India plundered V:

There are countless ways in which Indians are being looted

RN Bhaskar – 28 September 2020

==============

The other parts of this series can be found at

http://www.asiaconverge.com/2020/09/the-plunder-series/

==========================

There are many ways in which Indians are plundered by the government. And while the central government has its ways to plunder Indian taxpayers, some state governments are not far behind.

The list is long. It begins right from the graft that municipal staff collect through street goons from unlicensed hawkers and unauthorized stalls to municipal ‘inspectors’ demanding bribes from almost every (legal) commercial establishment under the Shops & Establishment Act.

The list is long. It begins right from the graft that municipal staff collect through street goons from unlicensed hawkers and unauthorized stalls to municipal ‘inspectors’ demanding bribes from almost every (legal) commercial establishment under the Shops & Establishment Act.

It goes on to large projects, which involve kickbacks. Eventually the tab is always picked up by the taxpayer.

The diversion of funds could take place through the alleged inflated number of registrants with Aadhar, and the way the NPCI overwrites older bank account numbers with new ones and refuses to keep a log of payments made (http://www.asiaconverge.com/2018/02/how-aadhaar-and-npci-together-open-the-door-to-major-frauds-and-impersonations/). Or it could be through turning a blind eye on beneficiaries of pollution – making the state pay for the mess that irresponsible (but politically connected) industries make (http://www.asiaconverge.com/2020/08/government-plunder-productive-states-in-india/). The profits are for the promoters, the expenses for the damages are borne by the state.

But let’s deal with national loot first.

Plunder through tax transfers

The plunder by the centre takes place in two ways.

First through tax transfers – legally. Some goes to the central government (which again gets used up for central government expenses, as well as special transfers to states like Uttar Pradesh (UP), Bihar or Madhya Pradesh (MP). Some gets transferred to states (the biggest beneficiaries again being the three starts mentioned above (http://www.asiaconverge.com/2020/09/india-plundered-iii-through-tax-devolution-and-transfgers/).

Then comes the second way. Illegal transfers. Both the states and the centre spend money on projects and for payments. Some are genuine, and some are not. Most of the payments (even the genuine ones) have an element of kickback – that goes to people close to politicians. A part of the illegal proceeds invariably goes to those in power.

A significant part of the illegal funds goes towards funding politics. But politicians also benefit. Watch the way their assets (and those of relatives) swell after they get elected. Much of the money is stashed away overseas. This money is then brought in later through the accounts of political parties.

How else do you explain the hurry with which the government passed (in February 2018) an amendment to the Prevention of Corruption Act (http://www.asiaconverge.com/2018/08/amendments-to-prevention-of-corruption-act-protect-corruption/), allowing political parties to get funds from overseas with no questions asked. This amendment was made with retrospective effect for 42 years! Thus — at a time when every developed country is fighting against foreign interference in domestic elections – Indian legislators legalised and welcomed foreign money into political party accounts. Reverse colonisation?

Not a single political party has protested this blatant invitation to foreign money to influence India’s politics. Not even the nationalist parties, which drafted the amendment and steered it through Parliament. Not the Opposition parties either. The only people who protested with people like EAS Sarma and some NGOs who challenged the constitutionality of such amendments before the Supreme Court. The courts have remained silent on this incredible amendment.

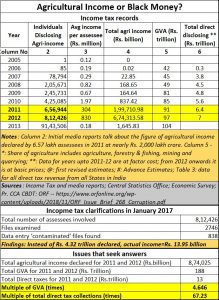

Obviously, all the political parties have been beneficiaries. So, if agricultural income was the earlier laundromat, political parties are the new laundromats. And as mentioned earlier, if the declarations before the Income tax in 2011-2013 are any indication, the amounts could be multiples of India’s GDP.

