https://www.freepressjournal.in/analysis/policy-watch-regulators-3-corruption-is-often-on-account-of-regulatory-processes

Regulatory Games 3: Corruption and regulatory processes

A great deal of intelligence can be invested in ignorance when the need for illusion is deep. — Saul Bellow

RN Bhaskar

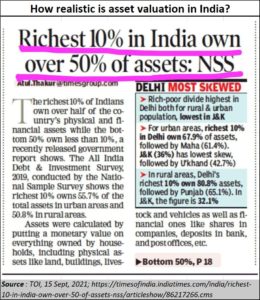

In the first week of September, a news item in a leading newspaper did not raise many eyebrows. Most people knew that asset ownership was terribly unequal in India. But serious readers were a bit surprised. It immediately reminded them about regulatory processes in India. But more on that later.

People had often heard that 90% of the wealth in India was owned by the top 10%. But here was a news item based on a survey by the NSS (National Sample Survey) which stated that only 50% of the assets were owned by the top 10%. Something was clearly amiss.

People had often heard that 90% of the wealth in India was owned by the top 10%. But here was a news item based on a survey by the NSS (National Sample Survey) which stated that only 50% of the assets were owned by the top 10%. Something was clearly amiss.

Then the penny drops, and the connection gets made. The NSS may be right. And so is the old belief that 90% of the wealth is owned by the top 10% of the population. But how do you reconcile both beliefs? The answer lies in the way anyone chooses to compute the value of assets.

The present survey helps show that inequality in India was not that terrible after all. Having 50% of the assets cornered by 10% is not as bad as having 90% of the assets owned by 10%.

Yet, NSS is not wrong. It probably went by apparent valuations.

Land value illusions

Take for instance the value of agricultural land. So long as it remains classified as agricultural land, the value is almost one-tenth (or even less, depending on its proximity to a bustling business centre) of non-agricultural (NA) land. The person who allows this conversion of land from agricultural to NA is the local land officer or the person in charge of the district, the collector. If they give their go-ahead, the valuation surges.

So, savvy real estate developers purchase agricultural land, don’t bother to change its status into NA right away. The conversion in status to NA is done only when the need arises. This way, they save on property taxes (NA lands attract higher property taxes).

So, the developer borrows Rs.100 (a notional figure), purchases agricultural land at Rs.30. He knows quite well that its value will be at least Rs.100 when he converts it. In fact, it could soar to Rs.200 or Rs.300 as well, depending on the buoyancy of the markets.

Now assume that the enforcement directorate (ED) of the government seizes this land and then puts it on auction, it may be able to fetch a valuation of just Rs.10 – not even Rs.30 the sales price. The regulatory clearance makes all the difference.

Usually, collectors (who are normally IAS officers) convert large parcels of land at the nod of the urban development minister of that state. If palms must be greased, that is shown as a cost of doing business. Usually, it is a fake receipt for balancing the developer’s books. All the players – the local land officer, the collector and the minister have huge discretionary powers, and the higher authority always has the right to countermand any orders given by the lower authority.

Usually, collectors (who are normally IAS officers) convert large parcels of land at the nod of the urban development minister of that state. If palms must be greased, that is shown as a cost of doing business. Usually, it is a fake receipt for balancing the developer’s books. All the players – the local land officer, the collector and the minister have huge discretionary powers, and the higher authority always has the right to countermand any orders given by the lower authority.

As the old saying goes, the greater the discretion, the greater is the potential for corruption.

DHFL and the Piramals

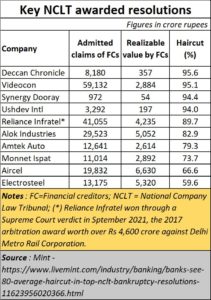

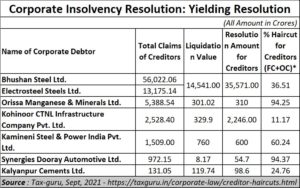

Now take a real-life example. Take the case of Dewan Housing Finance Limited (DHFL). The NCLT (National Company Law Tribunal) cleared the proposal put forth by the Piramal Group which offered to pay upfront in cash Rs 12,700 crore and a total of Rs 37,250 crore subsequently for assets estimated to be valued at over Rs.80,000 crore. This was challenged in the Supreme Court by Kapil Wadhawan, the erstwhile promoter of DHFL (https://www.business-standard.com/article/companies/kapil-wadhawan-moves-sc-over-nclat-stay-against-his-rs-91-000-cr-dhfl-offer-121060100852_1.html).

