http://www.freepressjournal.in/analysis/want-to-uproot-corruption-try-this/980341

Want to uproot corruption? Try this

How does one win confidence of people, and also strengthen the Indian economy?

That is no easy task. After all, most Indians feel deprived; and vulnerable. India remains a country where 53% of its wealth is concentrated in just 1% of its population, and 85% in the top 10%. Corruption – and exploitation — has become a way of life. It has been abetted by all the three arms of government – the legislators, the executive and even the judiciary.

That is no easy task. After all, most Indians feel deprived; and vulnerable. India remains a country where 53% of its wealth is concentrated in just 1% of its population, and 85% in the top 10%. Corruption – and exploitation — has become a way of life. It has been abetted by all the three arms of government – the legislators, the executive and even the judiciary.

According to the Transparency International Corruption Perception Index, India is ranked 76 out of 167 nations. The annual Kroll Global Fraud Report notes that India has among the highest national incidences of corruption (25%). It also states that India reports the highest proportion reporting procurement fraud (77%) as well as corruption and bribery (73%).

At least two recent government reports – http://rajyasabha.nic.in/rsnew/committees/prevention_corruption.pdf and http://www.nishithdesai.com/fileadmin/user_upload/pdfs/Research%20Papers/A_Comparative_View_of_Anti-Corruption_Laws_of_India.pdf recommend enactment of stronger laws to deal with corruption. But both miss out on the basic reforms that are needed. Three of them are worth a mention here.

First, to weed out corruption, the government needs to empower the common man. Today, he is treated as a criminal if he reports an incident where he was compelled to pay a bribe. This is because the law treats bribe-givers equally guilty as bribe-takers. (http://www.asiaconverge.com/2016/06/bribery-levels-five-shades/ and http://www.asiaconverge.com/2016/06/indian-laws-designed-protect-promote-bribery-time/).

To weed out corruption you need to record the incidence of a bribe being paid. You cannot proceed without documentation. That complaint can be rejected, but only after it is recorded. For this you should not treat the bribe giver as a criminal. You also need to remove the protection that legislators, executives and the judiciary enjoy which prevents any enquiry against them being launched (till authorized). This is absurd because usally there is collusion among the three. They will thus prevent authorization. The protection encourages corruption. Eventually, it is the victim – often the bribe-giver – who is silenced.

Take an instance. One of the many corrupt departments in Maharashtra is the one that monitors the implementation of the Shops & Establishments Act. Each establishment – both registered and even unregistered – has to pay a small amount as ‘protection money’ to this department. If this is not done, its inspectors will find out ways to file cases against the establishment.

The unregistered firms can have their offices and goods sealed, and slapped with penalties. The registered units can be faulted for not having lime-coating on the walls, or not having a first aid kit, or registers, or one of the countless stipulations in an antiquated rule-book.

Defaulters are given summary summons to appear before the small causes court. If you refuse to go, you could get arrest for contempt. If you go there to protest, you will often find that the department’s officials have not arrived to make their submissions before the court. A fresh date is given, repeatedly. Finally, most victims are exhausted and hire lawyers. Hearsay has it that usually the lawyers settle the matter ‘amicably’ with the department.

There is no respite even if the establishment is not in the wrong as a complaint to the department shows (http://www.asiaconverge.com/wp-content/uploads/2016/11/2010-06-29-ETL-letter-expln.pdf). The party still had to go to court at least three times, and finally paid a fine through a lawyer. The receipt for the fine does not clarify the reason for the fine being collected (http://www.asiaconverge.com/wp-content/uploads/2016/11/2010-08-30_SE-Kurla-court-fine.pdf). Charming, isn’t it?

The complainant can never say that he has paid a bribe. The complainant cannot easily complain about the abuse of the process of law. The corrupt official gets his loot, irrespective.

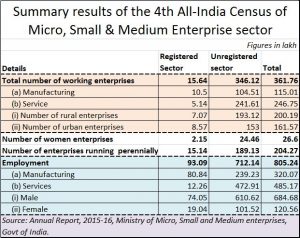

Officials of the department make money other ways as well. This is because a large number of establishments are unregistered (see table). Officials know this. It confirms the adage that, in India, data collation at the unofficial level is supremely efficient, because it is immensely lucrative.

The primary reason why so many units choose to remain unregistered is because the cost of being registered is high, even cumbersome. Thus remaining unregistered suits both the entrepreneur and the inspector. Both benefit.

That is why the second reform becomes critically important. To reduce corruption, reduce the rate of taxation to less than 2% so that the incentive for remaining unregistered disappears. Give a guarantee to the entire nation that this tax rate will not change for say the next 15 years.

A simple calculation confirms this. Even a notional Rs.15 tax for each of the 15.64 lakh registered units will yield only Rs.234.6 lakh. But a mere Rs.2 tax on all the (361.76 lakh) units could generate Rs.723.5 lakh. Moreover, at the ‘normal’ rate of 50% of the official fee, the higher the tax, the greater is the graft incentive for the inspector. To increase its revenues, and reduce those of corrupt officials, the government should reduce taxes.

That will bring employees too under the tax bracket. But, once again, to incentivise them to remain as registered employees, reduce the rates to one-tenth the current levels. The government will benefit, enterprises regularised, and corruption reduced.

This is because coercion with high tax rates often does not work. It is such coercion that made many entrepreneurs decide on remaining unregistered. Proof of coercion exists everywhere — taxes, labour laws, compliances. They are costly and cumbersome. As a result, for every 4 registered units, there are 94 unregistered units. Even when it comes to employment, for every 11 employees with registered units, there are 89 employed with unregistered units.

The third reform is to reduce the interface between the money collectors – the police, billing inspectors for water and electricity, excise inspectors, income tax officers and inspectors for sales tax and shops & establishments are some examples. Find out ways to bill people without them having to meet any official. If the rates are low, and the interfaces few, compliance will be extensive. But more on this next week.

COMMENTS