Property Taxes don’t reflect any maturing of the Indian economy

RN Bhaskar

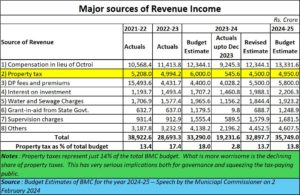

On 2 February 2024, the Municipal Commissioner of the BMC (BrihanMumbai Municipal Corporation or the erstwhile name Bombay Municipal Corporation) made a formal statement about the Corporation’s annual budget. Mumbai has the richest corporation in the country with a budget that exceeds that of many states in the country. And among his observations was a table that is relevant here.

What he effectively stated was that Property taxes represent just 14% of the total BMC budget. Globally, it is well known that cities pay for all their expenses, including capital costs, through property taxes. So why was the BMC just getting 14% of its revenues from such taxes?

What he effectively stated was that Property taxes represent just 14% of the total BMC budget. Globally, it is well known that cities pay for all their expenses, including capital costs, through property taxes. So why was the BMC just getting 14% of its revenues from such taxes?

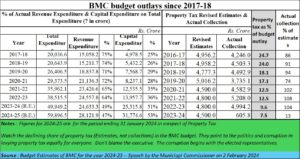

Equally worrisome is another fact. That in Mumbai, the share of property taxes to the total budget has been declining. As the table shows, while the size of the BMC budget has been going up, even the estimates of property taxes have gone down both in terms of the total revenues as well as a percentage of the budget. This is true even in the case of collections. Thus, between 2016-17 and 2018-19, the collection of property taxes as a percentage of estimates were 86, 91, 94% respectively, in the latest year, 2023-24, collections have slumped to just 13%.

Equally worrisome is another fact. That in Mumbai, the share of property taxes to the total budget has been declining. As the table shows, while the size of the BMC budget has been going up, even the estimates of property taxes have gone down both in terms of the total revenues as well as a percentage of the budget. This is true even in the case of collections. Thus, between 2016-17 and 2018-19, the collection of property taxes as a percentage of estimates were 86, 91, 94% respectively, in the latest year, 2023-24, collections have slumped to just 13%.

During three years since 2016-17, total collections were higher than estimated, probably because arrears for previous years also got collected.

During three years since 2016-17, total collections were higher than estimated, probably because arrears for previous years also got collected.

All these point to a sorry state of financial management in the BMC.

But don’t blame the municipal commissioner. He is just the head of an organisation which, despite its glorious past, is subject to the sly manoeuvres and policies of the elected representatives. Consequently, even though the best of cities in the world manage to finance themselves entirely through property taxes, this has just not been possible in Mumbai. And other cities as well.

This is because of three reasons.

Cities of slums

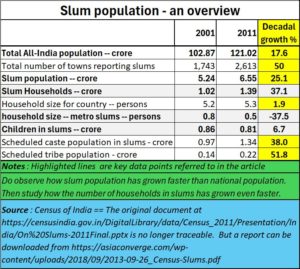

First, increasingly, politicians have allowed, even abetted the formation of slums (https://asiaconverge.com/2021/08/slums-2-benefitting-politicians-and-graft-seekers/). All the data based on which such statements can be made, emanate from documents compiled by the Census of India.

This data was earlier available at https://censusindia.gov.in/DigitalLibrary/data/Census_2011/Presentation/India/On%20Slums-2011Final.pptx. But the document disappeared shortly after the above article appeared in mainstream media. However, for the benefit of readers, the pdf version of the original Census presentation can be downloaded from https://asiaconverge.com/wp-content/uploads/2018/09/2013-09-26_Census-Slums.pdf.

As the Census data shows, even as early as in 2011, slums accounted for a huge share of residential accommodation in any major Indian city. Today, the number of cities with a population of over 1 million has gone up substantially, as has the incidence of slums. Mumbai, for instance, has almost 50% of its population in slums or in redeveloped flats designed to relocate slum dwellers.

As the Census data shows, even as early as in 2011, slums accounted for a huge share of residential accommodation in any major Indian city. Today, the number of cities with a population of over 1 million has gone up substantially, as has the incidence of slums. Mumbai, for instance, has almost 50% of its population in slums or in redeveloped flats designed to relocate slum dwellers.

Cessed properties

Another 20% — some say 30% — of the properties in Mumbai are classified as cessed properties. They pay historical rents that are a fraction of market rentals. For instance, a large opulent property, used as a dispensary, admeasuring 7,000 sq ft pays a princely rental of just Rs.700 per month. This is because the dispensary has been a tenant for the past 50 years. He, like many others, enjoys protection under the Rental Act, and thus pays the originally agreed historical rent.

Under the guise of not disturbing the lifestyles of people who have been tenants for ages, the courts and the government have allowed them to stay there at ridiculously low rentals that don’t exist even in the far-flung suburbs of Mumbai. The rental escalation that has now been permitted is at best a joke.

This also applies to some of the best-known shops and restaurants in swanky South Mumbai. They pay historical rents – a fraction of those prevailing in the open market. Since their rentals are low, the BMC cannot charge them high property taxes. Such a policy has been vetted by both the courts and the politicians.

Not surprisingly, many of the properties are held by persons very close to people in power.

And this leads us to the third reason. With 50% of the properties held by slum dwellers, and 20-30% by cessed tenants, Mumbai gets its market benchmarked property taxes from just 20% to 30^ of its population. What is sad is that even these 20-30% do not pay their property taxes on time, either because the BMC has been lethargic in billing them, or (more often) because delayed payments are condoned.

Consequently, this 20-30% of the population is taxed heavily, and the BMC collects the money it needs by levying a variety of other taxes.

