How North India suddenly became richer, and paid more taxes despite profligacy

By RN Bhaskar

Image generated by http://deepai.org/

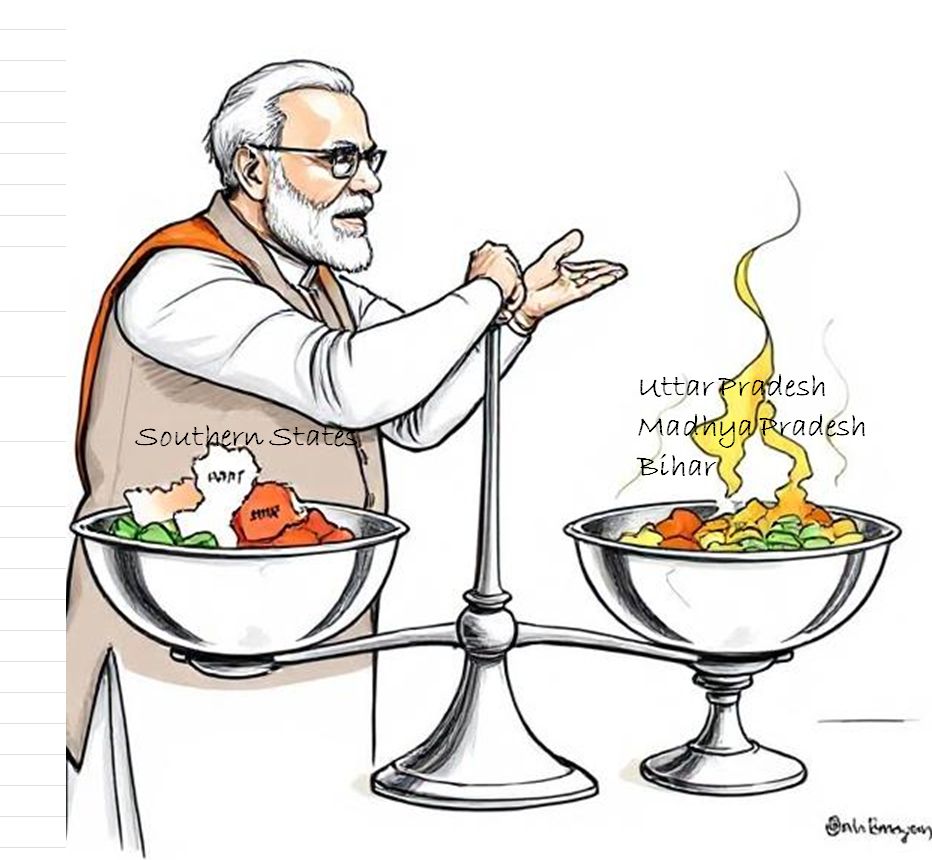

Go through the budget papers and you discover some strange numbers. North India has become the largest taxpayer. Hitherto, it was south and west India that held this honour.

Had the increase in wealth generation in North India’s wealth generation capabilities been genuine, every Indian would have been delighted. It would have made India’s per capita income swell, as well as its GDP. After all, Many states in North India – especially Bihar, Madhya Pradesh, Rajasthan and Uttar Pradesh (also referred to as Bimaru or sickly states) have among the lowest per capita incomes in India (https://asiaconverge.com/2021/08/the-fanciful-figures-of-uttar-pradesh/). But the rankings have been the result of figures that were possibly aimed at tilting the scales.

It is quite possible that Niti Aayog, which has by now become an expert at rigging numbers (https://bhaskarr.substack.com/p/niti-aayogs-visions-of-wealth-and), was also involved in this exercise.

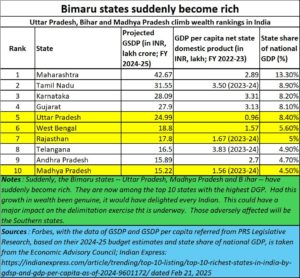

All of a sudden, the Bimaru states have begun showing better numbers in almost all government documents. The Indian Express was the first among media houses to point to this amazing development (https://indianexpress.com/article/trending/top-10-listing/top-10-richest-states-in-india-by-gdsp-and-gdp-per-capita-as-of-2024-9601172/)

All of a sudden, the Bimaru states have begun showing better numbers in almost all government documents. The Indian Express was the first among media houses to point to this amazing development (https://indianexpress.com/article/trending/top-10-listing/top-10-richest-states-in-india-by-gdsp-and-gdp-per-capita-as-of-2024-9601172/)

The role of doles and grants

How could sickly states suddenly emerge among the top 10 in terms of GDP? The culprit here appears to be the manner in which the government has been giving out doles and grants to these states.

