalities”. Registering PAN details is one way of bringing more people into India’s tax net.

So is the GJF trying to promote the irregular and the illegal? Considering the way it has failed to encourage fair business practices among its members, such fears would not be entirely misplaced.

Ashok Minawala, of the GJF, admits this obliquely. He asks, “The PAN card restriction has discouraged many semi-urban and rural jewellery buyers who are engaged either in farming or in small trade practices. With just 22.3 crore PAN cards issued in India, how can the industry survive with such restrictions?”

The answer to that question is simple. Those purchasing gold should get registered for their PAN cards first.

COMMENTS