https://www.freepressjournal.in/analysis/policy-watch-how-aadhaarpan-could-threaten-banking-and-financial-integrity

Article 139AA has created a big money laundering machine in India

RN Bhaskar

On 27 October 2020, there was a Twitter chat— “Curious case of PAN-Aadhaar linkage” — that was organised by the prestigious Economic and Political Weekly (EPW). It raised several questions that were extremely disturbing (https://threader.app/thread/1320703972303237125).

This article is an attempt to focus on some of the major arguments made by the two extremely bright analysts and activists — Anupam Saraph and Sanjana Krishnan. Their analysis convinces this author that India could be creating one of the biggest money laundering opportunities in the entire world.

This article is an attempt to focus on some of the major arguments made by the two extremely bright analysts and activists — Anupam Saraph and Sanjana Krishnan. Their analysis convinces this author that India could be creating one of the biggest money laundering opportunities in the entire world.

When an Aadhaar card is given to a PAN holder ( a — Permanent Account Number – is a card issued by the Income Tax (IT) authorities to identify all transactions done by the PAN holder), the situation is not worrying. PAN cards are issued to person after verifying his (or her) details. A PAN holder usually has a tax payment history, and the number is ‘certified’ by a competent officer (usually belonging to the IT cadre).

The problem arises when an Aadhaar card holder (Aadhaar too is a Unique identification number which is issued by the Unique Identification Authority of India or UIDAI — https://uidai.gov.in/) is allowed to get a PAN card automatically.

Aadhaar was meant to identify each and every citizen of India. It was meant to be a highly secure and reliable form of identification. But it has been riddled with controversies right from the time the concept was introduced. Allowing Aadhaar card holders to get a PAN automatically is therefore quite risky.

This is because, unlike the PAN Card or the passport, which is given to an individual after due verification and identification, the Aadhar card is issued without any nature of identification or certification. Thus, there is a fear that huge numbers of bogus Aadhaar cards are floating around.

Yet the government went ahead and, in the Finance Bill of 2017, introduced Article 139AA in the Income Tax Act allowing holders of Aadhaar cards to be issued PAN cards as well (https://incometaxindia.gov.in/Acts/Finance%20Acts/2017/102120000000064612.htm). This rule came into effect on 1 June 2017, the same date on which GST also got effected.

Consequences

As the table alongside shows, the number of PAN cards soared after the new ruling was put into effect. Today, as given in the table above, the total number of PAN cards issued based on Aadhaar cards could be at least 42% of the total population of PAN cards.

Now this poses a big problem, because the legality of Aadhaar is still being debated in the Supreme Court.

Among the reasons why Aadhaar is not found acceptable by many activists is because it opens a backdoor to creating fictitious identities which can be used for bogus voter identification on the electoral rolls, and worse, it could be used to embezzle money from the exchequer. And the numbers given in the table above suggest that it could be used for transforming India into the biggest money laundering machine in the world.

But why is Aadhaar suspect?

To understand some of the issues raised, one needs to first consider the way Aadhaar was launched in this country. Conceptually, the Aadhaar scheme made immense sense. You cannot have a country as large as India where a person cannot have access to a document which proves his citizenship. But the way it was implemented, and the legal issues surrounding this have resulted in several horror stories that people talk of.

First, remember that Aadhaar is a document that is not certified by any authority. It is a process that only authenticates a person and does not identify him. It is like using the name and password of another person and authenticating yourself when using someone else’s email account. The system merely authenticates that you are indeed the person who has used the right name in combination with the right password (http://www.asiaconverge.com/2018/02/does-aadhaar-identify-or-merely-authenticate/),

Second, to identify means getting someone to identify you. When you open a bank account (at least in the pre-Aadhaar days), the form requires you to get someone to identify you. His name, signature and other details are collected. The bank collects documents, but also mails the account details to the address given to confirm that you receive the document at the stated address. A similar process is followed when applying for a passport. The police come to your house, checks if you really exist, check with your neighbours, record all the details of witnesses and the investigating officer, before issuing a clearance to the passport authorities. That is identification. Aadhaar merely takes documents (often merely copies of such documents), takes the fingerprint and retina scan, but does not ask anyone to identify you. Nor does any officer certify that you have been identified.

Third, this absence of identification leads to a very major security loophole. Bogus entries can be made in various names. Foreigners could be asked to give their fingerprints and retina scans (especially when the foreigner looks like an Indian) along with bogus names, documents, and addresses. The danger of there being more Aadhaar cards than the actual population is always a big worry (http://www.asiaconverge.com/2020/02/aadhaar-cards-populations-many-ways-rig-numbers-financial-transactions/).

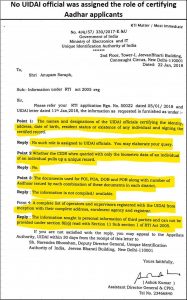

The fact that the Aadhaar process is not certified by any official is also admitted by the government through its reply to RTI (right to information) queries as recently as on 22 January 2018 (see image alongside).

The fact that the Aadhaar process is not certified by any official is also admitted by the government through its reply to RTI (right to information) queries as recently as on 22 January 2018 (see image alongside).

Compounded by the NPCI

A bigger problem comes up when one looks at the use of Aadhaar in conjunction with the National P:ayments Corporation of India (https://www.npci.org.in).

