China’s problems are becoming viral news. Is the situation that bad?

RN Bhaskar

The Western world and its allies are in a state of funk. They oscillate between aggression and fear – a kind of collective paranoia seldom seen before. They see China as the big ogre in the room that they thought was theirs. And they would love to predict the doom of this ‘ogre’.

India is viewed as a potential threat (a China in the making), a bulwark against China, and is wooed assiduously to remain an ally to the ‘civilised’ West. Together, India included, are hoping that China does not grow stronger. They view the crises China is facing as both an opportunity to reassert themselves, and as a source of contagion which could submerge the global economy.

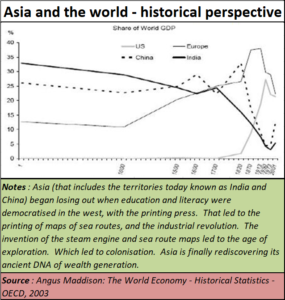

All such views could be partly right, and mostly wrong. This is because China (and, blunderingly) India are both rediscovering their ancient calling. Of being the true wealth generators in the world.

To understand this, a bit of history is important.

The whole of Asia – more particularly India and China – was the true wealth generator. As the Angus Maddison chart shows, this region once accounted for almost 60% of global GDP. It became rich, not through aggression, but through manufacture and trade. Unlike these territories (they were not countries then), much the western world made its money through plunder (piracy on the seas – remember the Vikings?), extortion (through colonisation) and exploitation (the reverse colonisation practiced by the USA, by importing slaves and making them work on the cotton fields that created the first bit of wealth).

Colonisation broke the backs of many Asian and African nations. The colonisers first took away their lands, their money, and then even their dignity. Fortunately, the 20th century saw many of these nations becoming independent. Each nation began to chart out its own path to wealth generation – China more surely than India.

In some ways, China had learnt from its big historical blunder. It was perhaps the first to invent the printing press. But China’s rulers saw education as a threat, and locked it up. The advantage then moved to the West with John Gutenberg.

Even the Indians did not like the concept of democratising education. Like elsewhere, education was mean for priests, or nobility. The only difference in India was that only priests’ sons could become priests. The opportunities for education were even further restricted than elsewhere in the world.

The people who democratised education were the Buddhists, who built the first universities of Takshashila and Nalanda – mostly meant for would-be monks and priests. That would also explain why, when these universities were ransacked and turned to rubble, Indians did nothing to resurrect them. They built temples, yes. But they did not promote education. Unfortunately, India hasn’t learnt from the past. It still ignores basic education (free subscription — https://bhaskarr.substack.com/p/the-state-of-education-in-india).

On the other hand, Europe promotes education more aggressively than do either the UK or the US. The latter have made it a commercial activity, largely affordable for the affluent, or the privileged. China, on the other, has embraced education at reasonable costs, and has maintained excellent standards. It is not surprising then that China has marched ahead faster than most other nations have been able to. The common respect for education is bound to bring Europe and China closer in the coming decades.

Today, the world has countries with qualities, demographics and wealth generation capabilities that need to be considered. Call this the DNA of nations.

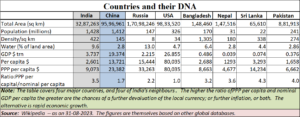

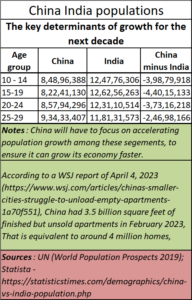

Watch the numbers above:

- China and the US are almost equal in land mass. Russia is double the size of either China or the US. India is one third the size of both the US and China. In the world of geopolitics, size matters, and land mass is crucially important. That could explain the fretful attempts on the part of the US to break up Russia. In the near future, the geopolitical weight appears to be behind Russia, USA, and China. India is there, but far behind, in many ways.

- Watch water. India is the most blessed among the selected nations. Over 9% of its area is under water (which can be misleading because it does not measure depth. But it remains a good indicator). Yet, India has abused, misused, and frittered away this advantage (https://asiaconverge.com/2019/05/india-faces-a-water-crisis-of-its-opwn-making/).

- China has the least water among the biggest nations. Hence it has done two things. First, it has become one of the most efficient water managers in the world (https://asiaconverge.com/2019/05/india-should-learn-water-management-from-china/). Even with less agricultural land, and with smaller fragmented holdings, it produces more agricultural output than India. But China needs more water. As this author predicted in 2009 (https://www.livemint.com/Companies/wDLWbd3OWUGppEzYYC0yYO/The-Capitalist–With-increasing-water-needs-will-China-deh.html) China finally worked out a deal with Russia to use its waters (Russia is the largest freshwater reserve of the world). Expect Russia to become a natural ally of China because it will remain the biggest supplier of water and energy. The stupid provocation of the Ukraine war by the US has only accelerated this process.

- Then take a look at population density. Russia is the worst casualty. It has very few people, even though it has lots of land and water. Thus, despite having the largest reserves of gold, rare earths, and other minerals, it hasn’t been able to exploit them because it has little surplus capital, and fewer people. In 2009, this author had urged the government of India to set up labour camps in Russia in a government-to-government deal which could help Russia exploit minerals in much the same way as India helps it extract oil and gas through OVL (a subsidiary of the government-owned ONGC). Now, if China is savvy, it will enter into such deals, because China has both the capital and the human resources. Either way, expect inter-dependencies among India, Russia, and China to increase, once again spurred on by the provocation of war between Ukraine and Russia (https://asiaconverge.com/2022/06/russia-india-china-should-work-together/). It is crucial for China to work closely with India.

