USA trips India on oil

By RN Bhaskar and Sakeena Bari Sayyed

Image generated: perplexity.ai.

President Donald J Trump is having a field day. He has succeeded in tripping up Venezuela. In spite of having the world’s largest reserves of oil, Venezuela’s production and exports have been curtailed to a trickle (https://www.bbc.com/news/articles/c62zzv02r3vo). Trump is threatening Nigeria (https://www.aljazeera.com/news/2025/11/1/trump-threatens-to-launch-attacks-in-nigeria-over-killing-of-christians), another large producer of oil. Each of these countries will slip on the oil slick Trump himself has created. It is now India’s turn to slip on this oily slope. Unless Russia succeeds in finding a way for India to deal with the rapidly developing economic situation globally.

Never mind what the RBI governor and some union ministers say. The RBI governor believes that the US trade deal is good for India (https://indianexpress.com/article/business/rbi-governor-sanjay-malhotra-good-trade-deal-us-rupee-10376974/).

Really? India is compelled to stop importing cheaper oil from Russia. It is being compelled to purchase more expensive oil from the US. And is being coerced to purchase (extremely expensive) arms from the US (https://www.bbc.com/news/articles/cdeger2k625o). Yet, the RBI governor believes that the deal is good for India! One interpretation is that the RBI governor has adopted the role of a US trade champion, forgetting that central bank governors seldom adopt that role. The other explanation is eyeing a sinecure with the IMF or even the government of India. The fact is that India is rapidly losing its balance. The falling rupee is a good sign of things to come.

Factors driving Trump

To understand why Trump is doing this, one needs to consider several other factors.

1.Trump has inherited an America with a huge debt burden. This has crossed $37 trillion and could cross $40 trillion with additional fiscal deficit (https://asiaconverge.com/2025/10/the-world-shudders-as-the-us-dollar-tumbles/).

2.Trump’s policies on immigration and tariffs have begun to hurt America. That has caused a fall in Nasdaq valuations. Wall Street is jittery, and everyone expects a crash anytime. This could be bigger than the crash in 2008. That was when the US lost almost 40% of its value. (https://www.morganstanley.com/insights/articles/us-dollar-declines).

2.Trump’s policies on immigration and tariffs have begun to hurt America. That has caused a fall in Nasdaq valuations. Wall Street is jittery, and everyone expects a crash anytime. This could be bigger than the crash in 2008. That was when the US lost almost 40% of its value. (https://www.morganstanley.com/insights/articles/us-dollar-declines).

3.Debt defaults have begun to take place. JP Morgan’s Jamie Dimon describes this as cockroaches – one cockroach indicates that there will be many more around (https://www.youtube.com/watch?v=SOteOr5eV48)

4.The US has very few sources of generating revenues. One is arms sales. The second is IT and the third is oil and gas.

5.The first (arms sales) is under pressure because of huge spends on Ukraine and Israel. The near disastrous performance of US weaponry in both the Ukraine and Middle East war theatres has reduced the demand for US war solutions. Yet, Trump arm-twists countries – including India — to purchase US weaponry. Many countries have begun opting for solutions from Russia, China, Iran and Turkey instead.

- On the IT front, the hype around AI is turning out to be a bubble. America funds its innovation through the capital markets. This is unlike China where the state pushes critical technologies without depending on market valuations. That is why the Chinese DeepSeek has trounced the AI offerings from the West. Expect more trouble on this front.

- But the biggest battles will relate to oil. This is where India could lose badly because its import bill will soar even further without a commensurate increase in exports. Expect the rupee to grow weaker. India will become even more wobbly at the knees.

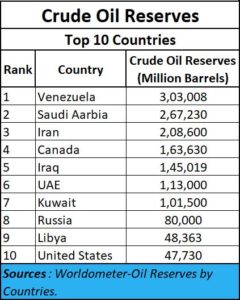

At first blush the US looks formidable. It is after all the world’s largest producer of oil. But probe a bit more and you will discover that the US has scant reserves of oil and gas.

