Demonetisation and the shrinking bank credit

The finance minister is exultant. He proudly points to the surge in tax collections. He then uses these numbers to deny that demonetisation has led to any serious slowdown in the Indian economy. His government insists that the economy was still vibrant.

Unfortunately, we do not have a breakup of the segments that make up the total tax collection. But there is a general belief that the surge in tax collections was on account of additional levies by the government (service tax and other cesses) and possibly some through income tax levies on black money declarations.

Shrinking bank credit

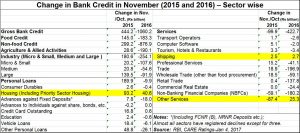

However, the numbers emanating from the Reserve Bank of India — succinctly captured by CARE Ratings in its January 4 report — confirm that credit offtake has declined in almost all sectors except for three (see the highlighted parts in the table). The adverse impact of demonetisation has been confirmed once again (http://www.asiaconverge.com/2017/01/2016-retrospective-pre-requisites-for-epayment/)

However, the numbers emanating from the Reserve Bank of India — succinctly captured by CARE Ratings in its January 4 report — confirm that credit offtake has declined in almost all sectors except for three (see the highlighted parts in the table). The adverse impact of demonetisation has been confirmed once again (http://www.asiaconverge.com/2017/01/2016-retrospective-pre-requisites-for-epayment/)

That in turn has made some people remark cryptically: “Yes, the government has got richer though, unfortunately the people have become poorer”.

Now compare the negative numbers for credit offtake during the year November-Ovtober 2016 with those of the previous corresponding period. During the period ended November 2015, there was a surge in credit offtake by almost all sectors.. The contrast is jarring enough to be extremely painful.

One of the pleasant exceptions relates to housing. Here, despite a slump in the real estate sector, the government has moved in quickly to promote affordable housing. As for other sectors, as the CARE puts it, “The expected pickup in Bank Credit, generally visible in November, did not materialise.”

In fact, the adverse impact of demonetisation is not entirely visible from these figures. There is a large part of the country’s economy which is driven by cash – especially in the small and medium sector – which does not depend much on bank credit.

Hence credit offtake by sectors like weaving, transport and real estate did not really matter. These sectors use cash, not bank credit. So when these sectors collapsed, the RBI data on credit offtake could not capture this. But the workers in these sectors are also consumers of goods produced by other sectors. So when they lost their jobs, their consumption was brought to a screeching halt. It is this reduction of expenditure on transport, food and other items of daily need that caused a contraction in the business of the major supply industries. That in turn caused these industries to opt for lower credit from banks. That reflection is a weak display of the actual pain to jobless workers.

To be fair, some of the collapse was to have been expected. Since much of the black money had gone into real estate, gold and transport, these sectors were expected to face a slump. But these sectors had employees too, and they in turn also stopped consumption. Gold survived for some time, because much of the black money went towards back-dated gold purchases. That in turn caused a surge in imports – mostly through smuggling. However, since gold smuggling is financed by black money, this surge has also escaped the RBI’s data-sheet.

In any case, when you seek to suck out 86% of the money in circulation, the collateral damage was bound to be immense.

What now?

Now that this has happened, what should be done?

First, focus on the biggest employment generators – affordable housing, infrastructure and tourism. But at least two of the three sectors requite huge dollops of patient capital. The biggest global funds refuse to invest in India because the government has not given foreign investors the investment protection guarante3es they require (http://www.asiaconverge.com/2016/11/where-will-the-jobs-come-from/). That must be done urgently, if the economy is not allowed to collapse.

Second, where affordable housing is concerned, building just a a few hundred thousand houses a year across several states will be a foolish exercise. The numbers of houses constructed each year need to be massive. The total estimated shortage of housing is 20 million (http://www.asiaconverge.com/2015/03/762affordable-housing-what-india-can-learn-from-iran/). If the numbers are meagre, it will spur a black market which will – once again – generate more black money.

Third, strengthen the adjudication process. Please sit with the higher judiciary and work out ways that will allow (a) for more judges to be appointed, and (b) speed up effective judicial redressal. That will release locked-up capital and make the wheels of commerce move faster. It will also go a long way to restore confidence in the economy.

But you cannot improve judicial redressal of grievances till politicians and bureaucrats are also allowed to come under investigative and judicial scrutiny. Currently, they are protected from complaints from people who perceive to have been wronged. This is unfair, because they are some of the biggest abettors, even promoters, of corruption (http://www.asiaconverge.com/2016/12/want-to-uproot-corruption/).

Conclusion

Can this be done? Yes it can. If the government can ram through a massive feat like demonetisation, it can do all the above very quickly. This can actually be immensely popular with voters too.

Failure to do this could make the aftereffects of demonetisation a festering wound. That could take a very very long time to heal.

COMMENTS