According to government regulations, all payment of subsidies or entitlements shall be made to the identified recipients based on Aadhaar card numbers. The government only sends to the NPCI the Aadhaar card numbers and the amounts that should be directly credited to recipients.

The NPCI, on its part, asks banks to send details of the Aadhaar cards of all account holders to it. NPCI maintains lists of Aadhaar numbers and their corresponding bank account numbers. But then there is a quaint (and highly controversial) line in the NPCI manuals which states that a new bank account opened by a person “overwrites” the older account number that might have existed in that person’s name.

NPCI also states that it does not keep logs of payments made (http://www.asiaconverge.com/2018/02/how-aadhaar-and-npci-together-open-the-door-to-major-frauds-and-impersonations/). This means that transactions by a person who opens a new bank account periodically (it could be every three months) cannot be traced. The NPCI does not append the bank account number, it overwrites them. Discussions with the NPCI authorities on this issue have routinely been stonewalled.

So, you can have bogus Aadhaar identities, which lead to bogus bank account numbers (the government has authorised the opening of bank account numbers using only Aadhaar as a sole proof of identity). And there is no trace of payments received or made. NPCI does not keep logs, overwrites the earlier account number, and the individual can have a new account (possibly even a new identity) each time. A charming situation indeed!

The government on its part, first allows the opening of accounts on the basis of Aadhaar cards (which are given without any certification). It tried to even issue passports based on Aadhaar cards, a move that has got stalled.

All this was challenged in the courts. In December 2018, Justice D. Y. Chandrachud frowned upon the provisions of Article 139AA (https://twitter.com/hashtag/139AA?src=hashtag_click). However, the government view prevailed. The justification was that there would be no harm in allowing the issue of PAN to Aadhaar Card holders.

In his minority judgement, Justice Chandrachud dwelt on how Aadhaar had failed to meet the three tests that were crucial (https://twitter.com/AnupamSaraph/status/1320734632694992896?s=08). They are

- he existence of a law

- The legitimate state interest, and

- It should pass the test of proportionality

He pointed out that Aadhaar does not pass the three tests, and hence said that it would have to be treated as unacceptable (https://twitter.com/AnupamSaraph/status/1079275824581234689/photo/1) . He stated (on pg. 477 of the judgement) that “the seeding of Aadhaar with PAN cards depends on the constitutional validity of the Aadhaar legislation itself. Section 139AA of the Income Tax Act 1962 is based on the premise that the Aadhaar itself is a valid legislation. Since the Aadhaar Act itself is now held to be unconstitutional for having been enacted as a Money Bill and on the touchstone of proportionality, the seeding of Aadhaar to PAN under Article 139AA does not stand independently” But his was a minority opinion, and so the Aadhaar has continued to stay even though arguments in the courts continue.

But since then, the numbers of the surge in PAN cards have surged alarmingly. This suggests that the entire exercise is fraught with risk to the financial integrity of the nation. It is now clear that India has just managed to create a big money laundering machine, which could be bigger than the Panama Papers.

The laundromat workings

Watch how the increase in PAN cards on account of Aadhaar cards has soared by 170 million, almost 42% of the total PAN cards issued.

The implications of this are extremely serious. Since each individual can show an income of up to Rs. 2 lakh a year without being taxable, all that a fraudster must do is to create multiple bogus Aadhar Cards and deposit (say) Rs.15,000 into each account in cash every month. At the end of the year each account will have close to Rs.1.8 lakh a year. This money can be used legally to purchase electronics, gold, or even pay others.

Since the amount is under Rs.2 lakh, it does not come under IT purview. But when multiplied into 9 crore bogus bank accounts (we are taking just 50% of the PAN cards that have been created on the basis of (uncertified) Aadhaar cards) the total money that can be laundered each year is over Rs.18 lakh crore. If all the Aadhar cards are considered, on the basis of which PAN cards were issued, the laundered funds could be as much as Rs.31 lakh crore annually.

India’s GDP in the first quarter of 2020 was around Rs.38 lakh crore. For the full year it could be Rs.131 lakh crore. In other words, India has created a system that could launder anywhere between 10-20% of its GDP year on year.

That is extremely frightening. Clearly, Article 139AA of the IT Act needs to be revisited, even removed immediately. At least for the sake of financial integrity of India

And do note that this measure comes along with other measures that have caused eyebrows to be raised. In February 2018, the government introduced a modification to the Foreign Contributions Regulations Act (FCRA) which allows for foreign contributions into the coffers of political parties, with no questions asked. (http://www.asiaconverge.com/2018/03/corruption-collusion-legislative-filibustering/). And that too retrospectively for 42 years! Thus, at a time when all nations strive to reduce foreign interference in their election processes, India has a law which legitimises the use of foreign funds for elections.

An appeal against this amendment was promptly filed before the Supreme Court. The appeal asked for immediate annulment of this amendment as being unconstitutional and fraught with risk to the concept of a nation. The court has not yet begun its hearings on this petition.

Similarly, it may be worth recalling that in 2014, a petition was made to the Allahabad High Court about agricultural income being declared (http://www.asiaconverge.com/2017/02/agriculture-as-laundromat-error-or-coverup/). During just two years, 2011 and 2012, the amount sought to be declared as agricultural income was Rs.879 crore (it could be larger averred the petition to the courts). It could be over eight times India’s GDP. The courts have not begun hearing this case either.

Taken together, all the three incidents point to moves that could make India the biggest money launderer in the world.

COMMENTS