China could rebound faster than many imagine

RN Bhaskar

Not a week passes without Western media trying to put out one story or the other about what is wrong with China. But such sneers are not a new development.

They were evident in 2009 when there was a flurry of reports in the media about the imminent breakup of China (https://indianexpress.com/article/news-archive/web/china-in-parts/). This was reiterated a few years later with this attached image (the story appeared at http://www.newindianexpress.com/thesundaystandard/2017/aug/13/china-faces-split-into-seven-parts-1642330–1.html) but is no longer available at this address, But the image does bring on a smile or two.

Then the world has come across other myths as well, which could have stumped many a smaller country. For instance, there was the much touted story about China concealing the number of deaths when the Coronavirus spooked the entire world (https://edition.cnn.com/2020/02/18/politics/tom-cotton-coronavirus/index.html). There were even more bizzare rumours flying thick, some by Kyle Bass, Chairman of the Board of The Rule of Law Foundation (https://asiaconverge.com/2020/04/us-sues-china-little-truth-less-understanding/). China shrugged them off – impervious, and even seemingly unconcerned.

Then the world has come across other myths as well, which could have stumped many a smaller country. For instance, there was the much touted story about China concealing the number of deaths when the Coronavirus spooked the entire world (https://edition.cnn.com/2020/02/18/politics/tom-cotton-coronavirus/index.html). There were even more bizzare rumours flying thick, some by Kyle Bass, Chairman of the Board of The Rule of Law Foundation (https://asiaconverge.com/2020/04/us-sues-china-little-truth-less-understanding/). China shrugged them off – impervious, and even seemingly unconcerned.

Lately, there are other myths doing the rounds –– that the Chinese economy will collapse. (https://time.com/6835935/china-debt-housing-bubble/). Another report (https://www.cfr.org/in-brief/does-evergrandes-collapse-threaten-chinas-economy) offers similar dire warnings. (https://www.ft.com/content/35471cfb-79a6-42c1-8e41-447bfaad2c36).

The last myth is on account of two factors.

First, the falling birth rates in China threaten to create a demographic nightmare for that country. But there is a new development that has taken the world by storm. The Strait Times reported in March 2024 (https://www.straitstimes.com/asia/china-battling-low-birth-rates-and-high-costs-encourages-frugal-weddings), that weddings in China in 2023 climbed by 12.4% over 2022, reversing close to a decade of declines. Clearly, the incentives that the Chinese government offers young couples, and the social media urgings, have begun to reverse this trend. Privately, informed sources say that by the end of this year, the increase in weddings could be much larger. Some speculate that it could be around 30%.

The second factor that bedevils China is the real estate crisis.

But as analysts have pointed out, that the biggest losers could be US funds which had invested in China’s real estate sector. Thus, the real estate crisis hurts western countries more than it does Chinese banks (https://www.mauldineconomics.com/global-macro-update/are-chinese-stocks-un-investable). As Ed D’Agostino of Mauldin Economics pointed out in February 2024 “[many US investors] might be invested in China and not even know it. Many popular emerging markets ETFs are heavily weighted towards China:

- iShares Core MSCI Emerging Markets ETF (IEMG) – 21.87%

- iShares MSCI Emerging Markets ETF (EEM) – 24.54%

- Vanguard FTSE Emerging Markets ETF (VWO) – 28.30%

- SPDR Portfolio Emerging Markets ETF (SPEM) – 25.32%

- Schwab Emerging Markets Equity ETF (SCHE) – 29.28%

Ex-China ETFs like the iShares MSCI Emerging Markets ex China ETF (EMXC) are popping up as more investors become aware of this.”

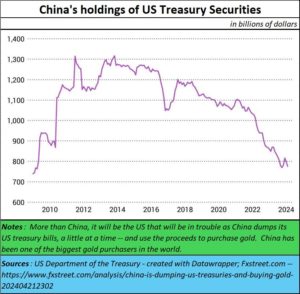

What irks the US even more is that China has been gradually dumping US treasuries (https://www.fxstreet.com/analysis/china-is-dumping-us-treasuries-and-buying-gold-202404212302). This money is being used to purchase gold. That in turn has made the US jittery, and has firmed up the price of gold. With the petrodollar also becoming near extinct – many countries are gradually beginning to move away from US dollar-based purchases to other currencies – there are some who believe that a gold backed regime may not be far away.

