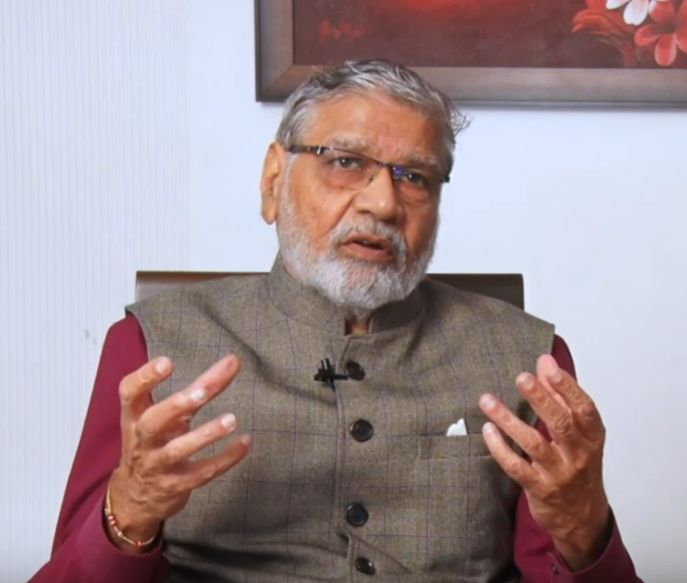

Sanjay Kothari and the transformation of the gems and jewellery trade in India

Sanjay Kothari has been a diamond industry player (Kunal Diamonds) for five decades with forward integration into jewellery. He has been involved with GJEPC since 1996 in various capacities, including two stints as Chairman. Other notable involvements have been with the industry’s education institute, charity foundation and with the skill development council. He spoke at length with both Pankaj Joshi and RN Bhaskar on a number of issues, ranging from jewellery trade evolution to lab-grown diamonds. Edited excerpts:

The recent past for the industry: https://youtu.be/CQVKcd9T5Cc

You’re aware of the realities of the industries over the last few decades. Ups and downs are a part of any industry and we’re no exception. The industry started from sixties, and in 1971 we had an issue, then even in the nineties we had problems, as we did in 2008. So in short, ups and downs keep recurring.

Before roughly five years, we were steady. But then what happened was, during the Covid period, we saw growth. People (in developed nations) had money in hand coming from governments, but couldn’t travel, access malls or restaurants – so fewer avenues to spend the same. Online shopping of jewellery was one of the options. Therefore, against our expectations, we could see a surge in our industry revenues. At industry level we were happy with these developments.

Now over the past few months, with the Ukraine war and its shadow on overall global events, a little bit of lull has set in. Also, with the restrictions done, people also are looking to spend money in other avenues.

Let’s see how Christmas sales unfold in the western countries. Diwali in India has been good. Those ups and downs apart, our share in world jewellery market has been very small (10-12 percent) and scope for growth is huge. We are late starters in jewellery – since 1991 – and for some years we catered only to local market. After 1991, we could import the machinery needed to make jewellery to cater to the global market. Today we compete well with Hong Kong, Thailand and Italy in the global jewellery market.

Lab-grown diamonds, their impact and their position: https://youtu.be/rt1qXxCLv7U

In an environment of potential recession and cost saving, lab-grown diamonds have been a blessing in disguise for the diamond industry overall. You would be aware that the Argyle mine, which was generating large volumes – both in numbers and carats – stopped production. Only Russia and African nations, apart from De Beers, were in vogue.

So, the large gap created by lack of Argyle diamonds availability was a huge question mark for the industry. You’re aware that 8-10 lakh workers are employed in the diamond processing activity and a question of employment arose for many of them.

At this juncture, the advent of lab-grown diamonds was a godsend, especially for the artisan, because you’re aware that processing of lab-grown diamonds also needs the same skills at the same scale.

Producers accepted the new technology; consumers accepted the new product in the market. In my view, both natural and lab-grown diamonds will survive and have their own space. Originality and affordability – both types of consumers will get their choices.

Regarding the market shares of both types of diamonds, I can see that lab-grown diamonds are steadily increasing their share with time. That said, natural diamond companies are putting in efforts in mining as well as in promotion of their output. Both categories will have their market and both will flourish.

