INVESTMENT PERSPECTIVE

By J Mulraj

May 1-7, 2022

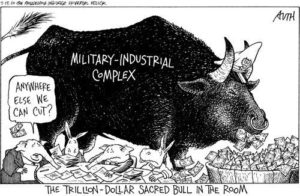

Diversion of resources away from health and education

Retired politician and author Ron Paul says, in his weekly column, that “War is a racket, wrote US Maj. General Smedley Butler in 1935. He explained: “A racket is best described, I believe, as something that is not what it seems to the majority of the people. Only a small ‘inside’ group knows what it is about. It is conducted for the benefit of the very few, at the expense of the very many. Out of war a few people make huge fortunes.”

Retired politician and author Ron Paul says, in his weekly column, that “War is a racket, wrote US Maj. General Smedley Butler in 1935. He explained: “A racket is best described, I believe, as something that is not what it seems to the majority of the people. Only a small ‘inside’ group knows what it is about. It is conducted for the benefit of the very few, at the expense of the very many. Out of war a few people make huge fortunes.”

The ‘inside group’ is the military-industrial-complex, (MIC) which appears to be able to influence US policy. Neither USA nor EU then accepted, as they do now, that Ukraine would not be given NATO membership, something that may have averted the war. Neither, for that matter, did Ukraine.

The war has created losers all around, in terms of men, property and resources, and the suffering that will continue after it ends would be devastating. There is likely to be a global food shortage, leading to famine, because the warring countries are the main suppliers of wheat and fertilisers to the world.

But the MIC has benefitted. Look at the stock prices of US companies supplying defence equipment, such as Lockheed Martin, Raytheon, and others. All of them have risen after the Russian invasion of Ukraine. Till then it was the FAANG stocks (Facebook, Apple, Amazon, Netflix and Google) which were the darlings of investors. All, barring perhaps Apple (slightly up), are lower, most significantly Netflix.

Ron Paul’s column quotes the CEO of Raytheon telling a meeting of shareholders, that military equipment going to Ukraine is coming out of stockpiles, either from DOD (department of defence) or NATO allies, and will ultimately be replaced (emphasis mine), using tax payer dollars. President Biden has asked Congress for $ 33 b. in further aid to Ukraine, including $ 20b. in military aid.

War is a business. And is waged to benefit business interests, not human interest.

In the aftermath of the war, European countries have increased defence budgets. Germany has doubled it. This would, of course, be at the cost of spending on other things like better medical infrastructure (to try and prevent another pandemic), or on education (to better prepare the populace for a technology driven world) or on much neglected infrastructure.

German novelist Thomas Mann correctly said that ‘war is only a cowardly escape from the problems of peace’. He is spot on. Political leaders of most countries have created serious problems for them. The US reels under a mountain of debt and has high inflation which it seeks to fight with interest rate hikes. The hikes, however, have resulted in a stronger dollar, raising commodity prices, thus diluting the fight against inflation. China, where cities like Shanghai and Beijing have been completely locked down due to its ‘zero tolerance’ policies, has seen a slump in GDP growth and resentment from the locked down populace. Russia is feeling the pinch of sanctions and deprivations therefrom.

So war is a cowardly escape from the problems of peace. Mann gaye.

At the analyst meet, some years ago, of a PSU defence company, the thought struck me whether applying for its shares was a good decision. An investor wants his company’s business to grow, right, so that he makes money. But no one wants war, which is how the company’s business would grow. So, though defence manufacturers are needed, for the defence of the country, should they be funded through private investment? Is it ethical, or logical, to do so? Because, as in Ron Paul’s column, a shareholder funded business would seek opportunities to grow the business, ergo, to encourage more conflict. Hmmm……

And there are other consequences of such a war. One of Biden’s first acts as President was an executive order to stop the lease of federal lands for fracking, thereby reducing the output of shale oil obtained through fracking. Simultaneously, because of ESG (environment, societal and governance) norms, banks stopped lending to traditional oil producers like Exxon Mobil or Chevron, for capex. As a result USA, once an oil exporter, reverted to becoming an oil importer, dependent on other countries for energy security. So the price of gasoline pump prices are above US $ 4/gallon, and diesel above $ 5/g. Since high gasoline prices can affect election results (Congressional polls are in November and the Dems are likely to lose control of the house), it is increasing the use of biodiesel, obtained from soy, to bring down pump prices. In this video, Doomberg calls it diesel for dinner! Of course, there is less soy for human consumption. What a tragedy of errors!

The lockdown in Shanghai, a city of 25 m. people, will have global impact. Shanghai has 70,000 global companies! Production of vehicles of Tesla, Volkswagon and GM are hit. So also of Apple’s phones by its supplier Pegatron. And of TSMC semiconductor chips. Astra Zeneca has a global research centre in Shanghai. Over 4 m. containers are blocked due to the inability of truck drivers to enter the city.

One does not know how the hold of the MIC on global policy making can be reduced. Only through public pressure can it create some pause, and slow down the insane arms race to focus on the human race.

Last week the BSE sensex dropped 2224 points to close at 54835.

The market was hit by an unexpected hike, by 0.4%, in repo rate, by RBI, to fight inflation. US Fed raised interest rates by 0.5%. Given the supply side issues created by the war, and the Chinese lockdowns, inflation is not likely to subside soon. Expect more interest rate hikes. Each of these make bond markets a tad more attractive, relatively, to equity markets, and higher interest costs reduce consumption spending and corporate profits. Though RIL and Tata Steel both announced good quarterly results.

The attitude towards investor protection is distressing. The Supreme Court has appointed a high level committee, under a retired judge, to enforce the Rs 3500 crore decrees and arbitration awards obtained by NSEL against defaulters. Normally that would be considered good news, except that it comes 9 years after NSEL was shut down, in 2013. What have the investigative authorities and the judiciary been doing for 9 years? In USA Bernie Madoff was sentenced in a year’s time, and the money was recovered soon thereafter and distributed. In India, SEBI still sits on the money deposited with it by Sahara. Do EOW, SEBI and other investigative agencies believe the money belongs to them? Should not the court lay down specific guidelines for the recovery and distribution to victims of money recovered, and a timeline for them? Is this not a part of Mr Modi’s campaign for better governance?

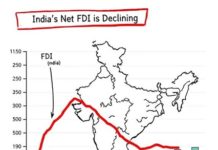

One does not know if anyone is trying to reach a negotiated end to the Ukraine war. Putin is threatening nuclear escalation, an unthinkable thought. But even without that nightmarish scenario, the risks of continuing high inflation, of rising interest rates to counter it, the risks of a global food shortage and rising famine, and of an un-tameable MIC, are causes of concern. Over the longer term, provided a nuclear war is averted, India has positioned itself well, barring a few weaknesses which hopefully will be attended to.

Picture Source: https://espionage.substack.com/p/domestic-military-industrial-complex?s=r

COMMENTS