Sounds preposterous, true. But that is what the agriculture income table suggests. And it is important to bear in mind that the public interest litigation (PIL) plea filed before the High Court of Patna mentions that this figure could be at least two times larger. The figure mentioned in the court appeal is Rs.2,000 lakh crore. The courts have remained silent on this PIL (https://www.orfonline.org/wp-content/uploads/2018/11/ORF_Issue_Brief_268_Corruption.pdf).

The banking route

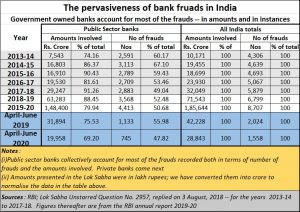

The other big way to plunder the people of India is using the bank route (see chart). Even after the government decided that NPAs would be stanched, the haemmorhage continues. Not surprisingly, much of the fraud is with government-owned banks, not with private banks or foreign banks. Even where private banks have been involved, it is now known that many of the fraudsters were well connected politically. There are reasons to believe that many of these frauds were because of ‘directed’ loans (http://www.asiaconverge.com/wp-content/uploads/2020/09/2020-09-24_PW_Bank-frauds.pdf).

The other big way to plunder the people of India is using the bank route (see chart). Even after the government decided that NPAs would be stanched, the haemmorhage continues. Not surprisingly, much of the fraud is with government-owned banks, not with private banks or foreign banks. Even where private banks have been involved, it is now known that many of the fraudsters were well connected politically. There are reasons to believe that many of these frauds were because of ‘directed’ loans (http://www.asiaconverge.com/wp-content/uploads/2020/09/2020-09-24_PW_Bank-frauds.pdf).

Once again, India’s politicians have shown that they know quite well how to game the system. The amounts involved are not small — ranging from Rs.71,543 crore to Rs.1,85,644 crore, year after year. If one opts to go beyond the two years given in the table, you will find the amount to be larger (http://www.asiaconverge.com/2019/12/bank-frauds-are-becoming-bigger-and-mesier/).

Almost every major bank scamster has connections with political entities, if not politicians themselves. Almost all of them remain Scott free. Yes, there are noises about the authorities chasing them to prosecute them. Assets are attached, but seldom sold. And not a single conviction takes place (http://www.asiaconverge.com/2020/09/bank-frauds-could-undermine-economic-recovery/).

As a market expert points out, even the Insolvency and Bankruptcy Code is flawed. Companies are allowed to become sick. A defaulting company’s ownership is transferred from one management to another. The banks (most of them government-owned) take a haircut. Eventually the recapitalization of the banks will take place from either bank customers (through interest or service charges), or by the taxpayers. Either way, both politicians and promoters become richer, while the people become poorer.

That is also the reason why, in India, despite all the impressive sounding legislation, promoters of companies remain rich, even though their companies become sick and even become defunct. Whether it is the Ruias of Essar or the Dhoots of Videocon, none of them has gone behind bars for defrauding Indian banks. There are reports by investigation agencies—with charges of diverting bank funds to shell companies, invariably listed in impervious tax havens like the Channel Islands. But hardly has any promoter been convicted. This includes the likes of the Sandesarias the promoters of Anugraha Finance.

Crowdsourcing plunder

The most widespread way is crowdsourcing graft. Almost every inspector of the Shops and Establishment department is on the take (http://www.asiaconverge.com/2016/12/want-to-uproot-corruption/). Some of the illegal collection is pocketed by the ‘inspector’, some goes to his immediate superior, some distributed among colleagues, and some to the corporator or the political boss who allows this state of affairs to continue.

And this brazen way of collecting graft is abetted by yet another modification in the Prevention of Corruption Act (http://www.asiaconverge.com/2018/08/amendments-to-prevention-of-corruption-act-protect-corruption/). The bribe given faces a stiff prison sentence if he discloses that a bribe has been paid. As a result, few dare complain about bribes. The bribe takers thus enjoy this legal sheath of protection.

And this brazen way of collecting graft is abetted by yet another modification in the Prevention of Corruption Act (http://www.asiaconverge.com/2018/08/amendments-to-prevention-of-corruption-act-protect-corruption/). The bribe given faces a stiff prison sentence if he discloses that a bribe has been paid. As a result, few dare complain about bribes. The bribe takers thus enjoy this legal sheath of protection.

