https://www.freepressjournal.in/analysis/when-the-inr-falls-it-is-easy-to-blame-gold-writes-rn-bhaskar

A weak INR and growing CAD are a result of poor gold policies

By RN Bhaskar

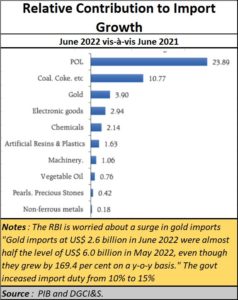

The RBI in its recent report (https://www.rbi.org.in/Scripts/BS_ViewBulletin.aspx?Id=21137#FN14) states “Gold imports at US$ 2.6 billion in June 2022 were almost half the level of US$ 6.0 billion in May 2022, even though they grew by 169.4 per cent on a y-o-y basis. As international gold prices remained stable in June, the  entire increase was on account of an increase in volume.” Its concern is about the CAD (current account deficit).

entire increase was on account of an increase in volume.” Its concern is about the CAD (current account deficit).

Even the government desperately tried to stanch gold imports by increasing import duty from an already high 10.75% to 15% (https://www.pib.gov.in/PressReleaseIframePage.aspx?PRID=1838455 — 01 JUL 2022). It noted that gold impots stood at 107 tonnes, which had put pressure on the nation’s CAD.

Clearly, the only solution the government appears to love is either a ban or an increased levy of import duty on gold. Both moves are unwise. But India’s policymakers are so myopic in their old set ways, that they have refused to look for other – healthier and more sustainable – solutions. And unless these are adopted quickly, India will continue to see more such CAD crises in the coming years.

First the facts

Gold is a metal that has enticed kings and laity across centuries in almost all nations. For instance, few people know that the region that bankrupted Rome and emptied its treasuries of its gold were Indian traders from the South of this territory known as India. Pliny has detailed this in his historical recordings. Kanishka then took the roman coins from the south, melted them, and stamped his face on them. These traders were what made India the “Sone ki chidiya”, the golden bird. In effect, do remember that India’s traders know how to manage gold accumulation better than the government can.

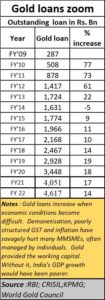

Today, India holds the largest gold collection in the world – estimated at around 25,000 tonnes – mostly held by countless small people. Gold for them is auspicious. It is a hedge against inflation. It is relatively indestructible and could be buried underground with little danger of pests destroying it. And, contrary to economists who claim it is a dead asset, gold provides a society an informal credit rating. When loans are taken against gold, the metal is just another commodity. Another asset that can be collaterised.

Today, India holds the largest gold collection in the world – estimated at around 25,000 tonnes – mostly held by countless small people. Gold for them is auspicious. It is a hedge against inflation. It is relatively indestructible and could be buried underground with little danger of pests destroying it. And, contrary to economists who claim it is a dead asset, gold provides a society an informal credit rating. When loans are taken against gold, the metal is just another commodity. Another asset that can be collaterised.

It is unfortunate, that this is seen only as a gold loan, with a special set of rules. Eventually, gold is an asset, and the sooner the government treats it merely as an asset, it will help bring out more gold from clandestine corners.

Indian policymakers have not been comfortable with people amassing gold. They have tried to control it – the gold control act – and slap it with import duties. But – irrespective of import duties — gold continues to roll into India. If it is not allowed officially, it will enter India unofficially. Why cannot gold be treated as just another commodity?

It is more a state of mind problem. Policymakers are fixated on gold being the source of many evils.

Unwise duty structure

This is where one needs to understand how gold can be encouraged without worrying too much about CAD or the current account deficit.

First, policymakers must realise that people want gold – for religious, social, and even investment purposes Just look at the numbers. Even statements made by the government before the Lok Sabha confirm this. India consumes anywhere between 700 and 900 tonnes each year – high import duties or otherwise.

First, policymakers must realise that people want gold – for religious, social, and even investment purposes Just look at the numbers. Even statements made by the government before the Lok Sabha confirm this. India consumes anywhere between 700 and 900 tonnes each year – high import duties or otherwise.

The trouble with high import duties is twofold. First, it encourages smuggling. Ask GJEPC. In its submissions to the government, it has constantly reiterated that any import duty above 4% only encourages smuggling. This is because at 5%, smuggling becomes economically viable. At these levels, smugglers can pay for the import of gold, the greasing of hands, and even defray the risk of some of the gold getting caught. That gold is actually smuggled into the country is evident from comparing data of gold dispatches and estimates of gold consumption within India.

