R N Bhaskar

It came in as a thunderclap. In mid-May, speaking at the Business and Climate Conference in Paris, Ali Al-Naimi, Saudi Arabia’s Minister of Petroleum and Minerals, dropped a bombshell.

He announced that fossil fuels wouldn’t be necessary in Saudi Arabia by the middle of this century. He said that his country would be moving into solar and wind power. He even remarked, possibly tongue-in-cheek, that the world would soon be importing Saudi electricity rather than oil.

Al-Naimi provided no details. But almost everyone knows that Saudi Arabia — besides the UAE and Kuwait — has embarked on extremely large solar and wind projects expected to cost over $16 billion for solar power. And Naimi’s pronouncements are seldom taken lightly.

So what gives? Is it the end of the road for oil, gas and coal? Maybe, not so soon. But the expiry date could soon become discernible.

Three indicators seem to suggest this.

First, the world is growing impatient with environment pollution. Germany showed the way to solving this problem by focusing on (largely rooftop) solar power. The relentless rise of oil prices (till recently) made solar a compelling solution.

Second, solar power tariffs crashed. Germany’s vision (and China’s mass production) helped solar power installation costs tumble from $8 a watt to just under $1 within a decade. Solar power is expected to achieve grid parity with conventional power within this year — especially in India. Here too, solar power tariffs have tumbled from around Rs 19 per kWh (kiloWatt-hour) to around Rs 6 over the past 12 years .

Third — better and cheaper batteries are round the corner. They could make oil and gas redundant. This could be the Holy Grail for clean energy enthusiasts.

The reason why the battery is critical is because all power generated through solar and wind is extremely irregular. A cloud passing over the face of the sun can cause the solar power generation to plummet even on a sunny afternoon. To ‘stabilise’ this power, and to ensure that it can be accepted by the grid, it has to go through a ‘battery’ of sorts that ‘stores’ this power and releases it in a steady flow.

If the battery is big enough, it can also act as an energy reserve, from which grids can draw additional power when energy demand peaks. Peaking power will no longer be expensive, as power utilities will no longer have to start up power generation plants just to meet peaking demand. Plus, the battery allows the grid to use renewable power even when the sun disappears, or the wind dies down.

Moreover, there are other solutions. Nuclear power. And fuel cells which break up water into hydrogen and oxygen, and allowing the former to energise cars, batteries and other power generation systems.

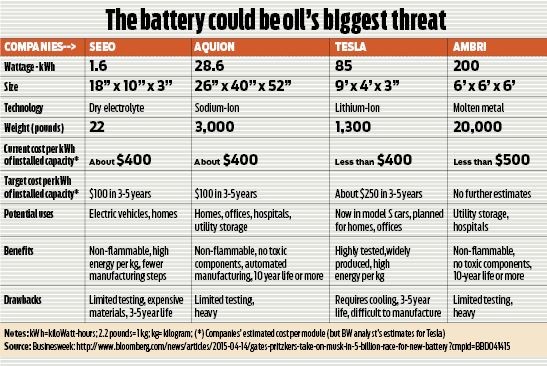

But the battery is the most promising. In this segment, Businessweek identifies four players who could become game-changers. The search for a new cheap effective battery has already invited $5 billion of funding. It could allow people to move away from fuels that pollute, and enable consumers to defect from the energy grid.

Take the case of Ambri which was born after Bill Gates (of Microsoft fame) managed to persuade Professor Donald Sadoway of MIT in August 2009, to develop a new battery.

Sadoway’s work with melting metals to create a new medium for storing (and releasing) energy appears to have produced the desired result.

Billionaire Nick Pritzker and his son Joby (along with Vinod Khosla) are backing Pittsburgh-based Aquion Energy founded by Jay Whitacre.

Tesla Motors CEO Elon Musk is working on a battery that could allow his Tesla cars go more than 200 miles on battery power. It would allow him to price his cars one-third the current tag of $100,000 for his Model S. And Khosla Ventures, with Samsung Venture Investment, is betting on Hany Eitouni’s Seeo.

Whichever battery wins, it will certainly replace the (flammable, potentially explosive) nickel-cadmium and lithium-ion batteries which Sony introduced to the world in 1991. But they remain expensive ($400 per kWh) and run for short durations.

What makes the business exciting is also that the battery market — estimated at $50 billion annually — is expected to increase 10-fold in just three years to 2,400 MW.

Obviously, India’s investments in solar energy could become invaluable once the battery gets invented. It might even reduce the demand for fossil fuels — including coal.

To prepare for such a situation, India needs to aggressively promote decentralised cluster power for villages and tribal settlements that do not have electricity. Till a good battery is found it could promote mini cluster grids using solar by daytime and methane based projects at night.

But that requires suitable policies. The government must allow for capitalisation — for at least 10 years — the subsidy amount that power consumers get in villages. That would provide finance for these cluster power generation units. And it must put into place rules on power usage, and plant maintenance, else the entire investment could get squandered away.

Without such guidelines, India’s quest for clean energy will remain a pipe dream.

The author is consulting editor, DNA.

Read the original article here.

Click here for more on India and its policies.

COMMENTS