https://www.freepressjournal.in/business/asia-dominates-on-internet-front-us-eu-way-behind-india-minuscule

Internet markets become more competitive

By RN Bhaskar

Fitch Ratings in its advisory dated 3 June 2021 (https://www.fitchratings.com/research/corporate-finance/chinese-internet-majors-investments-to-slow-profit-growth-03-06-2021) has underscored the possibility of fierce internet competition in the coming years. Already, major Chinese internet companies are prioritising investments in 2021. That will “slow their high profit growth for a year or two”, it added. It therefore expects the financial performances of the major companies to diverge.

Fitch expects expect growth in EBIT (earnings before Interest and Tax) for Chinese majors “to slow to a mid-single digit in 2021 from 24% in 2020”. The Chinese majors include Alibaba Group Holding Limited (A+/Stable), Tencent Holdings Limited (A+/Stable) and Baidu, Inc. (A/Stable). This will happen even though, “aggregate operating EBIT margin will narrow by four percentage points to 20%”. All these companies will be investing in order to “strengthen technology and content, support ecosystem partners, and improve access to new markets”.

Fitch expects expect growth in EBIT (earnings before Interest and Tax) for Chinese majors “to slow to a mid-single digit in 2021 from 24% in 2020”. The Chinese majors include Alibaba Group Holding Limited (A+/Stable), Tencent Holdings Limited (A+/Stable) and Baidu, Inc. (A/Stable). This will happen even though, “aggregate operating EBIT margin will narrow by four percentage points to 20%”. All these companies will be investing in order to “strengthen technology and content, support ecosystem partners, and improve access to new markets”.

Analysts point out that China has more than 850 million internet users, and a quarter of the world’s startups each valued in excess of a billion dollars.

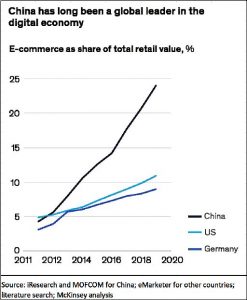

Mobile payment penetration is triple that of the US. e-commerce accounted for 24 percent of total retail sales in 2019, compared with 9 percent in Germany, and 11 percent in the US.

China is the world’s largest e-commerce market, accounting for about 45 percent of global retail e-commerce transaction value in 2018. In 2019, China’s internet market was worth $1.5 trn, while USA was $600 bn and India’s was $40 bn.

The emerging competition is also underscored by McKinsey in its recent China consumer report 2021 (Understanding Chinese Consumers: Growth Engine of the World). It notes that China is easily the world’s biggest player in the Internet sector (see chart).

McKinsey makes five observations (https://www.mckinsey.com/featured-insights/china/china-digital-consumer-trends-in-2019). First that digital tools become increasingly popular solutions, expanding from B2C to B2B.

Second, that there will be declining global exposure and the rising importance of domestic markets, technology, and capital.

Third, that there will be rising competitive intensity. Technology and agility will drive winners to capture the lion’s share of industry value.

Fourth that consumers (especially the young) are becoming more prudent and health-conscious.

Lastly, that private and social sectors will step up The private sector plays a stronger socioeconomic role, while the social sector rises.

Clearly, the internet sector is bound to witness fierce winds of competition ahead.

COMMENTS