Countries like Venezuela, Russia and Saudi Arabia have larger hydrocarbon reserves. This effectively means that the US is flogging its meagre reserves to produce more. That oil may not last. Clearly, the US wants to get rich as quickly as it can. That could also explain its reluctance to reject any curbs on hydrocarbons or environmental emissions.

Countries like Venezuela, Russia and Saudi Arabia have larger hydrocarbon reserves. This effectively means that the US is flogging its meagre reserves to produce more. That oil may not last. Clearly, the US wants to get rich as quickly as it can. That could also explain its reluctance to reject any curbs on hydrocarbons or environmental emissions.

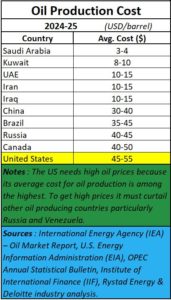

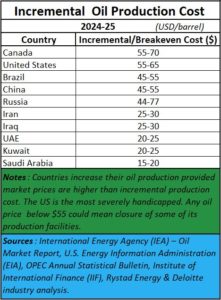

There is another problem that the US has been trying to conceal. It is one of the most expensive producers of oil. This is why the US cannot tolerate low-cost oil producers. At $50 a barrel many oil producers will be compelled to shut shop. The situation could become dire for the US if oil prices actually crash. Some media reports suggest that oil prices could crash to $30 a barrel. That could actually put many US plants out of business.

There is another problem that the US has been trying to conceal. It is one of the most expensive producers of oil. This is why the US cannot tolerate low-cost oil producers. At $50 a barrel many oil producers will be compelled to shut shop. The situation could become dire for the US if oil prices actually crash. Some media reports suggest that oil prices could crash to $30 a barrel. That could actually put many US plants out of business.

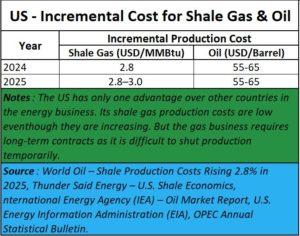

But there is one area where the US can be called formidable. Its (shale) gas production allows it to offer natural gas with huge profit margins.

But there is one area where the US can be called formidable. Its (shale) gas production allows it to offer natural gas with huge profit margins.

However, there is a problem here as well. Unlike oil, where oil-wells can be started, stopped and restarted, there is no way to cap a gas well. Hence you need long-term contracts so that gas production does not get hampered. The US hoped that the EU would sign long-term contracts. But, supply risks (long distances) and high prices deterred the EU, which wants to go back to Russian oil. Meanwhile, Turkey also has plans to become the energy hub for the Middle East and to supply oil and gas to Europe through pipelines (https://www.youtube.com/watch?v=UHBNQKhwo-Y).

However, there is a problem here as well. Unlike oil, where oil-wells can be started, stopped and restarted, there is no way to cap a gas well. Hence you need long-term contracts so that gas production does not get hampered. The US hoped that the EU would sign long-term contracts. But, supply risks (long distances) and high prices deterred the EU, which wants to go back to Russian oil. Meanwhile, Turkey also has plans to become the energy hub for the Middle East and to supply oil and gas to Europe through pipelines (https://www.youtube.com/watch?v=UHBNQKhwo-Y).

That could explain why the US has been compelling India to buy both its oil and its gas.

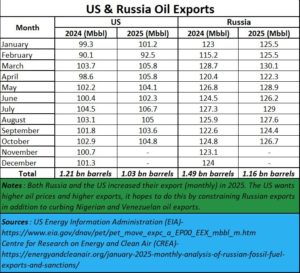

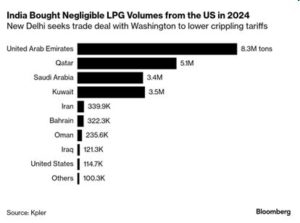

Till now India imported negligible quantities of gas and oil from the US. Thanks to arm-twisting by Trump, India will begin importing larger volumes of these items from America.

