Budget 2017: seven things that could help government galvanise economy and create jobs

Jobs needed desperately. That was the writing on the wall even in 2014. The refrain continues even for Budget 2017. Yet, 2014 was when Prime Minister Narendra Modi managed to sweep most Indian voters off their feet, and made his party – the Bharatiya Janata Party (BJP) sweep the hustings.

Many of the voters are believed to have voted for him because he promised them jobs and not merely doles. He had then appealed to their sense of pride and self respect.

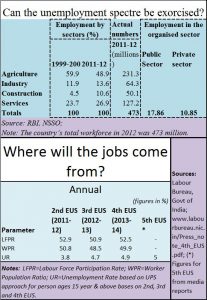

The smoke signals could be read quite easily even in 2013. The data that was available for 2012 showed that India needs huge investments and technology support to create new jobs. When the government came to power, it had an emploGikven India’s population, it needs to create at least 12-14 million jobs each year just to deal with the fresh crop of youngsters who come knocking at the doors of the job market. .

The smoke signals could be read quite easily even in 2013. The data that was available for 2012 showed that India needs huge investments and technology support to create new jobs. When the government came to power, it had an emploGikven India’s population, it needs to create at least 12-14 million jobs each year just to deal with the fresh crop of youngsters who come knocking at the doors of the job market. .

The government was aware, even in 2014, that the percentage of the workforce employed on farms will decline in the coming decade more rapidly than ever before. If the last 15 years have seen an 11% decline in farm labour, expect the coming decade to see this drop by at least another 15-20%. However, instead of reducing unemployment, the latest employment statistics from the government show that the unemployment rate is rising.

At least 50-100 million people are likely to migrate from farms to cities within the next decade in search of jobs, or glamour, or both. The smart cities could ease the housing crunch, and also create immediate employment (http://www.asiaconverge.com/2015/10/will-the-spectre-of-unemployment-disenchant-indias-electorate/).

Moreover, of the total workforce of 473 million, only 29 million (barely 6%) belong to the organised sector. This is because the government has pampered the organised sector, making it far too expensive for small entrepreneurs.

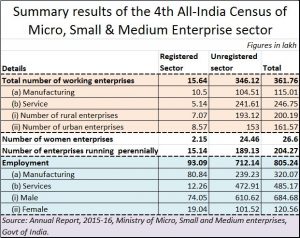

What has worsened the employment scene is demonetisation. It has hurt the MSMEmicro small and medium enterprises) sector very badly. Instead of creating jobs, the government has actually killed jobs. And the sector which provided India over 90% of the jobs has been hit this time.

What has worsened the employment scene is demonetisation. It has hurt the MSMEmicro small and medium enterprises) sector very badly. Instead of creating jobs, the government has actually killed jobs. And the sector which provided India over 90% of the jobs has been hit this time.

This comes on the heels of a year of jobless growth as well (http://www.asiaconverge.com/2016/11/where-will-the-jobs-come-from/).

That is why the provisions of Budget 2017 become crucially important. If this budget does not kickstart the economy and create jobs, then the political consequences for the party in power could be extremely painful. So will the economic and social consequences for the entire country.

So, this is what the budget could do:

- New Businesses: The Budget could offer incentives for the creation of new businesses that are employment oriented. Since this will require some tweaking of labour laws, expect such labour law flexibilities to be introduced for SEZs and the recently announced coastal economic zones (CEZs) that these colums talked about (http://www.firstpost.com/business/find-out-how-indias-vastly-unexplored-7500-km-coastline-can-generate-millions-of-jobs-3170668.html)

- Agriculture: Expect the government to push the envelope further to ensure that farm incomes are actually doubled as promised in last year’s budget. The government has already made the first major move in this direction. It has pushed India’s largest milk-producing state – Uttar Pradesh – into encouraging milk cooperatives. The government did this by nudging NDDB (National Dairy Development Corporation) to encourage Gujarat’s milk cooperatives to set up milk procurement and milk processing capacities just outside Delhi. This was aimed at procuring milk from Up. Farmers could now get Rs.25-28 per litre of milk. Without the cooperatives, farmers got only Rs.14-18 per litre. The encouragement of milk cooperatives will increase farm incomes in UP. Expect sops for milk and vegetable processing capacities so that farmers can get a higher value added for their produce. Since 50% of India’s population lives on farms, this will reduce the crisis of unemployment and urbanisation. Moreover, since rural votes formed a good chunk of votes that the BJP got in 2014, getting farmers more money means more votes as well.

- Rehabilitation: Expect some sops (for rehabilitation???) for weaver communities because this is one sector that has been very badly hit in UP, Bhiwandi, Surat and Tirpur (http://www.firstpost.com/business/demonetisation-with-polls-round-the-corner-budget-may-have-a-few-sops-for-devastated-weavers-3202900.html) .

- Infrastructure: Nothing creates jobs overnight the way infrastructure does. This means encouragement for building railways, roadways, waterways. The government has already notched up plans for giving these areas a major push. The trouble is that foreign investments are not forthcoming. This means that the government will try tap Indian investors. Will this mean big sops for infrastructure generation?

- Tax on cash: In keeping with Modi’s plan to promote cashless transactions expect several measures. First, expect NPCI to announce a further whittling down on merchant discount rates (http://www.firstpost.com/business/banks-vs-petrol-pumps-finally-indias-economy-planners-confront-the-complexities-3195740.html). That will make digital payment a little less painful. Also expect a reversal of the old Chidambaram prescription of levying tax on credit card transactions (P.C.Chidambaram was a former finance minister who had advocated such a tax). It is quite possible that the government will put a tax on cash transactions. That will drive businesses towards digital transactions.

- Transparency and fair play: It is quite possible that the government will also ask all businesses not to transfer merchant discount rates (MDRs to customers the way private airlines, some municipal corporations and the IRCTC have been doing (http://www.firstpost.com/business/shift-to-cashless-here-is-how-govt-departments-may-be-misusing-e-payments-3197266.html). Businesses must learn to be transparent. They should learn to put the actual final cost upfront. It is a bad practice to levy charges surreptitiously the way private airlines line Indigo have been doing.

- Real estate and affordable housing: One sector that has been badly hit by demonetisation is construction and real estate. A thrust on affordable housing could be the solution. There is only one problem. Most state governments and municipalities are greedy and charge exorbitant rates (both official and unofficial for construction permits. Affordable housing will not succeed unless such costs are eliminated. Moreover, affordable housing works when the numbers of houses built each year crosses a million. The shortage in India is around 20 million. Any number that is smaller will lead to black-marketing (because of little supply in the face of a huge demand). That will defeat the objective of affordable housing. It remains to be seen if the government will do this.

Lastly, in order to create very large numbers of jobs very quickly, the government will need investments. Foreign funds are running away because they believe India is trying to take away some of the protection they once enjoyed for their investments (http://www.asiaconverge.com/2016/11/where-will-the-jobs-come-from/). Will the government be able to re-instill confidence in foreign investors? Will it be able to patch up with the judiciary and do the right things that in turn offer quick effective redressal avenues for both resident Indians and foreigners alike?

Or will that be asking for too much?

COMMENTS