He instead offered to pay the entire outstanding principal of Rs 91,158 crore to creditors. In his letters, Wadhawan had said around Rs 9,062 crore was lying with DHFL, according to the company’s balance sheet. He said this will be utilised for upfront repayment of outstanding debts of small investors and the major breakup would be to non-convertible debentures (NCDs) held by the public.

The Supreme Courts (rightly) turned down this offer. DHFL had been dragged to the NCLT. because it had failed to pay its creditors. And regulations do not permit defaulting promoters to get back their assets at discounted prices.

Investigation agencies claim fake bills were also found at DHFL. But that could be explained. Much of the money involved in real estate development is acquired legally. Many of the bribes to be paid out to secure regulatory clearances are paid illegally and must be covered up with fake bills.

What Piramal will have to do is what DJFL’s promoters would have done in any case – secure regulatory clearances for all the assets worth around Rs.80,000 crore (the author’s estimate). This requires deep pockets, the right connections, and a good understanding about how the real estate development market works.

Had there been no discretionary power with the authorities and conversion of land, and obtaining of clearances quite transparent and time-bound, the bribes that are required to be paid out would not be that steep. Had property taxes on all land acquired been the same – both before and after conversion, the temptation to retain the old status till an appropriate time, would not have been so strong.

Clearly, successive governments have allowed these discretionary powers to stay because they are a wonderful source for slush money. The entire real estate development market got into a mess because of the freeze in money markets thanks to the IL&FS crisis. It may be recalled that IL&FS too was deep into finding effective ways to get regulatory clearances for huge land banks that it had acquired from Maytas (earlier a subsidiary of Satyam) which was later taken over by IL&FS and rechristened. The mess at IL&FS is still being sorted out. Many of the corporate insolvency cases arise from delayed and disputed payments by government owned entities.

Clearly, successive governments have allowed these discretionary powers to stay because they are a wonderful source for slush money. The entire real estate development market got into a mess because of the freeze in money markets thanks to the IL&FS crisis. It may be recalled that IL&FS too was deep into finding effective ways to get regulatory clearances for huge land banks that it had acquired from Maytas (earlier a subsidiary of Satyam) which was later taken over by IL&FS and rechristened. The mess at IL&FS is still being sorted out. Many of the corporate insolvency cases arise from delayed and disputed payments by government owned entities.

The government too can be capricious

Sometimes, the government can itself precipitate a financial crisis. Take the recent case of industrialist Anil Ambani trying to claim his dues from Delhi Metro (DMRC), a government owned entity. In the first fortnight of September 2021, the Supreme Court upheld an arbitration award of 2017 won by Anil Ambani’s company DAMEPL, a special purpose vehicle floated by Reliance Infrastructure (https://www.business-standard.com/article/companies/sc-admits-rinfra-plea-challenging-high-court-order-in-delhi-metro-case-121090901179_1.html). This suddenly made the Anil Ambani group richer by around Rs.5,000 crore.

DAMEPL had won the Rs 2,800-crore award in 2017 in an arbitration award, But DMRC challenged this decision. The matter went to the Delhi High Court which also ruled in favour of DAMEPL. DMRC then appealed to the Supreme Court contesting the Delhi High Court order on grant of interest and other issues. The decision to litigate an arbitration award caused a delay of over four years.

In fact, as has been pointed out repeatedly by his author, the government (usually through its entities such as DMRC) remains the biggest litigant in court. Even the Law Commission called it a compulsive litigant — https://asiaconverge.com/2019/11/good-governance-must-begin-at-home/. That in turn throws a spanner in the smooth working of financial markets.

Thus, if the government is really serious about an Atma Nirbhar Bharat (self-reliant India), it must reduce this huge generation of sleaze by authorities through regulations that allow for caprice and discretion. The market regulator, SEBI, is guilty of caprice and inexplicable decisions taken using its discretionary powers (https://asiaconverge.com/2021/09/regulatory-games2-sebi-wants-to-be-a-player-too/). As these columns showed two weeks ago, even the RBI is guilty of this ) https://asiaconverge.com/2021/09/games-regulators-play-1-is-rbi-becoming-capricious/). Discretionary powers need to be reduced, and a transparent process is urgently called for.

Can the government clean up this mess?

COMMENTS