As doles and grants increase, the GDP of these states also increases. The right way then would have to be to consider rates of return on such doles and grants. But this is something the Centre and its think tank Niti Aayog have been loath to do. By increasing doles and grants, you can make a state climb the rankings in terms of GDP, even though such grants may not be sustainable and may not be forthcoming in subsequent years.

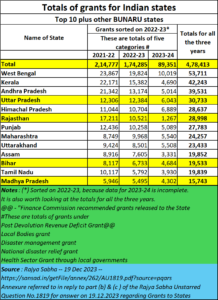

The best list of numbers available on such doles and grants – though not exhaustive – can be found in the government’s reply before the Rajya Sabha on 19 December 2023 (Microsoft Word – RS 1819 dt 19.12.2023_fNAL).

In the three tables given as annexures, you can see the volume of doles given to the BIMARU states (Bihar, Madhya Pradesh, Rajasthan and Uttar Pradesh). Please note that these grants do not include special grants for projects like Ayodhya, Kumbh Mela and the like. Add those, and the numbers will be staggering.

That is how both GDP and Tax paid status changes for these states.

Since the tables are large, they can be downloaded from here and here. No prizes for guessing that the largest recipients from grants in all the three annexures are the North Indian states.

Bimaru states become big taxpayers

Bimaru states become big taxpayers

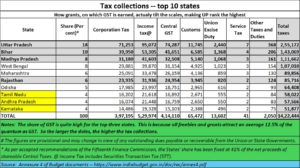

Equally baffling is the way the states in North India have become the largest taxpayers in the country. This is evident from a perusal of Annexure 4 of the Budget papers — https://www.indiabudget.gov.in/doc/rec/annex4.pdf.

How was this possible? Surely, states cannot fudge tax payments! The answer lies in a very simple fact. All doles and grants given to states and their people are meant to be spent. When this happens, they are subject to GST levy, which economists believe is more than 12.5% weighted average considering multiple transactions and the velocity of money. Just take a total of these grants and multiply them into 12.5%. You will arrive quite close to the tax amount paid.

The Southern states do not get the generous dollops of doles and grants that the Bimaru states get. Thus, the GST that Southern states pay is truly on goods and services produced. As a result, states in North India end up paying larger taxes than even the most productive states in India.

It won’t be surprising if such data is also used to justify giving to North India states a larger share of electoral seats during the proposed delimitation exercise.

Why were all these numbers fudged?

For this, it must be understood that India is no stranger to fudging of data (free subscription — https://bhaskarr.substack.com/p/nudge-fudge-but-the-economy-wont).

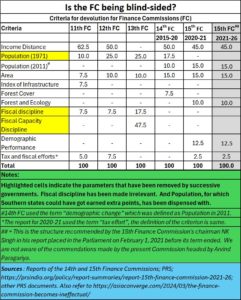

Second, it must also be understood that the Finance Commission, which decides how the central pool of taxes is to be distributed among states, has become largely ineffectual (https://asiaconverge.com/2024/03/the-finance-commission-becomes-ineffectual/). The very norms for justifying grants to stages have been diluted or even junked. That in turn has made this type of distorted distribution of largesse to states in North India very easy. Thus, the Finance Commission has been muzzled.

Third, many moves were made to allow the Finance Commission to arrive at conclusions that would give North Indian states a higher voting share in the delimitation exercise that is currently underway. Obviously, the Parliament will be persuaded to consider two things:

- One, the way states in North India have surged from poverty (Bimaru means sickly in Hindi) to economic strength (as indicated by the rise in GDP ranking).

- Two, the manner in which they have become the highest tax paying states. They will form the bedrock of justifications for allocating higher electoral seats to the Bimaru states.

Study closely how key parameters which point to financial integrity of numbers, fiscal discipline, and governance, have been dispensed with. Also watch how the population parameter – one of the key achievements of Southern states – has also been tinkered with. While, earlier, the cut-off year was the population of the 1971 Census, this stipulation was removed. Thus, states in North India would not be penalised for not managing their populations as effectively as the Southern states. Effectively, every method has been used to pave the way to higher weightages for Northern states.

Census subverted

But the coup de gras was delivered when the Census was subverted.