Debunking myths

The fact is that China is more unified today than ever before. What is even more startling for much of the world is that China has become a leader in most technologies (https://www.theguardian.com/world/2023/mar/02/china-leading-us-in-technology-race-in-all-but-a-few-fields-thinktank-finds). An Australian thinktank — Australian Strategic Policy Institute found – in March 2023 – revealed that China led well ahead of the US in 37 of 44 areas tracked. Some of the sectors are electric batteries, hypersonics and advanced radio-frequency communications such as 5G and 6G.

In any case, China has already wow-ed the world with the tremendous advances it has made in providing literacy to its people, giving the country a near 100% literacy rate. To do so – with a population of over 1.4 billion in just a couple of decades is truly an astounding achievement (https://asiaconverge.com/2016/04/lessons-education-china-india/). Equally mind-blowing is the way it pulled up almost its entire population out of poverty. In fact, when Covid struck, while India saw the numbers of its middle class being decimated, China’s numbers rose (https://asiaconverge.com/2021/05/povert-alleviation-a-great-service-to-mankind/).

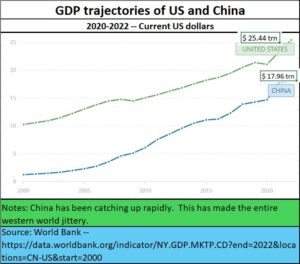

China’s GDP growth has been relentless. Except for a brief hiccup post Covid, its GDP growth rates have been catching up.

Today, China is home to 369 Unicorns, with an average value of $3.8 billion, led by AI and semiconductor firms (https://www.scmp.com/tech/tech-trends/article/3260831/china-now-home-369-unicorns-average-value-us38-billion-led-ai-and-semiconductor-firms-report-says). Across 16 sectors, AI unicorns are the highest valued, at an average of US$6.76 billion, followed by financial technology firms at US$6.57 billion · Beijing minted the greatest number of unicorns at 114, followed by 63 in Shanghai and 32 in southern technology hub Shenzhen.

It is important to note that one of the reasons why the US is keen on banning TikTok is because it does not want any non-US social media platform to become a challenger to either Google or Facebook. As Yanis Varoufakis, Academic Economist, Parliamentarian, Political Leader and Greece’s former Finance Minister, explained to the National Press Club of Australia in March 2024, the US is keen on reinforcing its position as a hegemon through such social platforms (https://www.youtube.com/watch?app=desktop&v=S3_I18eEABU).

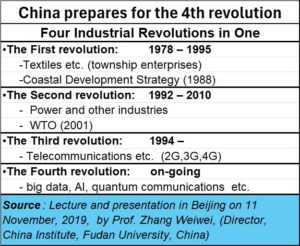

Finally, the oft propounded theory of “China plus one” appears to be getting submerged, as the country sees its share of global exports rise by 1.7% during the last five years (https://www.fortuneindia.com/macro/china-plus-one-narrative-sinks-as-chinese-share-of-global-exports-rises/116378). Moreover, China is gearing itself for what it calls the fourth revolution.

Finally, the oft propounded theory of “China plus one” appears to be getting submerged, as the country sees its share of global exports rise by 1.7% during the last five years (https://www.fortuneindia.com/macro/china-plus-one-narrative-sinks-as-chinese-share-of-global-exports-rises/116378). Moreover, China is gearing itself for what it calls the fourth revolution.

China’s rebound could be more impactful

Market analysts should not underestimate China’s resourcefulness. For instance, aware that it had very little water, China had already drawn up plans to get water from the 6,000 km long Lake Baikal in Russia to feed its water starved north-central regions. By 2017, plans were being drawn up to build a 1,000 km pipeline (https://www.theguardian.com/world/2017/mar/07/parched-chinese-city-plans-to-pump-water-from-russian-lake-via-1000km-pipeline). Planners said that this would quench the “desperate thirst” of a province that sees barely 380mm of rain each year. But those plans may have been shelved.

