MARKET PERSPECTIVE

By J Mulraj

April 27- May 3, 2024

India’s economic performance is standing out

Avid British climber, George Mallory, when asked why he was trying, for the third time, to climb Mr. Everest, said ‘because it’s there’.

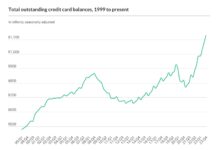

In much the same vein, American Presidents, if asked, why they borrow so much money, may similarly respond “because it’s there!” During their term of office, the last three Presidents have borrowed money excessively, and foolishly, ‘because it’s there’, not ‘because we need it’. Barack Obama added $7.6 trillion, Trump $6.7 t. and Biden $2.5 t.

They did not tightly hold the financial reins. As a result, USA is over $34 trillion in debt, the interest on which is over $1 trillion (the largest item of expenditure – the US Government spends more on interest than on Defense or Social Security) and inflation runs rampant as too much money chases fewer goods. Interest rates have risen 5% to contain it.

By increasing debt, the US Government is, essentially, betting on its economy growing enough to generate surplus to be able to repay the debt. But can it? As per this article, in Q4/23 US GDP grew by $ 334 billion, but its debt grew by $834 b. So if a country borrows $ 2.5 in order to generate an additional dollar of income, how on earth can it reduce debt??? (And then Biden wants to lock in aid to Ukraine for ten years, paid by further borrowing. See below). This One surely Flew Over the Cuckoo’s Nest!

The 5% increase in interest rates combined with low occupancy rates in commercial real estate, (whose building owners are the biggest customers of such community banks) are leading to bank failures. Last week, Republic Bank, a $ 10 b. community bank in Philadelphia, was taken over by FDIC and sold to another bank.

But hey, in 2023, one of the failed bank, viz Signature Bank, was sold to New York Community Bank (NYCB). Guess what? In March 2024, NYCB itself got into trouble and was sold to Flagstar Bank! The problems are structural, not managerial, and are the consequence of the 5% interest rate hike by the Fed. Community banks deploy their deposit money largely in two buckets, viz. commercial real estate (CRE), and T-Bills. The 5% interest rate hike impacts both. Small businesses become unviable after a sharp hike in interest, and shut down, increasing vacancy rates. High vacancy rates make it impossible for CRE building owners to refinance, and the lender, community bag, is left holding the baby. As re T Bills, as interest rates go up, the market prices of T Bills (or any debt) go down. Marking the depreciation of assets to market results in a loss, and a shaking of deposit holder confidence.

So selling ownership is like the game of passing the parcel. Again, it requires the new owner to have strong hands.

To be able to prevent bank failures from spreading, interest rates need to come down quickly, so that commercial real estate becomes viable, reducing pressure on the banks funding it. The promised Fed rate cuts are being pushed back, and now the market expects only two cuts in the rest of calendar 2024, instead of 3.

In addition to not holding tight financial reins, Biden is not holding tight other reins either. On immigration. On campus protests. On aid to other countries, instead of to his own citizens.

Watch this video which claims that the White House is working on getting US Congress to pass a bill assuring assistance to Ukraine for the next ten years! This is beyond insane! A congressionally approved bill cannot be overturned, so a future President, like Trump, won’t be able, if the bill is passed, to end the wasteful Ukraine war by threatening to cut aid to Ukraine. Is Biden really seeking to hold a decadal loose rein for Ukraine?

Yet US markets move upwards, led largely by a handful of companies termed the Magnificent Seven, new jobs created are high and the American venture capital industry continues to fund brilliant innovation. So the US economy retains its numero uno position, thanks to its private sector, even though the reins are held loosely in weak hands.

S& P Global forecasts US GDP growth at 2.5%.

Contrastingly, the reins in India are held more tightly, at least in monetary and fiscal hands (though they could be, and need to be, tightened in other hands like the judiciary and education). GST collections in April 2024 crossed Rs 2 trillion, up 12% over April 2023. This has led the IMF to revise upwards India’s GDP forecast from 6.5% to 6.8%.

India’s Purchase Managers Index (PMI), compiled by S&P Global, hit a 16 year high of 59.1 in March. A reading above 50 indicates an expansion of manufacturing activity. Indian auto sales are up, especially cars and two wheelers; the auto industry is 7% of GDP. Home sales grew 9% in 2023 and home prices are expected to hit a new peak in 2024. India leads the world in electronic transactions, clocking in a whopping 92 billion transactions in 2023, valued at ₹ 2050 trillion! With a young population, and favourable demographics, the economy is expected to grow for the foreseeable future.

In global news, efforts are being made for a negotiated end to the Palestinian conflict, with a return of all hostages taken by Hamas. The Columbia University campus seizure of a hall has been brought under control by the NYPD and the protestors, with several outsiders (supposedly non student, professional protestors) removed. But neither the US nor any other main power, is showing any inclination to end the Ukraine war. US seems content to outsource the fighting, and the deaths, to Ukraine by providing financial and military aid to Ukraine to fight, essentially, a losing war.

The global polity is devoid of conscience or soul.

The BSE Sensex ended the week at 73878 for a weekly gain of 148 points.

At its recent Fed meeting two days ago, Chair Powell felt that interest rates were, like Goldilock’s soup, neither too hot, nor too cold, but just right. He kept interest rates unchanged. This would disappoint investors who now hope that inflation cools enough to allow Powell to commence the interest rates down-cycle before the next meeting, and squeeze in two cuts, of 25 bips each, before end of year.

The strong India story is attracting investors, both domestic and foreign. One hopes that the winner of the ongoing general elections will continue to hold the reins tightly.

And, whilst talking of reins, one should pray for a good monsoon, to bolster agri crops and further prop up GDP.

Picture Source: https://kroops.com/blogs/explore/chariot-racing

For comments please write to jmulraj@asiaconverge.com

Keywords:

COMMENTS