Do bear in mind that this is the first time since 1881 that the Census for human populations in India was not held after a period of 10 years. Do pay heed to what EAS Sarma, former secretary to the government of India, has to say about this, “Tabling a census report on the population of India is an exercise that has been carried out uninterrupted since 1881. Every ten years, this is the document that each government studies carefully to understand which sections of the population need more attention. This is the first time that a government has assumed that the Census isn’t required” (https://bhaskarr.substack.com/p/elections-are-over-now-what-about)

There was a great deal of speculation that the Census was being delayed so that it could be timed with the delimitation exercise. Some people believe that when the Census is finally tabled – many speculate that it will be just weeks before the delimitation exercise begins — the revised data will be used without the usual process of getting it cross-checked. Moreover, the manner in which the 1971 cut-off was removed from the guidelines for the Financial Commission, such fears do get stoked even more vigorously.

The first to challenge such plans – publicly and compellingly — is Tamil Nadu, though several Southern States chief ministers have met in the past to discuss the implication of a ‘rigged’ delimitation exercise. Even as early as in August 2021, Sarma, in his letter addressed to the chief ministers of Southern states, had warned about this (https://asiaconverge.com/2021/08/delimitation-of-indian-states-and-rewarding-the-hindi-belt/).

The gauntlet has now been thrown by MK Stalin, chief minister of Tamil Nadu. He has called for a stop to the delimitation exercise. It has asked the Lok Sabha to freeze all proceedings. And he wants all discussions using population data to be frozen to the levels given in the 1971 Census.

Unfortunately, challenging the delimitation will not be easy because of what Article 82 (“Readjustment after each census”) says “Upon the completion of each census, the allocation of seats in the House of the People to the States and the division of each State into territorial constituencies shall be readjusted by such authority and in such manner as Parliament may by law determine”

But the manner in which the population curoff was arbitrarily changed from 1971 census to the latest census can be challenged. Similarly, the manner in which states in North India got their GDP and tax contribution escalated can also be questioned.

As EAS Sarma points out (https://asiaconverge.com/2021/08/delimitation-of-indian-states-and-rewarding-the-hindi-belt/) “The legal position is as follows.The Constitutiont) Act, 2001 and the Constitution (Eighty-seventh Amendment) Act, 2003 have, inter alia, amended Articles 81, 82, 170, 330 and 332 of the Constitution of India.

The cumulative effect of these amendments to the Constitution is that –

- the total number of existing seats as allocated to various States in the House of

the People on the basis of 1971 census shall remain unaltered till the first census to

be taken after the year 2026; - the total number of existing seats in the Legislative Assemblies of all States as

fixed on the basis of1971 census shall also remain unaltered till the first census to

be taken after the year 2026;”

By pushing the Census to 2026, the government will not have to wait till 2031, which would otherwise be the first Census year after 2026.

What next?

The battle over delimitation will soon spill over to

- the Census (https://asiaconverge.com/2024/09/what-about-the-population-census-please/),

- the missing dead (https://asiaconverge.com/2021/06/missing-dead-3_teaching-india-to-respect-the-dead/),

- bogus Aadhaar and PAN cards (https://asiaconverge.com/2020/11/aadhaar-pan-combined-through-article-139aa-threaten-banking-financial-integrity/),

- ghost voters (free subscription — https://bhaskarr.substack.com/p/ghosts-at-the-voting-booth), and

- The attempted imposition of Hindi in Southern states, and the tunnel-vision and limited language skills of North India (https://www.thehindu.com/data/over-90-in-hindi-belt-states-speak-only-one-language-rest-of-india-is-more-bilingual-data/article69285848.ece).

A lot will depend on the ability of the Southern states to put up a combinmed challenge to (a) the amendments to Articles 81, 82, 170, 330 and 332 of the Constitution of India; (b) to prevent any change of the cut-off year from 1971 to a later year.

Either way, all the issues listed above will now become a battle cry rallying southern states against the centre which is now being seen as a representative of the states in North India, and not of the entire country. Unless such fears are dispelled quickly, they could spill over and even infect the discontented border states in the North and North East, which too have been at the wrong end of the stick with the Centre.

India is suddenly looking vulnerable. A myopic agenda guided more by ideology than by economics or sagacious welfare is threatening to become a huge conflict.

Will sanity prevail?

================

Do watch my latest podcast on what Cawasji Jehangir means for Mumbai and India https://www.youtube.com/watch?v=0Vsqwik5q_s

COMMENTS