Instead, China has embarked on transferring water from the south to the north (https://www.water-technology.net/projects/south_north/). “Once completed in 2050, the project will bring 4 billion cubic metres of water from three tributaries of the Yangtze – the Tongtian, Yalong and Dadu rivers – nearly 500km across the Bayankala Mountains and then on to northwest China.” Expect industrial centres to get developed in the North which may become factories to cater to the domestic market, while those in the east would continue to be focussed on exports.

Dealing with real estate

China has also begun working overtime to deal with the real estate sector. Its planners are aware that real estate defaults do not really pose a systemic risk, the way they do in the US. This is because China is not like the US. The latter permits individuals to purchase a house with just 5-10% as down payment, with the rest of the funds coming from banks. So, when a crisis takes place, the entire burden is shouldered by banks. In China, as in India, the minimum down-payment is 30%. That in turn makes the buyer less willing to try flip the property for any short-term gains. As in India, purchasing a house is the biggest investment decision most people make in China.

That could explain why the government is urging developers to prioritise building houses where people have made the down-payment. Once the houses come up, people will move in there and create small eco-systems which in turn could spur local enterprise and business opportunities.

China could do one more thing. It could offer properties to couples at a partial interest waiver on housing loans if they get their first child, and further incentives if they get their second, and then a third. That in turn will push baby-boomers to pick up the slack in real estate and create smaller ecosystems around these residences along with their offspring.

That would do several things. First, it would swiftly permit the banks to convert idle real estate assets into viable loans. Second, it could create a new baby boom to cope with the demographic crisis the country faces. Third, every parent and child are potential taxpayers, thus creating the cushion a country needs.

There is yet another thing that China could do. It could firm up more relationships with Russia in ways that would benefit both countries and even the world.

Even as the Baikal water project was being discussed, China discovered a huge advantage in having long-term oil and gas contracts with Russia. It knew that the US had begun trying to ring-fence it by building naval bases around the Eastern coast, thus endangering overdependence on oil and gas from the Middle East using sea lanes.

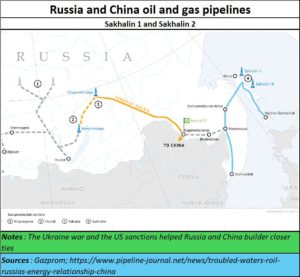

Having a pipeline for this energy from Russia – Sakhalin 1 — would derisk it from the US naval fleet.

It also began working on the CPEC (China Pakistan Economic Corridor) which would give it access to the Arabian Sea, and provide it another channel for oil and gas imports directly from the Middle East without sailing through the South China Sea.

The Ukraine war gave it another opportunity. Russia was facing US imposed sanctions. Building a second pipeline – Sakhalin 2 – would help derisk it further (https://asiaconverge.com/2022/10/geopolitics-bring-russia-india-china-closer/).

The US sanctions thus brought Russia and China closer, and both realised that they had huge common interests. Railway lines connecting China and Russia are being built.

If China wants, it should begin talks with Russia to allow both countries to get into production sharing agreements for the extraction of gold and other precious minerals like rare earths. Russia has the world’s largest underground reserves of almost every mineral – especially gold and rare earths.

Russia has hitherto resisted the idea of Chinese on its territory for fears of the latter becoming squatters. But working on labour and site contracts the way Saudi Arabia does for migrant workers, China could assuage Russian fears.

Russia has the largest land mass in the world — almost 2.5 times the size of China. But it has a fraction of its population (Russia has a per capita density of 8.4 people per square km vs China’s 145). Russia needs capital and people to harness its geological wealth. China has both. Eventually, both countries will benefit.

The coming years could see China accelerate such production contracts with a host of other countries. That would allow it to insure itself against any risk of trade embargo or sanctions imposed by the US.

In fact, the US sanctions have only helped the China-Russia-Iran-North Korea combine come closer to forget stronger business relationships.

These are developments the West does not like. But they were the result of the imperiousness that these countries exhibited in the first place. And that could explain the frenetic disinformation campaign against all these four countries.

================

Also, do watch my latest podcast on How the Indian government has crippled its agricultural sector — https://www.youtube.com/watch?v=jxyvaLqMK08&t=7s

COMMENTS