The current supply situation from Russia: https://youtu.be/r9dxacGvQf8

Supplies from Russia have not stopped, but are coming in a staggered manner. Russia does want to sell, and we want rough diamonds, so there are people trying to find out ways and means to make the deals happen, maybe through a rupee-rouble exchange mechanism. With that in place and lab-grown diamonds, we would survive. Given that this war has affected the world at large, we cannot expect to be insulated.

That said, I expect a difficult period ahead in 2023, especially with (as you said) the threat of recession looming for different nations. Let us see how Christmas sales rank in our main markets.

Surat’s emergence as a marketing hub: https://youtu.be/AobyakdnGn4

Surat has for long been the main centre of the cutting and polishing segment of the diamond industry. Mumbai was essentially a trade and export centre. Now, seeing the currently functioning Bharat Diamond Bourse and the upcoming Surat Diamond Bourse, my view is that both will survive and grow. If you look at the USA, which has 20-30 percent of the global diamond market, there are three bourses and all doing their part. Trading will continue to happen in Mumbai largely, with smaller diamond players perhaps going to Surat and taking advantage of that platform. Manufacturing will be based out of Surat. It is a complementary development.

Regarding diversification of manufacturing in different parts of India, it has not been very successful. It is mainly because the Surat people, particularly the Patels, have put in so much effort into creating an ecosystem of skilled manpower. If you look at South India, the skills that the artisans there have are focused primarily on jewellery. Even in Gujarat, apart from Surat, other jewellery manufacturing hubs are developing. I believe there is space for everyone to survive.

China as a potential rival: https://youtu.be/6CDG7nrc6IU

It has been seen in the past that De Beers and other global giants tried to create parallel processing centres – in Sri Lanka, in China, in other places. But nothing worked as far as diamond cutting and polishing was concerned. They had to come back and admit dependence on Indian companies. India has delivered for these last 30-40 years on the back of hard work and knowledge.

China, for its part, is doing well in jewellery manufacturing and even in lab-grown diamonds. In lab-grown diamonds, especially on the small gems side, people are importing raw material from China. Cutting and polishing though, remains here and will remain here.

FTAs and the expected impact on exports: https://youtu.be/dp2Ev7DiSNc

FTAs especially with the UAE, will help expand jewellery exports. The UAE has been a big market for years. We import gold and export jewellery, both diamond studded and plain. If you see the UAE export numbers in the past few months, they have gone up. The same thing I believe will happen with Australia, and in time more and more nations will have similar agreements with us.

For many big nations, a good part of trade comes from neighbouring countries. India at first sight does not fit this pattern, but if you see a good part of our exports to Hong Kong are then routed to other nations in our neighborhood. That does not take away the point that there is scope to grow, but I believe whether East or West, India is well placed to increase its exports.

Gazing into the next five years: https://youtu.be/zMmZFQA0hVw

For the next five years, jewellery is set to grow for sure. With some constraints on natural diamond availability, and aided by rapid growth in production of lab-grown diamonds, jewellery market will expand in different price bands.

If we talk of diamonds by itself, probably lab-grown diamonds will grow quickly within the diamonds space.

As long as ladies are there on the planet, jewellery will continue to grow.

Acceptance of lab-grown diamonds is now a done thing. It is good because it enables artisans to be employed. Like imitation jewellery, jewellery which is made from lab-grown diamonds will steadily create a market for itself and sustain.

In lab-grown diamonds, in the bigger size segment, India will be the dominant player. It all depends on the saleability of such jewellery. Right now the USA is the dominant market for jewellery made from lab-grown market, and UAE is an upcoming market.

For lab-grown diamonds, one key requirement is consistent electricity supply. And on the sales side, for lab-grown diamonds to be accepted in India, a concerted effort in promotion will be needed, on the lines of how De Beers has done for 30-40 years in natural diamonds. The promotion has to come at association level.

One inhibition in consumers’ purchase of lab-grown diamonds would be fear about their resale value. Against that, one solid trigger in favour of lab-grown diamonds is their positioning as a fashion accessory.

Another growth avenue for lab-grown diamonds could be their application in areas like electronics or medical equipment industry.

COMMENTS