NMDC’s lust for foreign gold is mysterious indeed

NMDC rushes to seek gold overseas, when goldfields and mine development are pending in India.

RN Bhaskar

On 5 November, NMDC made an unusual announcement – captured by Reuters (https://www.reuters.com/markets/commodities/indias-nmdc-subsidiary-legacy-iron-ore-mine-gold-australia-2023-11-05/). It said that it was going into gold mining through a subsidiary in Australia.

The Reuters report said the following: “- Indian state-owned iron ore miner NMDC Ltd.’s (NMDC.NS) subsidiary Legacy Iron Ore Ltd is set to mine gold in western Australia, India’s government said in a statement on Sunday.

NMDC will commence its mining operation at the Mount Celia gold project located in western Australia, the government said, adding it will be first gold mine in its extensive portfolio.

“The first ore for processing at Paddington gold mine is scheduled for CYQ1, 2024, and it is poised to become a significant contributor to India’s gold production landscape,” the statement added.

Reuters reported in May, citing sources, that NMDC was in talks with Australia’s Hancock Prospecting Pty Ltd for lithium exploration and mining.”

NMDC’s own press release on 6 November was equally circumspect (https://www.nmdc.co.in/cms-admin/Upload/Press_Realese_Documents/a5fd7d18537e459b8b9d21eb16170425_20231107094006959.pdf). It said, “NMDC commenced gold mining operations at Mt Celia in Western Australia through its subsidiary company Legacy Iron Ore Limited on Sunday.

Shri Nagendra Nath Sinha (Secretary) Ministry of Steel, Government of India inaugurated the Gold Project of Legacy in the presence of Shri Amitava Mukherjee, CMD (Addl. Charge), NMDC and Shri Rakesh Gupta, CEO, Legacy.

Legacy’s Mount Celia Gold Project will start ore mining at Blue Peter pits in the next two to three months. It is a watershed achievement for the 66-year-old mining company, NMDC, as it adds a new geography and a new mineral to its Portfolio, reiterating its commitment to build self-reliance in India’s mining sector.”

Little additional information was available from NMDC’s Facebook page. But it had a photograph, which is reproduced here.

Perplexing decision

The NMDC announcement is perplexing for several reasons.

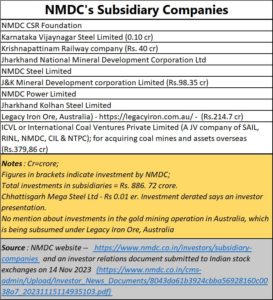

- The Australian gold mining company is being held by Legacy Iron Ore, Australia (https://legacyiron.com.au/), an NMDC subsidiary in which it has invested Rs.214.7 crore, according to its presentation to investors which was filed with the Indian stock exchanges (under No.18(5)/2023-Sectt) on 14 November 2023 (https://www.nmdc.co.in/cms-admin/Upload/Investor_News_Documents/8043da61b3924cbba56928160c0038a7_20231115114935103.pdf). Its very name suggests that it is an iron ore company. While it is true that its website mentions that the company is located in an area where other precious minerals are found, there is no reason for India to invest in gold mining overseas. Had it invested in lithium or rare earths, that would have been understandable. India needs them. But gold? Something is definitely unusual.

- NMDC is already the sixth largest producer of iron ore in the world, according to its website. Why should it produce more overseas? Shouldn’t that be left to private miners?

- According to the NMDC citizens’ charter (https://www.nmdc.co.in/cms-admin/Upload/Citizen_Charter_Documents/6078261769dd4c20adc86172ea0fa561_20210922095810096.pdf) “Established on 15th November 1958 as a Public Sector Undertaking to explore, develop and exploit mineral resources other than fuel oil and atomic minerals, NMDC is engaged in mining of Iron ore, Magnesite and Diamonds.” If it wishes to get into gold, shouldn’t that come in as part of the Citizen’s charter. It has already diversified into coal mines overseas. But there is no mention of this either in the citizena’ charter.

- NMDC already has a lot of unfinished work in India where gold and iron ore mining are concerned. Consider the following:

- It has failed to operate gold mines in India. Instead, it has chosen to close mines even though they have proven reserved. One of them is the mine at Donimalai (see Rajya Sabha Unstarred Question No 433 which can be downloaded from https://steel.gov.in/sites/default/files/ru433.pdf). Donimalai is a large Iron ore mine being operated by NMDC. It is not a gold mine.

- It has not cleared mining proposals along with the ministry of mines at Chigargunta, Bissanattam in Andhra Pradesh, southern extension of Kolar fields and

- It has ignored Ganajur gold mines, where despite proven reserves, Technically Ganajur Gold Mine belongs to Deccan Gold Mines Ltd. But NMDC could have urged the government to get this reopened.