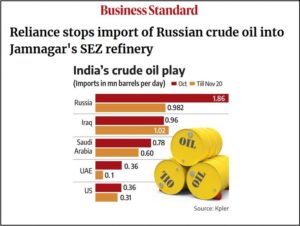

To ensure that India’s volumes of US imports remain high, India had to be compelled to stop importing crude from Russia. That in effect curtailed Russian sales on the one hand but promoted US sales on the other. By curtailing sales from Venezuela and possibly even Nigeria, Trump hopes to benefit from higher hydrocarbon prices as well. He might also have plans to take over Venezuela’s oil extraction business – either through regime change, or through negotiations – so that the US is guaranteed of more reserves when its own run out.

It could be the threat of secondary sanctions that the US wants to impose on any country importing Russian oil. Or it could be plain blackmail that Sergey Lavrov preferred to in his public talk in Delhi in 2023 (Timeline 18:47 at https://www.youtube.com/watch?v=hiA8Ex9KQo4). Whatever the reason, the fact is that India has capitulated. Unless Russia can persuade India to act differently. Else, expect oil prices to increase because the marginal cost of incremental oil production remains high for the US. That is one reason why the US will pick fights with countries that seek to increase oil production and thus lower prices.

That is why RBI governor Malhotra is wrong. A trade deal with the US is not good, it it worsens India’s balance of trade position. Moreover, if the Rupee strengthens after March, it could be because the US dollar is expected to weaken considerably. That is the view of no one less than Yanis Varoufakis, former finance minister of Greece.

That is why RBI governor Malhotra is wrong. A trade deal with the US is not good, it it worsens India’s balance of trade position. Moreover, if the Rupee strengthens after March, it could be because the US dollar is expected to weaken considerably. That is the view of no one less than Yanis Varoufakis, former finance minister of Greece.

India will thus cushion the US’s fall. But it will itself be left battered and bruised. To take people’s attention away from the looming economic crisis, expect more shrill cries against minorities in India. One voice already talks about changing the definition of “minorities” and allow them only when they account for 2% or less of the national population (https://indianexpress.com/article/political-pulse/only-those-should-be-considered-minorities-in-india-who-are-below-2-of-population-bjp-mp-10400106/). Clearly, he has not studied the dictionary for the meaning of minority.

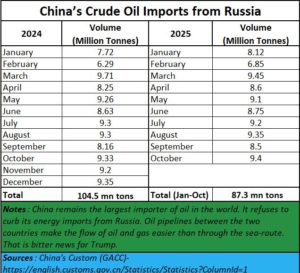

China and Russia know how to stand up to the US. Therefore, even while China reduces its oil transport by sea, it has increased consumption of Russian oil through pipelines. Russia too is sitting pretty. It knows that the US will not be able to block its sales.

The US is already determined to grind India’s nose to the ground. It knows that India’s ability to stand up and fight back is quite poor. Hence, US lobbies are working overtime to ensure that FDI from China doesn’t make India stronger.

The US is already determined to grind India’s nose to the ground. It knows that India’s ability to stand up and fight back is quite poor. Hence, US lobbies are working overtime to ensure that FDI from China doesn’t make India stronger.

However, India needs investments urgently for three reasons:

However, India needs investments urgently for three reasons:

- India must create jobs which is possible only if new factories are set up.

- Investments are the fastest way to reduce the balance of payments crisis.

- If India has to become strong, it must become a production and export centre at the earliest. Neither USA nor the EU have any money to invest in other countries. India will have to fend for itself by attracting investments from China.

Conclusion

India will have to find new ways to thwart the investor unfriendly moves of the US. It will have to find new ways of continuing to trade with Russia and China. It will also have to develop a spine so that it can stand up to US pressures and create stronger and better linkages with the rest of Asia.

=====================

Do view my latest podcast on the throughtles pursuit of desalination. You can find it at https://youtu.be/sWOMXIAlM2c

============================

And do watch our weekly “News Behind the News” podcasts, streamed ‘live’ every Saturday morning, at 8:15 am IST. The latest can be found at https://www.youtube.com/live/its-sXttxxo?si=d5-0jIvlCuI6OfEB

============================

COMMENTS