If you are a legal entity, you pay a smaller bribe for not being inconvenienced. It is nothing else but protection money. If you are not a legal entity, you pay a higher sum. But greed and the desire to keep the cash rolling in compels state governments to ensure that many of the entities remain illegal. (see chart), and unlicensed (http://www.asiaconverge.com/2018/09/3-measures-can-stop-india-becoming-failed-state/).

Refusal to pay such protection money could result in extremely vexatious retribution.

For unlicensed hawkers it could be confiscation of goods, and a few nights in the police lockup. For legal commercial establishments, it could be summary summons to the small causes courts. The ‘inspectors’ do not turn up in court, and the commercial establishment officer (or his lawyer) is required to appear before the magistrate on another day. Each visit costs money and time. The pain can be endless. Refuse to turn up, and you could be hauled up for contempt of court summons.

That is when the penny drops. When the cost of non-compliance is significantly smaller than the costs for compliance, the market is perfect for bribes and loot.

Hence, it profits petty officers to ensure that hawkers remain unlicensed, and irregularities in construction or roadside stalls do take place. Each irregularity becomes another avenue for regular graft. So, hawkers remain unlicensed. Stalls on the pavements remain unauthorized. Bogus driving licences proliferate. Illegal settlers are rewarded. Even prostitution (http://www.asiaconverge.com/2019/01/maharashtra-specious-morality-dance-bars-and-prostitution/) is permitted, though unlicensed. This is where the party making more money than the prostitute or the pimp is the state administration (the police and the civic staff).

That is also why the Bombay Municipal Corporation (BMC) keeps two sets of laws for dealing with similar cases (https://indianexpress.com/article/cities/mumbai/illegal-constructions-two-laws-exist-bmc-officers-decide-which-one-to-apply-in-a-case-6593800/). If the person is politically inconvenient – remember the demolition of Kangana Ranaut’s office? — one set of rules is applied. Else, another set is applied. There is yet another way – no law is applied. You can complain about illegal constructions. The BMC will look the other way (this author is facing such a problem currently). The top brass may be willing to attend to the grievance, but the operative guys refuse to comply or cooperate, thumbing a snook at the laws and the directives. Such infractions are also not punished severely.

One way out would have been am effective judicial system. But the politicians will not permit this (Chapter 5, Hobbled governance; Game India-seven strategic advantages that could steer India to wealth; https://tinyurl.com/y5noov5h).

Plunder through votebanks

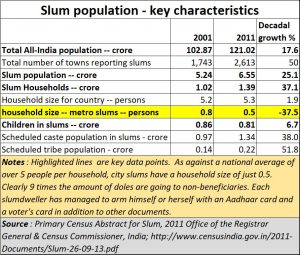

Consider slums for instance (http://www.asiaconverge.com/2020/03/coronavirus-slums-become-new-hotspots-ravage-cities/). When you have city slums that account for 50% of the population, you  know that a massive effort to buy vote banks is underway.

know that a massive effort to buy vote banks is underway.

These vote banks are financed by sums that decent taxpayers pay. This is abetted by an administration that looks the other way even though the household size for slums is just 0.5 people Census 2011 figures), compared to under five persons for the rest of the country. Thus, slums enjoy 9 times more entitlements that should be given. By inflating the number of households, you suck out more money from the system. This is yet another method for regular loot. Legalised. Legitimised. And the hold over a vote banks gets consolidated.

And yet Maharashtra wants to waive property tax for slumdwellers in perpetuity – other honest taxpayers will bear the burden, of course (https://www.freepressjournal.in/mumbai/bmc-to-exempt-houses-up-to-500-sq-ft-from-property-tax) . It also wants to give free electricity to households using less than 100 units (https://www.hindustantimes.com/mumbai-news/state-mulls-waiver-of-electricity-bills-up-to-100-units/story-NgFf3FNNzjJbt2uDlRBlyI.html). Since each household as 0.5 people (compared to the national norm of 5), this means 1,000 units per household free of cost per month. Loot over loot. Paid for by taxpayers!

