https://www.freepressjournal.in/analysis/policy-watch-maharashtra-wants-to-raise-money-through-an-unequal-na-tax-even-while-waiving-other-taxes

Maharashtra’s new, unfair and controversial, real estate tax laws

RN Bhaskar

In December 2021, the government of Maharashtra began sending non-agricultural tax (NA Tax) demand notices to residents in some parts of Mumbai. This was based on legislations that the state passed, permitted it to charge NA tax on residents of Mumbai’s suburbs. It would be with retrospective effect from 2006.

There are many things about the way the state government tries to manage revenues. Some of them are now being being challenged in the Bombay High Court.

Coming on the heels of this levy was the state government’s decision to abolish property tax for properties of 500 sq ft and below. The announcement was made by the Maharashtra chief minister Uddhav Thackeray on 31 December, 2021 (https://timesofindia.indiatimes.com/city/mumbai/no-property-tax-on-residential-properties-up-to-500-sq-ft-in-mumbai-says-uddhav-thackeray/articleshow/88635208.cms) .

Clearly, the state government has been pushing through legislations that are unusual, absurd, and even dangerous.

Clearly, the state government has been pushing through legislations that are unusual, absurd, and even dangerous.

Downward spiral

At present the decision to abolish property taxes for premises of under 500 sq. ft applies only to Mumbai and the MCGM (Municipal Corporation of Greater Mumbai. But we can expect every city in the state to make similar demands. This could lead to another downward spiral for the state’s revenue mobilization.

Also expect more families to break up their large properties into units of 500 sq ft. This way, a 1,000 sq ft property would become two flats of 500 sq ft and escape property taxes altogether. The concept of one-law-for-one-people has obviously been abandoned.

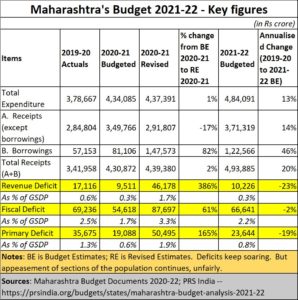

This decision has been taken even while the state government is reeling under losses.

As for MCGM, the Municipal Commissioner sought to justify this by saying, “ till December 31, the BMC has also collection Rs.3,450 crore in property tax whereas its target was only Rs.800 crore. For 2021-22, the property tax target is Rs.5,000 crore and we shall easily cover it.” Each year the outstandings are around Rs.1,500 crore he explained (https://www.hindustantimes.com/cities/mumbai-news/cm-no-property-tax-of-residential-properties-up-to-500-sq-ft-101641061621604.html) . He said that the waiver will cost MCGM only Rs.400-500 crore. But even this Rs.500 crore has  to be subsidised by the state government which is already into deficits (https://prsindia.org/budgets/states/maharashtra-budget-analysis-2021-22).

to be subsidised by the state government which is already into deficits (https://prsindia.org/budgets/states/maharashtra-budget-analysis-2021-22).

And the problem is not just Mumbai. Already MBMC (Mira Bhayandar Municipal Corporation) has begun clamouring for similar property tax waivers (https://www.freepressjournal.in/mumbai/mira-bhayandar-after-property-tax-waiver-on-houses-up-to-500-sq-ft-in-mumbai-demand-for-similar-benefits-in-mbmc-gains-momentum) . Effectively, the state government will have to cope with further deficits.

Cynics say that it is possible that the property tax waiver may not be made effective. That can happen only if there is a gazette notification. They point to the number of times the state government has made announcements, only to let them lapse for the want of a gazette notification. Will this happen again? We don’t know.

The slum connection

The roots of this property tax waiver can be traced to the appeasement of slums and nurturing votebanks there (https://www.freepressjournal.in/analysis/policy-watch-slums-2-how-slums-distort-normal-economics-in-india).

The government promised to free slums and redeveloped slums of property tax as an election promise (https://mumbai.citizenmatters.in/bmc-property-taxes-promises-exemption-effect-27792).

It made this promise to slum dwellers way back in May 2019, and even earlier (https://www.freepressjournal.in/cmcm/mumbai-bmc-to-not-tax-city-slums). Effectively, the state government was willing to

- Pull down the value of existing good residential areas by allowing slums in and around them.

- Creating vote banks at the cost of other citizens.

- Creating hotpots with conditions that are ripe for the spread of more infectious diseases.

- Turning a blind eye to the horrifying increase in the number of households in slums – possibly to benefit from allocation of benefits which are meant for households. As a result, as census 2011 data shows, in slums like Mumbai, the average household size was just 0.5 compared to a national average of over 5. This means that slums are costing the exchequer 10 times more than what they ought to in terms of entitlements (household size of 5 divided by 0.5).

- Promoting an iniquitous tax structure.

It is possible that the government realised that waiving property taxes only for slums might incur the wrath of the courts. Already, the state government has annoyed the courts. They had frowned at the state’s attitude and remarked that it “would appear that all lands were now being treated as the personal property” of the law enforcement authorities (https://indianexpress.com/article/cities/mumbai/seems-like-maharashtras-land-is-paternal-property-of-executive-bombay-hc-7392325/),

So, to make it look fair and just, the state has now included all flats under 500 sq ft. This way, hope the bureaucrats, the move cannot be termed as being discriminatory.