But, even then, leakages in the BMC are huge. Leakages on water billing are by now legendary. Mumbai has among the highest NRW rates — meaning non-revenue water where the water used cannot be explained (https://asiaconverge.com/2019/09/what-india-can-learn-about-water-management-from-israel/). The fees collected on account of illegal parking or hawking are a fraction of what they ought to be. Even revenues from water tankers is another source of graft (https://asiaconverge.com/2019/06/the-stranglehold-of-the-water-tanker-mafia/)

The most corrosive factor for Indian cities is slums.

As the Census data shows, while national population grew at 17.6% during the earlier decade, slum population grew (in cities) by 25%. Clearly, someone was incentivising people to form slums (https://www.youtube.com/watch?v=IbFvtjBT5R4).

What is more astounding is that households in slums grew by a whopping 37%.

Even more shocking is that against a national average household size of 5 people per household, slums had 0.5 people per household. Effectively this means that each person in the slum belongs to two households on an average.

Why>

Because all doles and freebies are given to households, not individuals. Each household gets a quantum of subsidised electricity, gas cylinders, ration etc. Thus, by inflating the number of households, slums get 10 times more subsidies and doles than they ought to have got.

But the biggest benefit for politicians is that slums allow them to create vote banks and even rig elections. The latter charge may sound preposterous, but this is how it works. If you stay in a constituency where there are 1,000 residents, and you elect someone whom the 1000 people like, then there is a way to frustrate all your plans to elect your representative.

A slumlord, under the protection of an elected representative, encourages 50,000 people to squat near and around your locality, by forming a slum, thus marginalising your community’s votes to just 2%. The enlarged community now votes for the person the slumlord/ politician wants to have as the winner representative. You can’t do a damn thing about it.

That is why, under the guise of a “human approach” most slum redevelopment plans allow slum dwellers to get new flats in the same location where their slums originally existed. This way the slumlord/politician’s newly created vote bank remains intact. The slum dweller gets a new residence free of cost, freebies from the slumlord/politician and is even allowed not to pay property taxes.

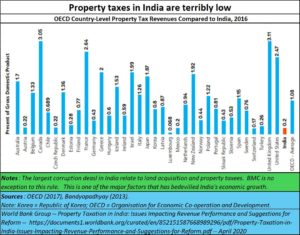

Sadly, neither the election commissioner, nor the courts have struck down such corrosive manoeuvres. Thus, even by Asian standards, property tax collections in India remain pathetically low.

Sadly, neither the election commissioner, nor the courts have struck down such corrosive manoeuvres. Thus, even by Asian standards, property tax collections in India remain pathetically low.

What slums do is to defraud the common citizenry — first of their money paid by way of taxes, and then even their franchise. It becomes a mockery of the entire electoral system in some of the most lucrative centres that India has.

Property taxes waived

To favour their vote banks, politicians clamour for a total exemption from property tax for dwellings which measure under 500 sq ft. It is no coincidence that this size is just the area that slum dwellers get under the redevelopment scheme. As the Municipal Commission himself states, “BMC had filed a petition no.17009/2019 in Hon’ble Supreme Court against the decision passed by Hon’ble High Court in W.P. No.2592/2013 against Capital Value Base Tax System in which the final verdict was against BMC. Capital Value 2010 and 2015, rule no.20, 21, 22 have been quashed by Hon’ble Supreme Court’s order. Hence, there is drop in collection of Property Tax resulting thereby a decrease in income of BMC from Property Tax.” He also states, “Property tax [has been] waived off to the residential units with carpet area less than 500 sq. feet according to the Maharashtra Ordinance No.1 of Maharashtra Government Gazette Extraordinary part four of 2022 dated.” (https://www.mcgm.gov.in/irj/go/km/docs/documents/MCGM%20Department%20List/Chief%20Accountant%20(Finance)/Budget/Budget%20Estimate%202024-2025/1-%20MC’s%20Speech/BUDGET%20A%2c%20B%2cG/ENGLISH%20SPEECH.pdf)

The consequences are obvious. With no property tax from slums, and a fraction of property tax from cessed properties, it is not surprising that the collection of property tax in Mumbai, and the rest of India, is extremely low. Even when compared with property taxes in other parts of Asia, India’s collections are pathetic.

And this is even though rentals in India are among the highest in the world.

And this is even though rentals in India are among the highest in the world.

Like Mumbai, like India

India does not provide national figures of property taxes collected under the excuse that property taxes are under municipalities and the states. But a developing country ought to share data, because data collection and dissemination is one of the responsibilities of the government.

Both the central government and the state governments pretend that India can develop (remember the slogan Viksit Bharat – free subscription — https://bhaskarr.substack.com/p/did-someone-say-viksit-bharat) by ignoring property taxes. Data from the IMF and OECD show that developed countries are those which have a higher share of property tax as a percentage of GDP.

Thus, except for the chest thumping and the war like cries that India will be the third largest country in the world, all signs point to an underdeveloped country, which does not even know how to collect property taxes.

Thus, except for the chest thumping and the war like cries that India will be the third largest country in the world, all signs point to an underdeveloped country, which does not even know how to collect property taxes.

India thus remains a country that claims to be a democracy, but introduces measures that allow for large scale tinkering with demographics to marginalise free and fair voting.

And yes, ironies abound. Instead of touting the need for one-country-one-vote, why does the government not stuff ballot boxes with fake ballot papers? It would save the country both time and cost. After all, the slum policy of the government (both state and centre) shows that local choices don’t really matter.

Instead, the country’s elected representatives can actually change the composition of votes whenever they want. Policies like “in situ” alternative accommodation, “zero property tax” for slums, and discounted taxes for cessed properties ensure that the entire election exercise and financial management can be rendered meaningless.

=======================

Do watch my latest podcast on why India has underperformed at https://youtu.be/FZs_7XTCIO8

COMMENTS