RBI has more caprice than respect for standards

Can anyone be the world’s best central bank governor if he cannot protect the sanctity of his own country’s currency?

By RN Bhaskar Last week, the Bombay High Court granted time to the Reserve Bank of India (RBI) to consider suggestions of an expert committee appointed by Delhi High Court for making currency notes and coins friendly for the visually challenged (https://www.freepressjournal.in/legal/mumbai-hc-asks-rbi-to-consider-report-to-make-currency-friendly-for-visually-impaired-people)

Last week, the Bombay High Court granted time to the Reserve Bank of India (RBI) to consider suggestions of an expert committee appointed by Delhi High Court for making currency notes and coins friendly for the visually challenged (https://www.freepressjournal.in/legal/mumbai-hc-asks-rbi-to-consider-report-to-make-currency-friendly-for-visually-impaired-people)

A division bench of Acting Chief Justice Nitin Jamdar and Justice Arif Doctor was hearing a public interest litigation (PIL) filed by the National Association of the Blind (NAB) in 2016. Clearly, the High Court needs to look at what has happened since then. In fact, it needs to study the patterns in caprice on the part of both the government of India and the RBI since 2013 (https://www.freepressjournal.in/analysis/coins-judicial-overreach-or-administrative-underreach-r-n-bhaskar).

Some standardisation please

The NAB had then stated that the RBI and the government were being whimsical in bringing out new coins and notes of varying sizes, colours and even weights. That made it extremely difficult for the visually impaired to identify and distinguish them.

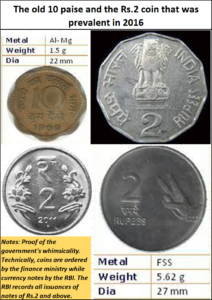

The truth is that most people, even those who are not visually impaired, complain that the RBI and the government have made it increasingly difficult for them to make out which currency note or coin is for what value. Just look at the way the shape of the 10 paise coin was suddenly imposed on the two-rupee coin, which too is now being phased out gradually.

The truth is that most people, even those who are not visually impaired, complain that the RBI and the government have made it increasingly difficult for them to make out which currency note or coin is for what value. Just look at the way the shape of the 10 paise coin was suddenly imposed on the two-rupee coin, which too is now being phased out gradually.

At present, the RBI’s contention that it is studying the possibility of introducing plastic notes. Even that is fraught with more whimsicality. The RBI needs to be reminded is that it must first learn to respect the conventions and rules governing the business of numismatics. These codes have been honoured by almost all central banks in the developed world. The rule is to maintain the shape, weight and look of the country’s currency for various denominations. That is what lends credibility to the currency system of any country.

It may be recalled that even recently, the Rs.2,000 note was ushered into the market with great speed. It was only later that someone realised that the new notes could not be dispensed by India’s ATMs. Eventually, the ATMs had to be redesigned. And now, even this note is being recalled. Charming situation!

Just look at the US dollar. Can you find one dollar note differing from another for the past hundred years or more? Ditto with the British Pound. The same is true with the Singaporean dollar. Then why does India have the itch to interfere with standards all the time? Today this disdain afflicts currency notes, roads, buildings, or even names of cities. Sobriety, predictability, and conformity with time-honoured principles that have been observed in the printing and issuing of currency notes, appear to have been forgotten altogether.

Money is trust – in shambles since 2013

Money is, after all, something that is based on trust. And truth means several things. One of the basic requirements for trust is to be sure that the currency has the same size, colour, and weight. If these parameters keep on changing, people get confused. They are not sure which currency is genuine and which is fake. That is one reason why counterfeiting Indian currency is easier than counterfeiting notes of other countries. In India, nobody is sure which is the latest currency issuance.

During the hearings before the Bombay High Court, senior advocate Venkatesh Dhond, appearing for the RBI, informed the bench that they have received a report of the expert committee and hence require some time to consider the suggestions. What the learned counsel may not have told the court is that this confusion and the abandonment of sobriety goes back to as early as 2013. And despite this the RBI wants even more time?

During the hearings before the Bombay High Court, senior advocate Venkatesh Dhond, appearing for the RBI, informed the bench that they have received a report of the expert committee and hence require some time to consider the suggestions. What the learned counsel may not have told the court is that this confusion and the abandonment of sobriety goes back to as early as 2013. And despite this the RBI wants even more time?

The learned counsel said that it would be difficult to implement the demand for the same size of currency notes. Nobody is asking for the same size for all notes. But shouldn’t all Rs.10 notes have the same size and colour? Ditto with Rs.50 and so on. . . Is the RBI suggesting that Indians are inferior or inept at maintaining standards?