NA Tax

The move to waive property tax for houses of 500 sq ft and less stands out in sharp contrast to its move to apply NA tax on premises in suburban Mumbai.

The demands for NA tax, with retrospective effect from 2006, are currently being distributed to property owners.

This is despite howls of protest from various cooperative societies and organisations. On 25 March 2021, (https://www.punekarnews.in/pil-to-be-filed-against-collection-of-na-tax-maharashtra-state-co-operative-housing-federation-has-warned-maharashtra-government/) there was a move to file a PIL against such a move by the government. Maharashtra State Co-operative Housing Federation warned that a petition would be filed in April, if the government did not rescind the proposed levy. That did not happen. Possibly, this emboldened the government to proceed with its plans.

In mid-December, however, the Pune District Co-operative Housing Societies And Apartments Federation moved the Bombay High Court to seek scrapping of the NA tax on urban and sub-urban residential lands (https://www.punekarnews.in/validity-of-na-tax-for-urban-and-sub-urban-regions-of-maharashtra-challenged-in-bombay-high-court/).

And now the BJP has also begun exhorting people not to pay this tax (https://www.freepressjournal.in/mumbai/defer-non-agricultural-tax-notices-issued-to-housing-societies-bjp-led-delegation-to-maharashtra-revenue-minister). But that could be mere sloganeering. Citizens are required to pay the tax because it is now a law. Unless, of course, the courts step in and find the imposition of this tax to be unlawful.

Significantly, the NA tax is not applicable to properties in South Mumbai (https://mumbaimirror.indiatimes.com/mumbai/cover-story/societies-get-relief-from-unfair-tax/articleshow/63457402.cms ) as they were technically not agricultural land at any point of time.

As the petition before the Bombay High Court states, “NA Tax has a history since the British era when the irrigation and cultivation activity was taxed. Historically there was also a need to contain the conversion of land from Agricultural use to Non-Agricultural use as India faced scarcity of food grains during those days. This is no longer the scenario. The Maharashtra Land Revenue Code 1966 (MLRC) regulates the provisions related to NA Tax.

According to the provisions of MLRC, the residential sites which were originally villages or ‘Gaothans’ are exempt from levy & collection of NA tax as they were considered as predominantly residential sites, and no agricultural activity was ever carried out on such lands. Then why such landholders be charged the NA Tax again and again?

Effectively, the application of the NA Tax will be discriminatory within Mumbai itself. – the more affluent parts of Mumbai won’t have to pay this tax, while the relatively less affluent must pay this additional tax.

Refusal to raise funds creatively

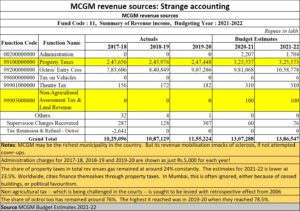

Strangely, the government has not bothered to increase revenue mobilisation through several options that it has. The MCGM hopes to garner a mere Rs.100 lakh (Rs.1 crore) through NA tax. The property tax waiver is even greater. Moreover, there were other ways to increase this relatively smaller collection of Rs.1 crore. There has been little creative revenue mobilisation effort by the government.

Strangely, the government has not bothered to increase revenue mobilisation through several options that it has. The MCGM hopes to garner a mere Rs.100 lakh (Rs.1 crore) through NA tax. The property tax waiver is even greater. Moreover, there were other ways to increase this relatively smaller collection of Rs.1 crore. There has been little creative revenue mobilisation effort by the government.

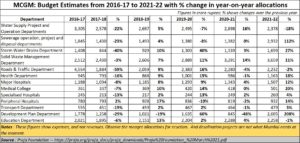

Then there is the issue of expenses.

As numbers put together from Praja Foundation show, the government actually allowed the share of water taxes to go down in percentage terms. Instead, it has allowed the water tanker mafia to continue making windfall profits at the expense of hapless citizen (https://asiaconverge.com/2019/06/the-stranglehold-of-the-water-tanker-mafia/).

If the government could manage just water leakages (referred to as NRW or non-revenue water) – which is around a whopping 30% of water with the MCGM — there would be no water shortage. Hence, there would have been no need to go in for the expensive desalination plant, which will further bleed this state for decades (https://asiaconverge.com/2019/08/desalination-is-a-money-game-in-india/). And like many of the states in North India, its expenditure on education is embarrassingly low.

The government’s unseemly hurry in pushing through the property tax waiver and the imposition of NA tax is not viewed kindly by many. The government’s haste is so great, that the NA tax department does not have a functioning official email address (emails to this address bounce off, and the officers have requested citizens to use a Gmail address instead). Its website is clumsy, and its payment gateways do not function properly.

Quo Vadis

So, you have appeasement of slums through a cleverly modified property tax waiver of all flats under 500 sq ft. You have the continuing regularisation of slums. And you also have the imposition of a controversial NA Tax in Maharashtra.

This is worsened by expenditure that could have been curbed (through controls on slums) and scrapping of the desalination project, and creative revenue mobilisation.

As a result, the citizen who is not privileged enough to stay in South Mumbai will now have to pay additional taxes.

It looks like the Bombay High Court will witness a series of challenged to such laws in the coming months.

COMMENTS