https://www.moneycontrol.com/news/india/comment-why-the-swiss-banking-numbers-arent-proof-of-money-laundering-2671481.html

Swiss Banking isnn’t the same any more

Key question – has corruption declined? Or has it not?

The Swiss National Bank appears to have done it again. It has confirmed that Indians continue to smuggle money out of the country – never mind what the prime minister declared in his election speeches in 2014.

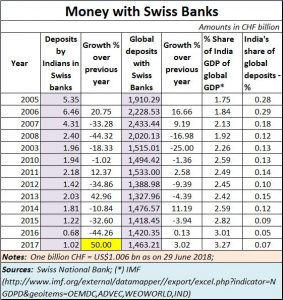

Predictably, there was a hue and cry. Opposition leaders accused the government of abetting corruption. They pointed to the surge of 50% in Swiss bank deposits from India (see chart alongside).

Predictably, there was a hue and cry. Opposition leaders accused the government of abetting corruption. They pointed to the surge of 50% in Swiss bank deposits from India (see chart alongside).

But the opposition could be barking up the wrong tree. They could be full of sound and fury, signifying actually nothing at all.

Barking, not biting

There are three reasons to believe that the accusations do not merit much attention.

First, look at the numbers carefully. True, they jumped by 50%. But that was on a very small base which kept shrinking ever since Prime Minister Modi formed his government. Even after accounting for the 50% surge, the current deposits stand at just CHF 1.02 billion, which is half the amount in 2013, when the UPA was in power. It is almost one-sixth the amount of CHF 6.46 billion in Swiss banks in 2006, when too, the UPA was in power.

Second, watch how the quantum of Indian money in Swiss banks is at one of the lowest levels ever during the past decade (when considered as a percentage of total deposits with the Swiss banks). The lowest level was in 2016 at 0.05% and the second lowest was in 2017 at 0.07%. Thus, even though India accounted for over 3% of global GDP, it accounted for a significantly smaller share of deposits with Swiss banks.

Depositing black money in Swiss banks does not make much sense nowadays. This is because, during the past few years, Switzerland has entered into several bilateral treaties for making disclosures about bank deposits to requesting states. That includes a treaty with India to provide real-time information with regard to Indians from January 2019. Obviously, any Indian who wants to stash away black money will not do so with Swiss banks, because he would stand exposed.

Clearly, the opposition is merely posturing. It is trying to disenchant people by making them believe in an interpretation of numbers that is patently not true!

Clearly, the opposition is merely posturing. It is trying to disenchant people by making them believe in an interpretation of numbers that is patently not true!

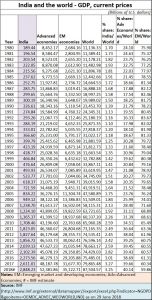

Take a look at some other numbers sourced from the IMF. India’s GDP has grown faster than the average GDP growth for Emerging Market (EM) countries and even advanced countries. During the period 2014-2017, India’s share of world GDP went up from 2.59% to 3.27%. Compare this with the growth of the share of EM countries which climbed from 39.45% to 39.66%. These shares were obviously snatched from advanced countries which saw their share of global GDP slip from 60.55% to 60.34% over the same period.

Of course, if IMF estimates are to be believed, India’s share will come down in 2018 to 3.25% even while the share of EM countries will continue to climb to 40.14%. India is evidently losing steam. But more on that later.

Where is the corruption?

If all this is true, then why did deposits into Swiss Banks climb so dramatically? Talk to those in the know and they suggest that there could be one very plausible explanation. The government’s decision in March 2018 to introduce amendments to the Foreign Corrupt Practices Act (FCRA) could have been the trigger. These amendments clearly frustrated the Supreme Court’s directive that political parties disclose the source of funding from overseas (https://www.moneycontrol.com/news/india/comment-corruption-collusion-and-legislative-filibustering-will-cripple-democracy-2531493.html). If political parties knew that such amendments were to be pushed through, they would have transferred some of their money to Swiss Banks. The fact that no political party has protested against these amendments being pushed through does suggest that they had no problem with piece of legislation becoming law. With the decks being cleared, it would make sense for such parties to bring back their money from less safe tax havens into Swiss banks instead, where their money could be safer. Thus Indian money in Switzerland could register a further increase.

Of course, there is a need for a caveat here. Public-spirited persons like EAS Sarma (http://www.asiaconverge.com/wp-content/uploads/2018/02/2018-02-16_EAS-Sarma-Retrospective-amendment.pdf) have challenged these amendments before the Supreme Court, calling them unconstitutional. It remains to be seen what the courts decide.

That brings us to the key question – has corruption declined? Or has it not?

That is difficult to say, because investigations into three key areas remain pending.

First, the best proof of corruption can be found in the income tax disclosures of agricultural income for the years 2011 and 2012 (http://www.moneycontrol.com/news/business/comment-from-pnb-to-mallya-to-farm-income-india-enables-corruption-2510203.html). In just those two years, the disclosures made were horrifying because (a) they were larger than ever before; (b) the cumulative value of disclosures during the two years was a mind-boggling Rs.874 lakh crore (Rs.874 trillion); (c) the cumulative value of disclosures was eight times India’s GVA for 2013, and almost 100 times the total tax collected in that year. Investigations into the names of the parties that made these disclosures is still pending. A petition before the Patna High Courts remains unheard.

Second, there are good reasons to believe that much of the slush money can be unearthed if only the enforcement authorities decide to auction off the properties (of accused parties) that were seized in the past– irrespective of whether they relate to the NSEL Scam (http://www.asiaconverge.com/2014/06/auction-off-nsel-defaulters-assets-restore-investor-confidence/) or the politicians being investigated for corruption (on extremely narrow charges). Attachment of properties makes for big news. But nothing happens thereafter, once public memory fades. Even leaders of the opposition remain silent on this.

Some of the slush funds may be tracked from the fortunes amassed by senior officials who were charge-sheeted, suspended, when fraud was discovered, and then reinstated when public memory died. They can also be found from reconstructing the files that routinely get burnt in fires that take place in government offices – possibly aimed at making evidence disappear – especially when it comes to corrupt deals and land development scams.

Corruption hasn’t really declined. Anecdotal evidence suggests this. The number of politicians charged with corruption but not prosecuted is there for everyone to see. The role of politicians and bureaucrats in instructing bank managers to lend unwisely has not even been investigated. Similarly, there has been no investigation into who caused Air India’s losses to swell so dramatically.

Clearly, black money generation will continue. But the Swiss National Bank’s figures cannot be used as proof of increased money laundering in India.

COMMENTS