In any case, the Bombay High Court has agreed to take up this issue on July 19 this year.

Tracing disdain to 2013

The malaise afflicting coins and notes in India can be traced back to 2013, when the then finance minister chose to issue a five-rupee coin with the image of one of the Hindu goddesses https://asiaconverge.com/2021/09/games-regulators-play-1-is-rbi-becoming-capricious/). There was a hue and cry but the voices were smothered by the imperiousness of the finance ministry. That imperiousness appears to have become even more common lately.

In 2016, this author had some discussions with senior RBI officials on the condition of anonymity. Some of these findings were reported in an article that can be found at https://asiaconverge.com/2016/09/coins-judicial-overreach-or-executive-underreach/. The anonymity condition imposed on the author was understandable. No RBI official likes to be seen opposing any view of the finance ministry. And the following were the things this author learnt from the RBI:

1. RBI is not in charge of coins. It does not issue coins. They are issued by government of India.

- It only looks after currency printing. “(In 2016) there are four printing presses – two – Nashik and Dewas – are owned by government of India and two – Salboni, West Bengal and Mysore – are owned by RBI,” said the official.

- Re.1 becomes a liability of government of India. Except for one-rupee notes, all other notes are liabilities of the RBI and find reflection on the RBI balance sheet. A one-rupee note, even though it is in the form of a note, is actually a coin and therefore a liability of the government of India.

- Rs. 10, even if it is a coin, is to be treated like a note and is a liability of the RBI. “We estimate the demand – arising out of growth of the economy, inflation expected, demand for replacements, demand for festivals, etc., and give indents to the government and government places the order with four of its mints,” said the official. Thus, all ten-rupee and five-rupee notes are accounted for in the RBI balance sheet.

- This also means that the size, shape, and design of the coins would largely vest with the government and not the RBI.

It would appear that the RBI may not have made these disclosures before the High Court. If so, it could be protecting the finance ministry. It is also surprising that one of the pages on the RBI website — https://www.rbi.org.in/currency/coins.html — which gave details about coin issuances is no longer there. That webpage also had the following nuggets:

It would appear that the RBI may not have made these disclosures before the High Court. If so, it could be protecting the finance ministry. It is also surprising that one of the pages on the RBI website — https://www.rbi.org.in/currency/coins.html — which gave details about coin issuances is no longer there. That webpage also had the following nuggets:

- The Government of India has the sole right to mint coins.

- The responsibility for coinage vests with the Government of India in terms of the Coinage Act, 1906 as amended from time to time. The designing and minting of coins in various denominations is also the responsibility of the Government of India. Coins are minted at the four India Government Mints at Mumbai, Alipore (Kolkata), Saifabad (Hyderabad), Cherlapally (Hyderabad) and NOIDA (UP).

- The coins are issued for circulation only through the Reserve Bank in terms of the RBI Act.

- Coins in India are presently being issued in denominations of 10 paise, 20 paise, 25 paise, 50 paise, one rupee, two rupees and five rupees. Coins up to 50 paise are called ‘small coins’ and coins of Rupee one and above are called ‘Rupee Coins’. Coins can be issued up to the denomination of Rs.1000 as per the Coinage Act, 1906.

- The various Mints in the country have been modernised and upgraded to enhance their production capacities.

- Government has in the recent past, imported coins to augment indigenous production.

- Notes in denomination of Rs.5 have been reintroduced to supplement the supply of coins.

It is possible that none of these facts have been presented before the court. The government, despite its talk about protecting the rights of the handicapped and the visually impaired, is guilty of issuing coins that confuse. You have Re.1 coins that look like 50 paise coins. You have 10 rupee and 20-rupee coins that look similar. In fact, people have begun looking at coins more than once before accepting them, or issuing them. If normal people function this way, just imagine the plight of the visually impaired?

Obviously, the courts need to haul the government up for the issue of coins, and the RBI for abdicating its responsibility when it comes to issuing rupee notes. It has been guilty in issuing currency notes that adhere neither to size nor even colour. The sampling given in the pictures displayed on this page is just a fraction of the excesses on the part of the RBI.

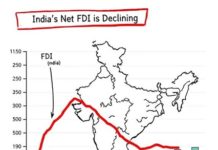

That is why, even as the Bank of England celebrates Shaktikanta Das as the Governor of the Year 2023 (https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1907827), a question that will not be answered is: What if the Governor has not even been able to protect the sanctity of his own country’s currency? But then, it must be remembered that the government and its finance ministry are also to be blamed. Together, they have thrown to the winds all respect for norms and rules that have governed the issue of currency.

COMMENTS