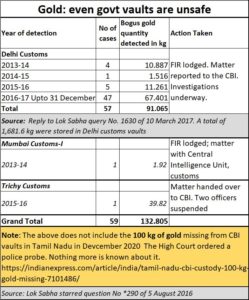

The fact is that the government is pathetically helpless and cannot control smuggling. Just remember that of the approximately 100 tonnes smuggled into India, seizures by various government departments account for only 2.8 tonnes over four years. That is 3 tonnes out of 400 tonnes – less than 1%. So clearly, something needs to be done about it.

But there is a second – much more serious – problem with smuggling. Once smuggling becomes economically viable, it allows for the creation of a channel. Look at this channel as a pipeline. There is a cost involved in setting up this pipeline, and a cost in maintaining it. This pipeline involves suppliers, landing agents, greasing of palms, distributors and finally the customer. Once the pipeline is paid for, it can be used for bringing in or taking out other items as well at marginal costs. This could be drugs, or even arms.

Lastly, do remember that much of smuggled gold is paid for with dollars purchased on the black market. That corrodes the value of the Indian Rupee (INR). If you encourage smuggling through high duties, you will weaken the INR.

Governments must ensure that such a pipeline is not built. The very economics of this pipeline need to be addressed. And the corrosion of the INR must be stanched.

Possible solutions

One way is to keep customs duties at very low levels. Let’s assume that the import duty is just 1%. Let it be imported through designated banks, so that the volumes imported can be tracked. Let banks sell them to bulk purchasers with a 1% markup and a 1% GST.  Then let the dealer sell it to jewellery makers with a markup of another 1%, leaving the customer to bear a markup of another 1%. Altogether the government gets 4% — 1% as customs, which it does not have to share with the states, and 3% as GST. What happens then is that state governments too get involved in cleaning up the gold trade. The banks earn some revenues as well.

Then let the dealer sell it to jewellery makers with a markup of another 1%, leaving the customer to bear a markup of another 1%. Altogether the government gets 4% — 1% as customs, which it does not have to share with the states, and 3% as GST. What happens then is that state governments too get involved in cleaning up the gold trade. The banks earn some revenues as well.

Suddenly, smuggling becomes unattractive. Small amounts will still get smuggled in – especially when dealing with exchange against narcotics. But that can be ignored temporarily. The focus should be on making the pipeline unviable.

If that is not done, trade will thrive underground. It will get into illegitimate trade circles. The underground market becomes bigger and stronger with each passing year.

To clean up the trade, the government needs to keep all gold under the purview of a central authority preferably the RBI or its nominee gold bank.

This is because even the government’s vaults are porous. The danger with porous vaults is that they do more harm to the integrity of national accounts, even national security (if a government vault can be broken into, what should be considered safe?).

Once again, the focus should be on streamlining processes, and not having multiple processes and controls. The smoother the process, the greater the confidence in the gold trade.

Once again, the focus should be on streamlining processes, and not having multiple processes and controls. The smoother the process, the greater the confidence in the gold trade.

Such moves would help bring more unaccounted for gold into the reserves basket of the RBI. That in turn would make India’s reserves a great deal healthier. Second, it would allow gold to be used for commercial purposes – for sale, as collateral, or as raw material for making jewellery.

Liberalise gold mining.

India has some unfair laws. If you find gold on your land, the government confiscate s the land itself, as well as the gold. Allow people to develop their own small gold mines.

Surveys have showed that India could produce – through small, not large mines – around 100 tonnes of gold a year (https://asiaconverge.com/2021/01/gold-mining-series/). But to do that you need to decentralise the mining of gold, with more benefits for the finders.

If that is done, there will be a reduced burden on India’s CAD, and the possibility of greater trade (both exports and domestic sales). It would lead to healthier business practices as well because the role of the inspector and licensing raj will decline.

Distorted policies result in distorted trade practices, which in turn prevents the trade from gaining the reputation and the export potential it should. If policies relating to gold are handled well, you could actually improve India’s security (a smuggling pipeline becomes weaker), enhance its commercial potential (gold is used as a raw material or collateral) and more transparent trade practices.

This is what every policy maker should aspire for.

COMMENTS