- Finally, look at the financial numbers. China has a significantly lower per capita GDP (nominal) than the US, and even Russia. But the rate at which China is growing, it won’t be long before even this benchmark is crossed. China’s refusal to spend much on waging wars or developing a military machine has ensured that its energies remain focused on the growth of its economic and human resources. That is where the US could lose out. Without its weapons sales, the US could shrivel to half its size. In fact, the urging of Europe to spend more on arms will actually weaken Europe, not make it stronger.

- But watch India. Its per capita income is lower than that of Sri Lanka, even though its large population allows it to have more heft through its GDP numbers (Free subscription — https://open.substack.com/pub/bhaskarr/p/india-trade-slips-deeper-into-the?utm_campaign=post&utm_medium=web).

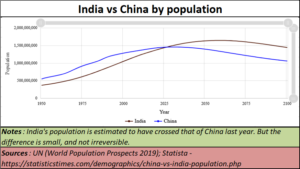

First, there is no denying that China is facing a slump in the growth of its population. Second, it is obvious that it is burdened by debt.

As an April 2023 report in the New York Times (https://www.nytimes.com/2023/07/08/business/china-debt-explained.html) points out, “China, which has lent nearly $1 trillion to some 150 developing countries, has been reluctant to cancel large debts owed by countries struggling to make ends meet. That is at least in part because China is facing a debt bomb at home: trillions of dollars owed by local governments, their mostly off-the-books financial affiliates, and real estate developers.”

That, according to the NYT, has made China averse to help the US and the Western world crawl of its indebtedness. “One of the main issues for Treasury Secretary Janet L. Yellen during her visit to Beijing this week is whether she can persuade China to cooperate more to address an evolving debt crisis facing lower-income countries. But China’s state-controlled banking system is wary of accepting losses on foreign loans when it faces far greater losses on loans within China.”

The report also points to a JP Morgan Chase which “calculated last month that overall debt within China — including households, companies, and the government — had reached 282 percent of the country’s annual economic output. That compares with an average of 256 percent in developed economies around the world and 257 percent in the United States.”

That is why it is possible that China will adopt a strategy of shoring up its wealth generation in partnership with Russia. It would also like to see better relations with India so that trade makes both countries richer. People who are suspicious about the growing trade deficit with China also need to bear in mind that many of the items India imports from China, actually enable this country to export pharmaceuticals and electronics items. Had these imports not taken place, exports would have shrivelled up as well. Both countries need to sit together and find out ways to ensure mutual prosperity.

Real Estate Woes

Most media attention is focussed on the real estate debt of China. Says the Economist (https://www.economist.com/finance-and-economics/2023/08/24/chinas-economy-is-in-desperateneed-of-rescue), “The market got ahead of itself in 2020 and 2021, buoyed by people looking for a place to park their wealth, rather than a place to live. Although the non-speculative, fundamental demand for new construction will remain on a gently declining path from its historical peak, demand is now so low it has probably fallen below this fundamental pace. Sales are running at about 54% of their 2019 level. A sustainable pace would be closer to 75%, reckons Ms Yao of Gavekal Dragonomics.”

So, will China’s real estate problems sing its ambitions? Not really. In fact, China is perfectly, capable of showing The Economist (https://www.economist.com/leaders/2023/08/24/why-chinas-economy-wont-befixed) how wrong it can be in saying that its economy won’t be fixed.

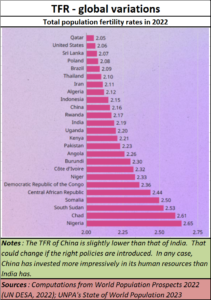

For instance, all it must do is to buy up all the unsold inventory of homes with post dated cheques to the developers. It can then offer a house to any family that has more than two children. At what price it offers such houses depends on government policy. It can offer rebates from 25% to as much as 75% depending on the region and the class of people it wants to promote. The family can pay back to the government its share of the purchase price in say 10 years’ time.

Suddenly, the unsold inventory becomes the government’s assets, and a growing population do two things.

First it creates additional purchasing power. Second, it protects the country’s demographics. And yes, it also solves the problem of real estate debt. In doing so, it would only be introducing a variant of Iran’s meherbani which helped that country stave off riots and unemployment for almost a decade (https://asiaconverge.com/2015/11/housing-lessons-from-iran/).

In fact, both China and India have very young populations. The big difference between the two is that China has focussed on literacy and has practically no illiterates. Hence its population can be a lot more productive than that of India.

The second difference is that China boasts of better healthcare.

Those two factors could easily allow China to reverse demographic trends. And this is where India needs to focus on healthcare and education on a war footing. Its recent attempts to ban impot of computers in favour of manufacturing them in India will only result in two things.

Those two factors could easily allow China to reverse demographic trends. And this is where India needs to focus on healthcare and education on a war footing. Its recent attempts to ban impot of computers in favour of manufacturing them in India will only result in two things.

First, it will re-usher in the licence and control economy raj, which inevitably leads to lower economic growth rates.

Second, it will make computers that much more expensive, thus making access to education even more difficult than before.

India cannot be complacent about being in a sweet spot, of attracting foreign direct investments (which in reality is slipping), or becoming a manufacturing hub to replce China (Free subscription — https://bhaskarr.substack.com/p/fdi-figures-tell-many-tales?sd=pf). India cannot do this without education, stable ecobnomic policies, speedy adjudication and good healthcare.

Hence, it would be wiser to keep one’s fingers crossed, instead of trying to write China off.

The consequences for India could be very dire if it does not heed such warning. This will be the focus in another article.

COMMENTS