Taxpayers pay for keeping sick state owned units alive as well. Just the way the central government also does it. In Maharashtra, the latest report by the a by Comptroller and Auditor General (CAG) of India has sought an urgent closure of loss-making public sector undertakings (PSU). The report, tabled in the state legislature in September 2020 pegs losses by state-run PSUs at Rs 20,214 crore, while observing that the average return of investment to the state from PSUs was a meagre 0.07 per cent (https://indianexpress.com/article/cities/mumbai/cag-flags-loss-of-rs-20214-cr-by-psus-seeks-closure-of-loss-makers-6589664/). No prizes for guessing that the report will be ignored, if not forgotten. Loss making PSUs also provide useful ways of appeasing vote banks and making money clandestinely.

Similarly, do note how the state government has agreed to guarantee the principal loan amount and interest to nearly 37 cooperative sugar factories whose net worth is eroded and incurred huge losses (https://www.freepressjournal.in/mumbai/maharashtra-cabinet-approves-guarantee-to-37-coop-sugar-factories-with-negative-net-worth). If the units have a negative net worth, they should be put on the block and sold. Why pour good money over bad. Once again, taxpayers will have to bear the burden.

Maharashtra plunders Mumbai

That is how the state of Maharashtra does to Mumbai the same as what the government of India does to wealth generating states. The central government plunders richer states and builds its vote banks in populous states. The state government loots Mumbai by building its vote bank through slums in the city. This also ensures that its representatives control the purse strings of the country’s richest municipal corporation. Like all plunderers, the wealth of the moneymakers is siphoned out to other areas in the state.

This approach finds reflection in the state’s policies relating to sugarcane and milk as well (http://www.asiaconverge.com/2020/08/sugarcane-politics-and-milk-subsidies-could-wreck-maharashtra/). Plunder remains the driving force, both with the centre and the state.

And do note that this does not take into account the loot from bigger scams. The irrigation scam and the Telgi scam in Maharashtra remain unresolved, despite involving thousands of crores of rupees. The scamsters remain at large. Investigative agencies have opted to close such cases citing lack of evidence. No politician goes behind bars.

Then there is the moolah from the tanker mafia (http://www.asiaconverge.com/2019/06/the-stranglehold-of-the-water-tanker-mafia/). The pickings are so large, that they are an invitation to authorities to declare a water scarcity as early as possible and thus boost the revenues of the tanker mafia.

Ditto with illegal parking in cities (http://www.asiaconverge.com/2017/11/traffic-violations-misplaced-sentiments-loopholed-policies-sticky-fingers/) . The amounts are not to be sniffed at. Solutions to illegal parking exist (http://www.asiaconverge.com/2017/12/solution-indias-parking-hawker-problem-kills-graft-rewards-investors-unclutters-roads/). But that would take away the grease money, right? Hence, not acceptable.

That is why, when a Parliament announces a 30% cut in the salaries of Parliamentarians, cynics smirk (https://timesofindia.indiatimes.com/india/bill-to-cut-mps-salaries-by-30-to-meet-covid-exigencies-introduced-in-lok-sabha/articleshow/78105775.cms). The cuts are mere lip service. The loot is bigger. It is all pervasive. It involves almost every politician. You have only to look at their bank balances before they became representatives of people, and after.

The judiciary could do a lot to cleanse the rot. But will it be allowed to?

The plunder, in all probability will continue.

With this article the “Plunder” series gets concluded.

———————-

The earlier articles in this series can be found at

Part I – http://www.asiaconverge.com/2020/08/government-plunder-productive-states-in-india/

Part III — http://www.asiaconverge.com/2020/09/india-plundered-iii-through-tax-devolution-and-transfgers/

——————————————

COMMENTS