5. NMDC prefers to mine iron ore overseas, even while it has given away one of its iron ore mines in Dantewada, Chhattisgarh, on lease to a private party (See Rajya Sabha unstarred question no.1118 (https://steel.gov.in/sites/default/files/ru1118.pdf).

6.NMDC could have taken up processing of the 35 million tonnes of tailing dumps spread over the 8km length of the old Kolar Gold Fields, points out Dr. V.N. Vasudev, earth scientist, advising gold projects in India.

7. Refusal to reply to some of the questions posed above to NMDC and the Steel Ministry both via email and through Twitter (Now X) – the questions can be viewed in the threat that can be found at https://twitter.com/rnbhaskar1/status/1729015624863805793). As a public sector company, which is also a listed entity, it is obligatory on its part to provide answers to the above.

There is no denying that NMDC is profitable. But it makes much of its money through the mining and sale of iron ore.

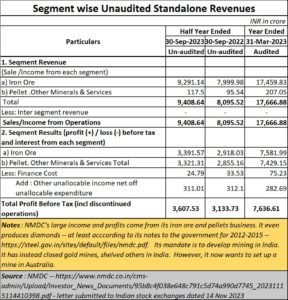

As its website states, a fact mentioned above as well, it is the world’s sixth largest producer of iron ore. This is confirmed from its segment wise details of its operations as provided in its latest submission to the Indian stock exchanges (https://www.nmdc.co.in/cms-admin/Upload/Investor_News_Documents/95b8c4f038e648c791c5d74a990d7745_20231115114410398.pdf).

NMDC also has many subsidiaries – though all of them do not appear on the Investor presentation page referred to above. This is equally intriguing.

NMDC also has many subsidiaries – though all of them do not appear on the Investor presentation page referred to above. This is equally intriguing.

Focus on mining issues in India

Focus on mining issues in India

NMDC and the ministry of Mining fail to admit that India has a huge potential when it comes to gold mining (https://asiaconverge.com/2021/01/gold-mining-series/). One of the biggest proponents of this potential is Dr. Vasudev. He has been lobbying with every government officer to allow private mining to take off, to allow small mines to come up in India and to avoid the mistake of reserving all mining sites with big players.

As he and other mining specialists – many from Australia – point out, the geological terrain of India and Australia is the same. As one geologist put it “In Australia we produce around 300 tonnes (9.7 million troy ounces) compared to barely 2 tonnes in India. We think India could produce a lot more. In fact,” he adds, “look at China. Even China has a similar geological terrain. In 1994, India produced around 2 tonnes, and China produced around 3 tonnes. Today, China produces 450 tonnes.” India is one-third the size of China. So statistically, it could produce 150 tonnes a year, at least. Clearly the potential for India is huge.” Ironically, even while Australian miners are prospecting in India where the pickings seem big, NMDC has instead chosen to go to Australia.

In fact, every policymaker in India should read Dr. Vasudev’s article in ICC Communique of July 2023. The article is titled “Backward integration of gold refining: An opportunity for India’s quest to become a $5 trillion economy”.

There are other facts that government officials do not pay heed to

- That India’s gold production is pathetic (https://asiaconverge.com/2020/12/indias-blighted-vision-about-gold-mining/). These columns have been telling the government since January 2021 that it needs to focus on gold mining in India, not overseas. Yet NMDC does quite the opposite.

- The government knows the locations where gold can be found. In fact, there is a map in public domain which is quite enlightening (see map). Also, a list of locations from where gold can be extracted (2020-12-17_Gold-mining-locations). But even this map, explain geologists, is outdated. It was created in 2006. Newer technologies coupled with satellite and drone imaging suggest that there could be many more sites than indicated on the old map. Further, the quantities that can be extracted from each tonne of ore could be much huger than had been earlier estimated.

- Much of the gold tailings, referred to above, were formed over the past 100 years. Technology then was not as good as those existing today. The dumps can be beneficiated. Says Dr. Vasudev, “There are 8 dumps of a total of 14 dumps. Spread over 8 km. of Kolar gold fields. They account for 35 million tonne. Kolar Tailing dumps contain 0.7grams per ton gold on the average, of which 0.55 gram is extractable. The profits are huge. What is strange is that NMDC and the government have ignored this for decades even though there are provisions to allocate this work and the dumps to any PSU.

NMDC is doing exactly what Atma Nirbhar Bharat (self reliant India) was not supposed to do.

NMDC and the government must come out with a clear answer on why it has failed to develop gold mines in India. The present moves send money to foreign lands, when investments are sorely needed in India. Such moves create jobs overseas, when the country needs jobs here. And instead of leaving non-essential minerals like gold to the private sector, NMDC should focus on minerals that this country needs.

The ways of NMDC are mysterious indeed.

COMMENTS